SOL From $9 to $200: Can Solana Repeat Ethereum’s 2020-2021 Rally?

KEY POINTS:

- Independent analyst Hansolar predicts Solana’s price could reach $600 citing similarities to Ethereum’s 2020-2021 surge.

- Total-value-locked (TVL) crosses $4.21 Billion and with rise in daily SOL transactions.

- Solana breaks the $200 primary target supported by a bullish continuation pattern on its daily chart.

Amidst Bitcoin’s ongoing cryptocurrency market boom Solana (SOL) has climbed to $204 with a staggering 2000% growth from $9 at the beginning of 2023. An independent analyst with the X handle Hansolar speculated that Solana could repeat the great ETH surge of 2020-2021 bull market.

hansolar

@hansolar21

When SOL takeoff?

✦ SOL

Assuming SOL is the new ETH this cycle, I think SOL really takes off later than BTC and ETH.

Previously ETH took off when BTC actually broke out into ATHs.

It's then when retail buys into SOL as the high beta catch up play.

Currently SOL is at around… pic.twitter.com/mwyhJ5DO6m

Feb 28, 2024

Hansolar has sparked optimism in the community suggesting that Solana’s price could soar to $600, drawing parallels to Ethereum’s remarkable ascent during the previous crypto market bull run. Ethereum’s price surged from around $85 to a staggering $4,935 following Bitcoin’s uptrend in 2020-2021, a surge of approximately 1,400%. Coin Edition

Coin Edition

Bitcoin is set for an extended bull run above its November 2021 ATH of $69,000 and Hansolar believes Solana stands to benefit similarly.

Assuming SOL is the new ETH this cycle, I think SOL takes off later than BTC and ETH. Previously ETH took off when BTC broke out into ATHs.

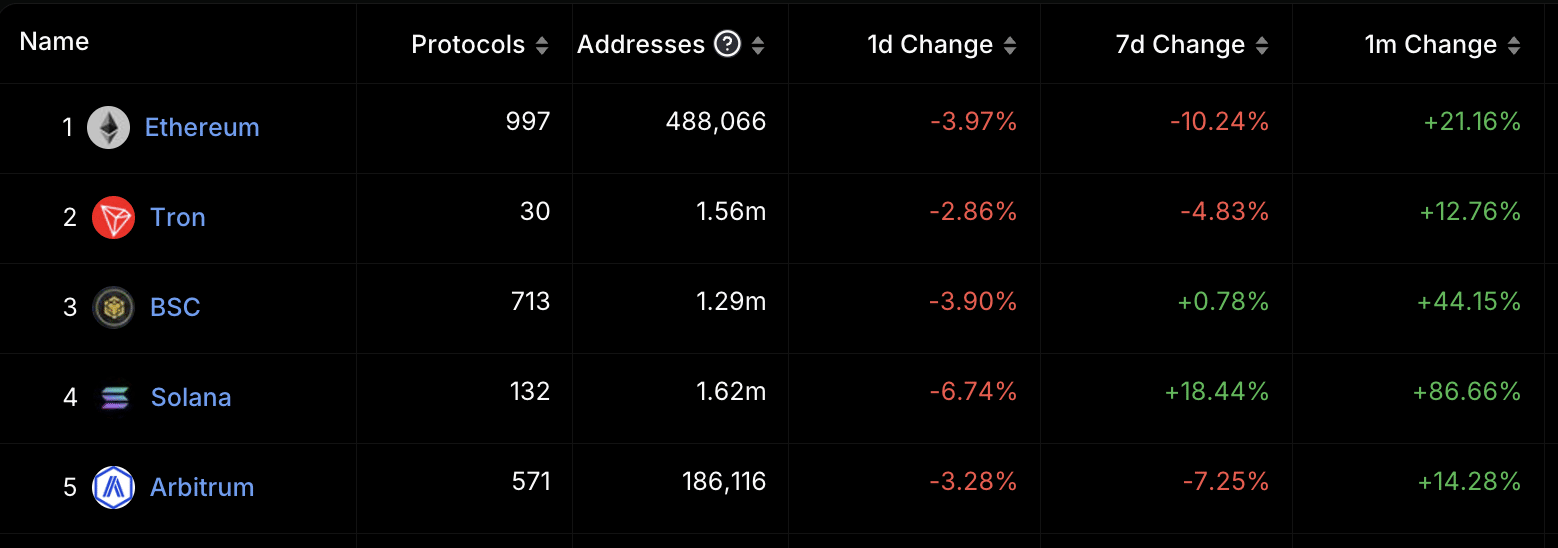

The fundamentals of Solana indicate a promising outlook. The total-value-locked (TVL) across its ecosystem has reached 20.51 million SOL, its highest level since January 2023. Solana also surpassed Ethereum and other Ethereum Virtual Machine (EVM)-based Layer-2 solutions in 24-hour transaction volume, with Solana’s $3.654 billion outdoing Ethereum’s $2.397 billion.

Solana broke the $200 band earlier on Monday morning. With a bullish outlook, the chart indicates $257 as its next target.

Coin Edition

Crypto

Read more from Coin Edition

SOL Crosses $200 as Meme Coin Frenzy Bumps Demand for Solana Network

Scores of newly issued tokens boast trading volumes of tens of millions, showcasing network usage and demand for blockspace.

By Shaurya MalwaMar 18, 2024 at 2:33 p.m.

Updated Mar 18, 2024 at 2:35 p.m. Solana's offices in NYC (Danny Nelson)

Solana's offices in NYC (Danny Nelson)

Solana’s SOL crossed $200 for the first time since November 2021 as network activity continues to grow rapidly on the back of the meme coin frenzy.

SOL is now 22% away from its lifetime peak of $260 but has already crossed its record market capitalization of $75 billion market capitalization, CoinGecko data shows, as new tokens entered the market over the past year.

Data shows that various metrics, such as network volumes, active wallets, total value locked (TVL), fees, and SOL’s market capitalization, crossed lifetime peaks over the weekend, led by a surge in pre-sale activity.

The network amassed $3.2 million in fees over a 24-hour period, beating a $300,000 record from 2021. Onchain volumes climbed over $3 billion, flipping a November 2022 record of $300 million. Solana network metrics. (DefiLlama)

Solana network metrics. (DefiLlama)

However, net inflows to the Solana blockchain have been negative over the past week, suggesting there has not been a significant influx of new money into the ecosystem.

Sentiment data shows Solana network activity has been likely led by retail traders who chased newer meme coins and presales that popped up on the network over the weekend.

STORY CONTINUES BELOW

Recommended for you:

- Craig Wright Is Not Satoshi, Didn't Author Bitcoin Whitepaper, Judge Rules

- First Mover Americas: Robinhood Shares Jump, Layer 2s Become Cheaper

- Hong Kong's Markets Regulator Issues Warning Against Crypto Exchange Bybit

SOL was trading at $202 during Asian morning hours, up 10% since Sunday. Meanwhile, bitcoin was hovering over $68,000, while the broader CoinDesk 20 index is up 6%.

Edited by

Newsletter

Every Wednesday

TheProtocol

Sign up for The Protocol, our weekly newsletter exploring the tech behind crypto one block at a time.

Enter your Email

Sign Up

By clicking ‘Sign Up’, you agree to receive newsletter from CoinDesk as well as other partner offers and accept our terms of services and privacy policy.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk offers all employees above a certain salary threshold, including journalists, stock options in the Bullish group as part of their compensation.

Solana (SOL) & BOME Prices To Hit Target Price, Or Reversal Ahead?

SOL and BOME prices surged amid social media hype, signaling potential targets but also facing scrutiny amid market uncertainty.

STORY HIGHLIGHTS

- Solana (SOL) and BOME lead social media hype, according to a report.

- The investors are shifting focus toward Solana casting a shadow on Ethereum-based projects.

- Price predictions indicate potential targets for SOL, while BOME faces volatility.

The crypto market is witnessing a dynamic shift as Solana (SOL) and its associated meme coin, Book Of Meme (BOME), emerge as prominent contenders, overshadowing Ethereum projects. With Solana’s price surging by nearly 12% and BOME gaining traction following Binance’s listing announcement, investor attention is shifting toward these alternatives.

However, recent developments, including a probe into potential insider trading of BOME, have stirred uncertainty. So, let’s delve into how Solana and BOME are reshaping the crypto landscape.

Social Media Buzz On Solana and BOME

Solana and its meme coin counterpart, BOME, are spearheading the crypto market with their recent surge in popularity. According to a recent report from the prominent on-chain data provider, Santiment, both SOL and BOME are dominating discussions across various social platforms, including X, Reddit, Telegram, and 4Chan.

Notably, the market participants are increasingly viewing Solana and associated meme coins as viable alternatives to Ethereum-based projects, given their outperformance in recent times. Also, the recent rally in the SOL & BOME prices has reflected the growing confidence of the investors towards the crypto.

However, despite robust gains, BOME faced a setback following Binance’s announcement of a probe into potential insider trading. This development triggered a retreat in BOME’s price, highlighting the volatility inherent in the crypto market.

In contrast, the momentum behind Solana remains strong, especially during Asian trading hours, as noted by Matrixport. Solana has witnessed significant gains, surging 807% in the last 12 months, with a notable 85% rally in the past 30 days, a substantial portion of which occurred during Asian trading sessions.

Also Read: Reddit IPO Targets $6.5 Billion In Valuation

Prices Amid Mixed Sentiments

The rise of Solana and BOME raises questions about the future of Ethereum projects. As investors explore alternative options in the blockchain space, Ethereum faces heightened competition.

Meanwhile, the attention garnered by Solana and its meme coin counterpart, BOME underscores the shifting dynamics within the crypto space. While Ethereum remains a dominant force, the emergence of formidable competitors like Solana poses challenges and opportunities for the Ethereum ecosystem.

Notably, according to debit data as well as Rekt Capital’s analysis, the Solana price may hit $210 before options expiry on March 22. However, despite the gains, some analysts warned that investors might utilize the recent surge in SOL price as a profit-booking opportunity. Notably, the Solana price was up 11.78% to $203.38 during writing and surged around 35% over the last seven days.

On the other hand, the BOME price, after a significant rally, plunged due to Binance’s recent announcement. As of writing, the BOME price was down 22.38% and traded at $0.1564, while its trading volume fell 60% to $2 billion. However, since March 14, its price has surged over 1630%, reflecting the buzz surrounding the meme coin.

Also Read: Bitcoin Rebound Set to Impact Prices of Luxury Watches

Solana DeFi TVL soars 80% in a month: How will SOL react?

- Solana’s DeFi TVL has climbed by over 80% in the last month.

- Demand for SOL persisted despite the general market downturn.

Solana’s [SOL] decentralized finance (DeFi) total value locked (TVL) has surged by over 80% in the last month, according to data from DefiLlama.

This impressive growth has propelled Solana’s DeFi TVL to its highest level in the past two years.

At press time, the network’s DeFi TVL was $3.8 billion. Among the top five DeFi networks by TVL, it ranked as the blockchain with the highest growth over the past month.

Solana’s DeFi ecosystem so far this month

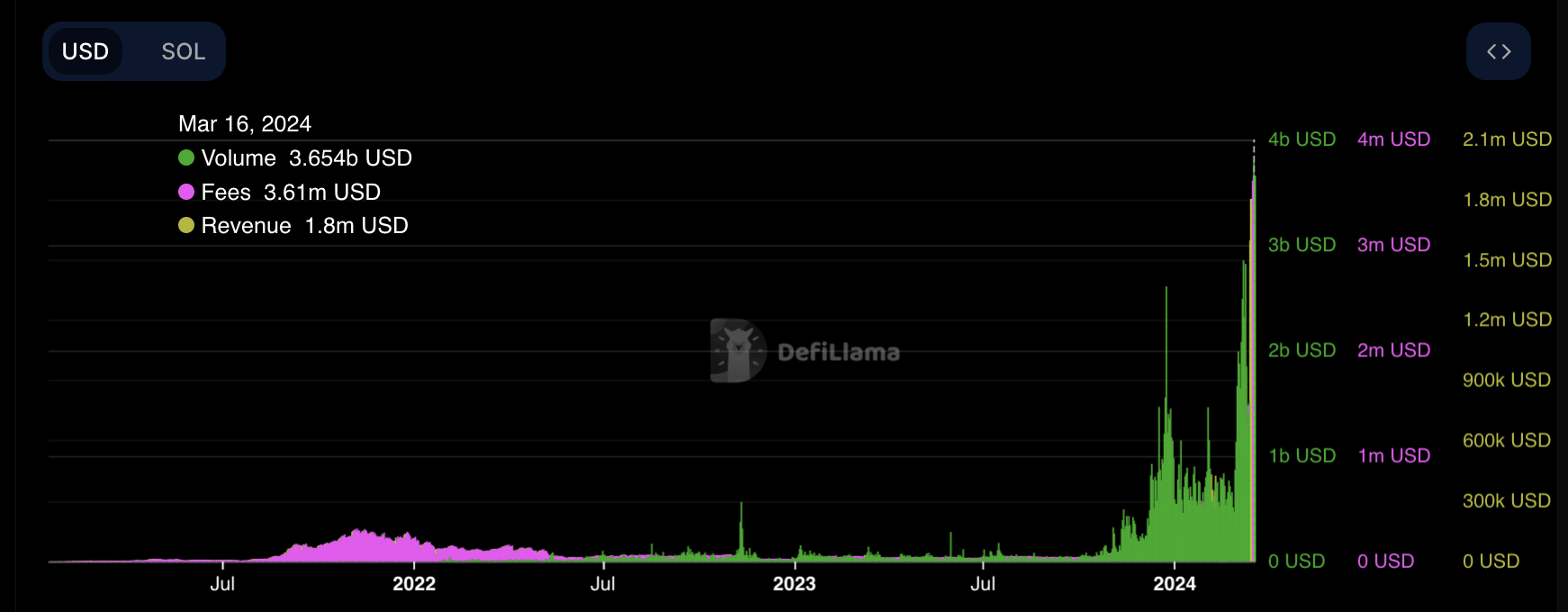

The surge in Solana’s TVL in the last month is attributable to the significant uptick in trading volume on the DeFi protocols housed on the Layer 1 network (L1).

Since the beginning of the month, the total trading volume recorded daily on these protocols has climbed by 125%.

In fact, on the 15th of March, trading volume on Solana’s DeFi vertical rallied to a multi-year high of $3.7 billion.

Network fees totaled $3.61 million on the 16th of March, marking the network’s highest single-day recorded fees since launch.

The revenue derived from these fees was $1.6 million, representing the network’s highest daily revenue. Source: DefiLlama

Source: DefiLlama

SOL defies market trajectory

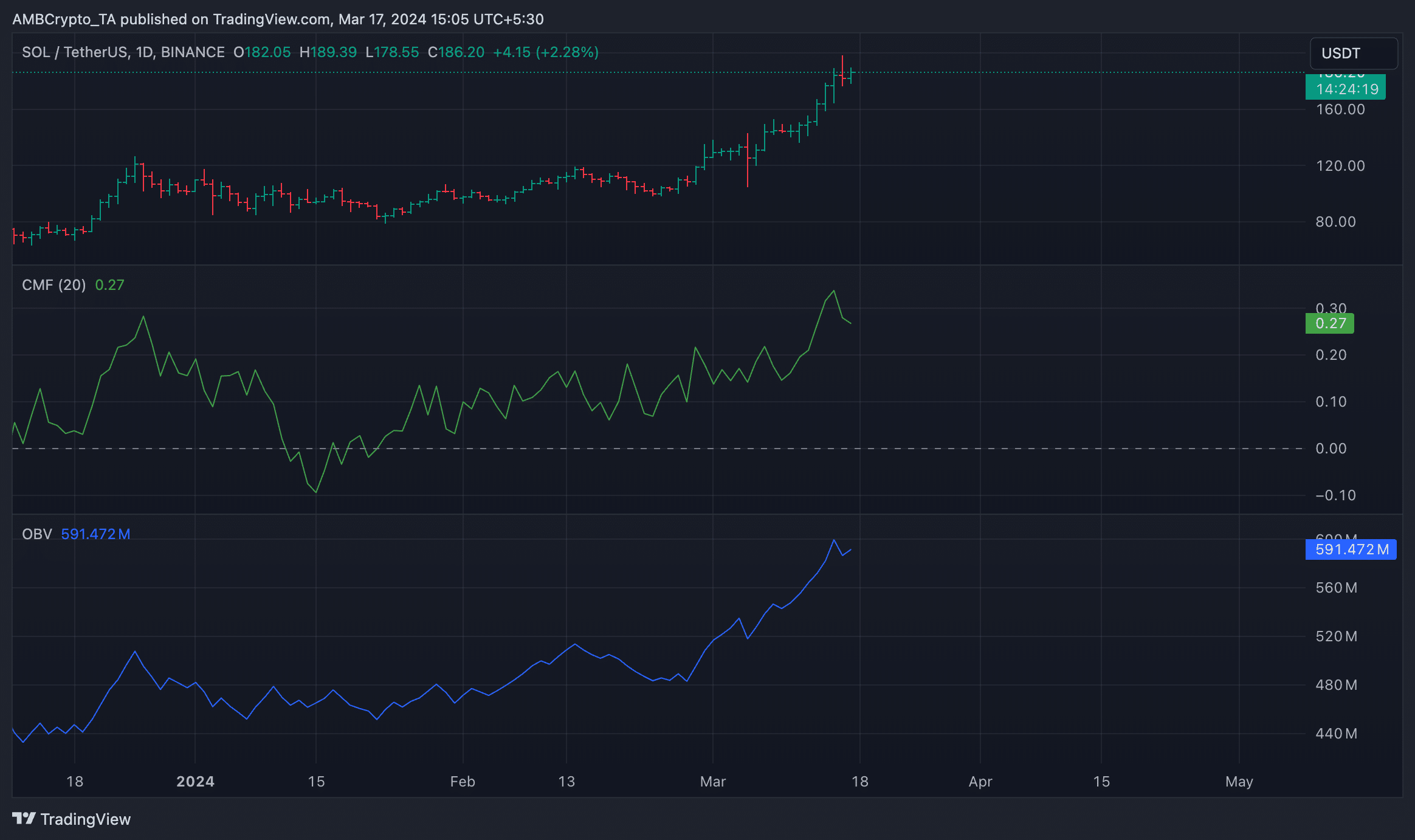

At press time, SOL exchanged hands at $187. Per CoinMarketCap’s data, the altcoin’s value has increased by 72% in the last month.

While the rest of the market grapples with price reversals, SOL bucks the trend as bullish sentiment grows.

AMBCrypto’s assessment of the coin’s movements on a daily chart revealed a steady uptick in demand for SOL.

For example, its On-Balance-Volume (OBV), which tracks the coin’s buying and selling pressure, was in an uptrend at press time.

At 591.42 million at press time, SOL’s OBV has risen by 16% since the beginning of March. When an asset’s OBV witnesses this kind of growth, it suggests a growth in buying momentum. Source: TradingView

Source: TradingView

How much are 1,10,100 SOLs worth today?

The uptrend in SOL’s Chaikin Money Flow (CMF) confirmed this growth. This indicator measures the flow of money in and out of an asset.

Above zero and returning a value of 0.27 at press time, SOL’s CMF showed growth in liquidity inflow into the market.

Will BNB post another bull rally? Here are the odds

2min Read

BNB dropped by more than 7% in the last 24 hours, but a trend reversal could happen.

- BNB’s Ichimoku cloud hinted at a possible bull rally on the coin’s monthly chart.

- Technical indicators in the short term remained bearish.

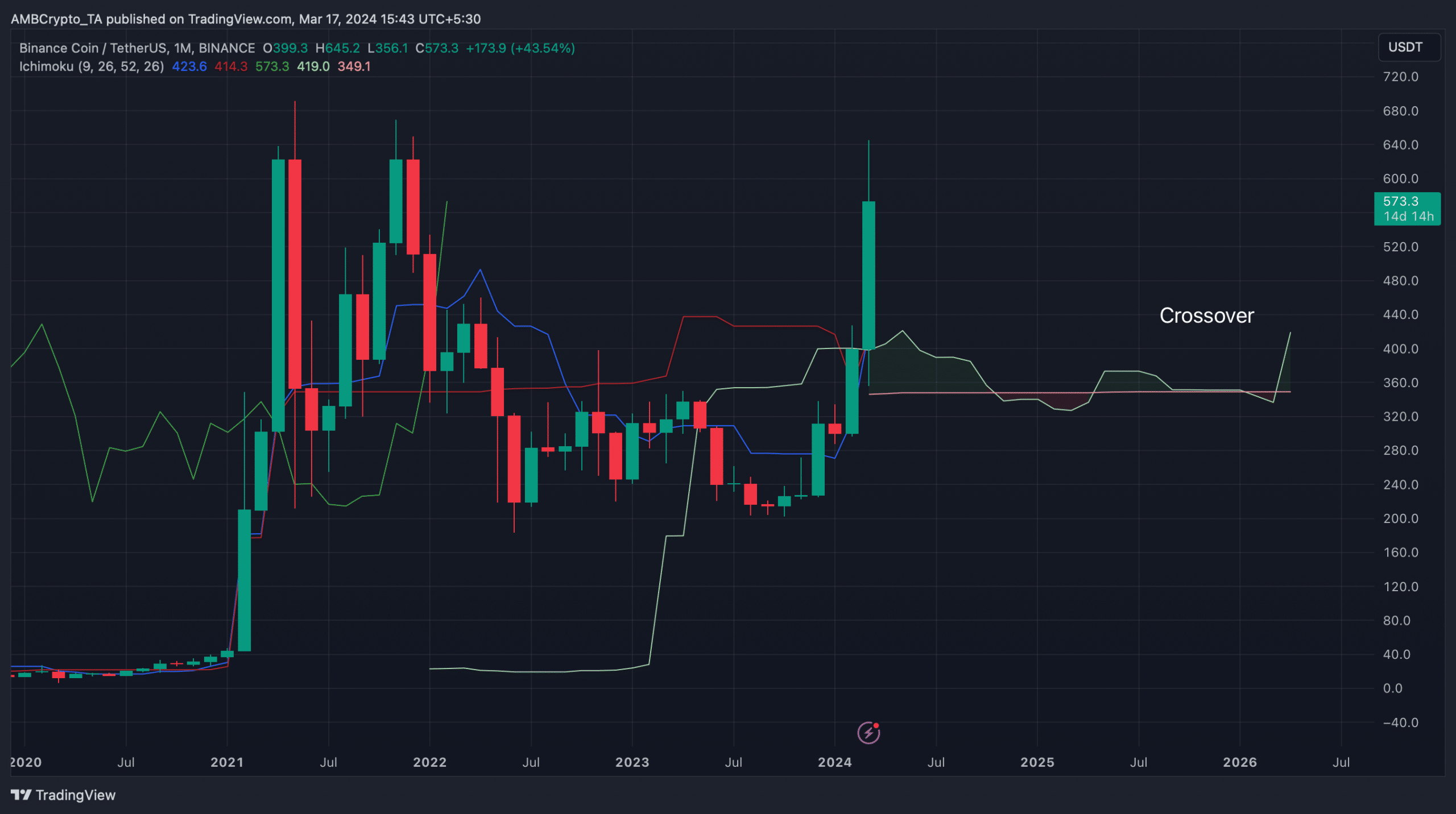

Like most cryptos, Binance Coin [BNB] witnessed a major price correction in the last 24 hours. However, if an indicator is to be believed, investors might witness BNB’s daily chart turning bullish soon.

BNB on a rollercoaster ride

According to CoinMarketCap, BNB’s price has risen by more than 8% in the last seven days. But the last 24 hours were disastrous, as the coin’s value plummeted by over 7%.

At the time of writing, BNB was trading at $572.94 with a market capitalization of over $85 billion, making it the fourth-largest crypto.

Though this looked bearish, Ichimoku Cloud, a technical indicator, displayed a crossover.

For the uninitiated, the Ichimoku cloud is a collection of technical indicators that show support and resistance levels along with trend directions.

As the cloud (crossover) forms in the direction of the last candlestick, it gives off a bullish notion.

At press time, the indicator suggested a strong bullish move over the coming months that could help the coin reach new highs. Source: TradingView

Source: TradingView

What to expect in the short term?

Since things in the long term looked optimistic, AMBCrypto checked BNB’s press time state to see what to expect in the near term.

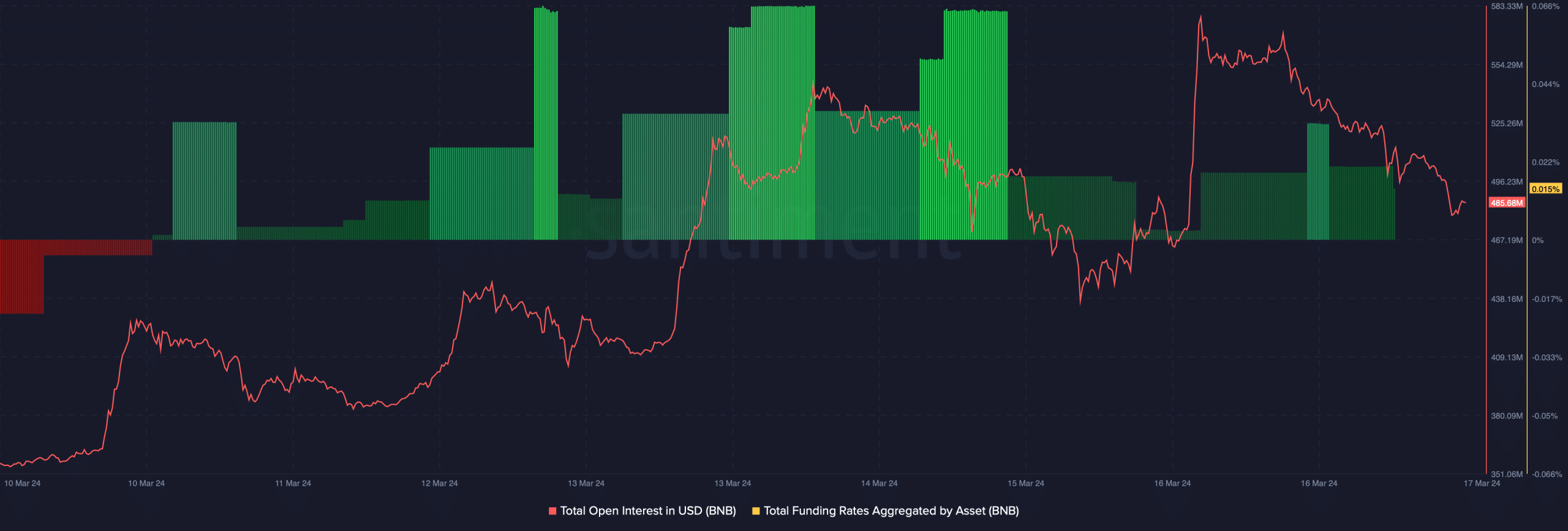

Our analysis of Santiment’s data revealed that BNB’s Open Interest had dropped at press time. This indicated that there were chances of a trend reversal.

The altcoin’s Funding Rate had also dropped, meaning that Futures investors were not actively buying the coin at press time.  Source: Santiment

Source: Santiment

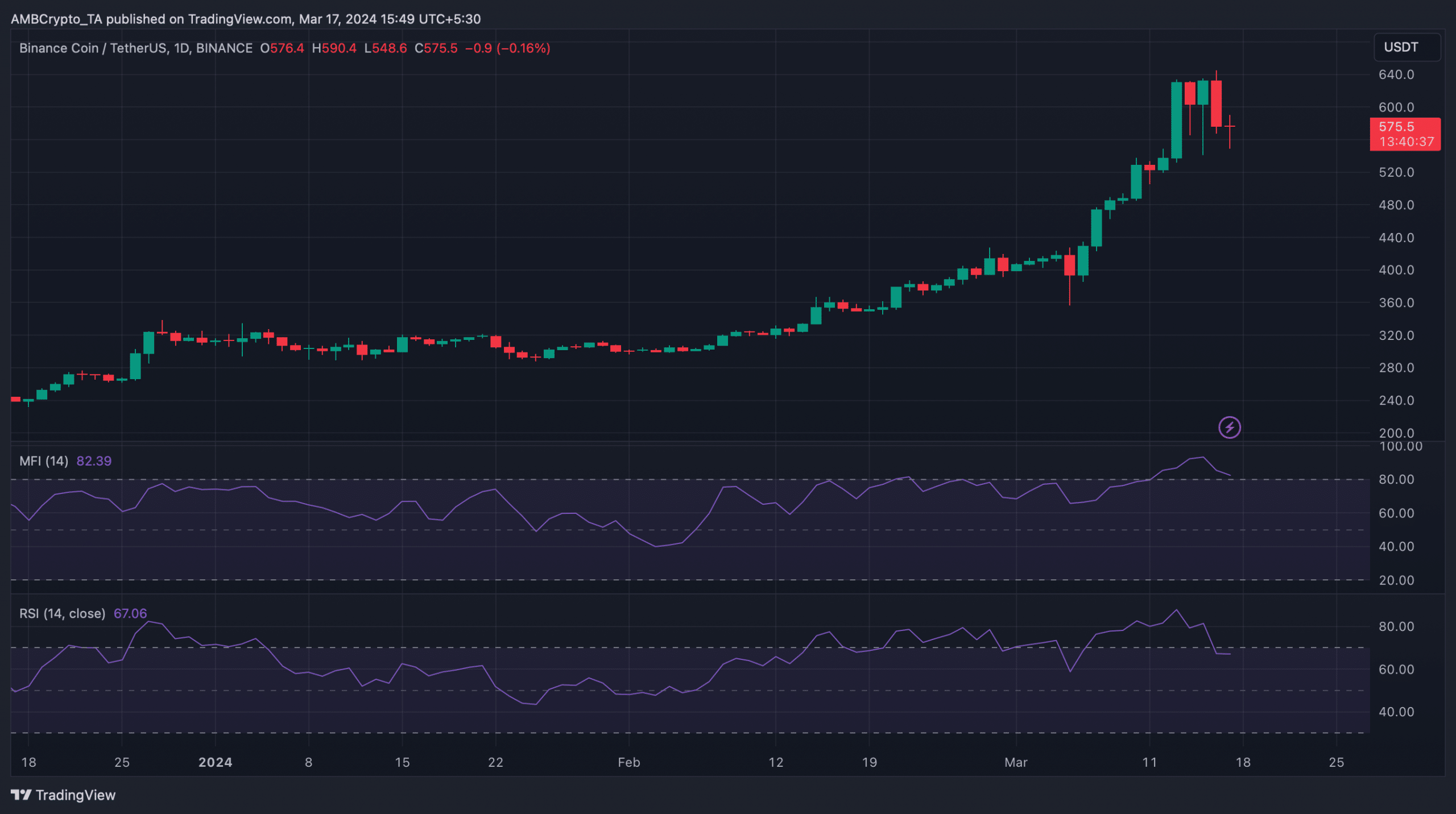

However, technical indicators remained bearish. Notably, the Relative Strength Index (RSI) registered a downtick. The Money Flow Index (MFI) also declined, showing chances of a continued price decline.  Source: TradingView

Source: TradingView

Network activity is high

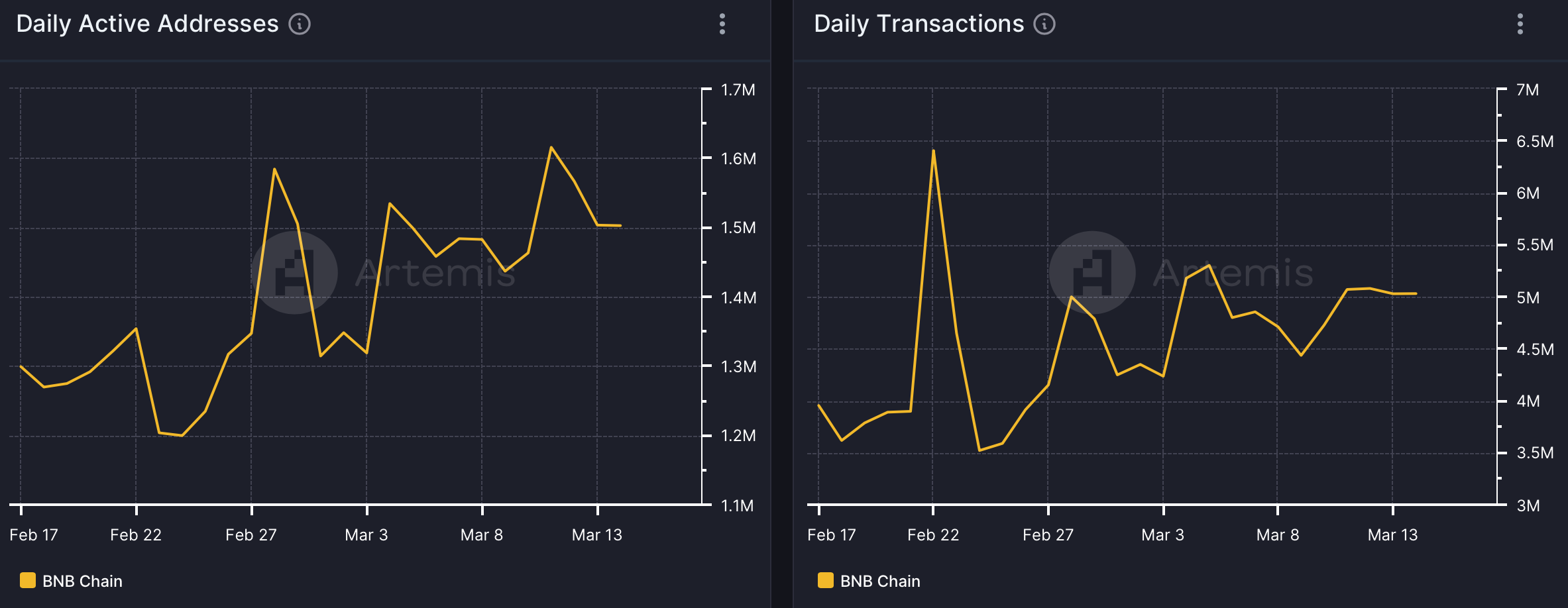

While the coin’s price moved in both directions, the blockchain’s network activity remained high.

AMBCryto’s analysis of Artemis’ data revealed that the Binance network’s daily active addresses went up during the last month. As a result, the blockchain’s daily transactions also remained relatively high.  Source: Artemis

Source: Artemis

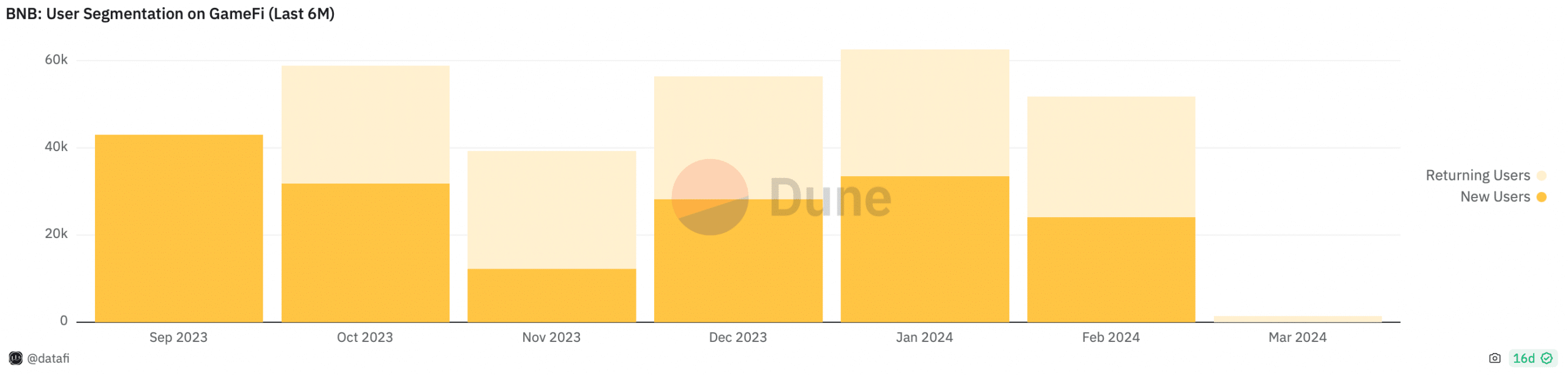

It was interesting to note that BNB Chain’s GameFi ecosystem was also growing. Dune’s’ data pointed out that the number of BNB Chain GameFi users spiked in January and February.

The number of returning users also remained high, reflecting high adoption and usage.  Source: Dune

Source: Dune

Read Binance Coin’s [BNB] Price Prediction 2024-25

Things might get even better for the blockchain’s GameFi ecosystem, thanks to a new integration. BNB Chain recently announced that the blockchain has onboarded Gamehash AI.

The new collaboration might help attract new users and allow the blockchain’s GameFi space to flourish.

Previous: Solana DeFi TVL soars 80% in a month: How will SOL react?

Next: Can Cardano [ADA] rise to $1.70? Take notes, traders