Liquidity Pool (LP) in DeFi and how it works

If you are a professional investor or are learning about the crypto market, you have probably heard of the term liquidity pools (LP). This is one of the technology platforms behind the DeFi decentralized financial ecosystem. This is also an important part of the AMM automated market, borrowing and lending protocols, yield farming, blockchain games, etc.

So what exactly is a liquidity pool, and how does it work? Let's find out with me in today's article.

Concept

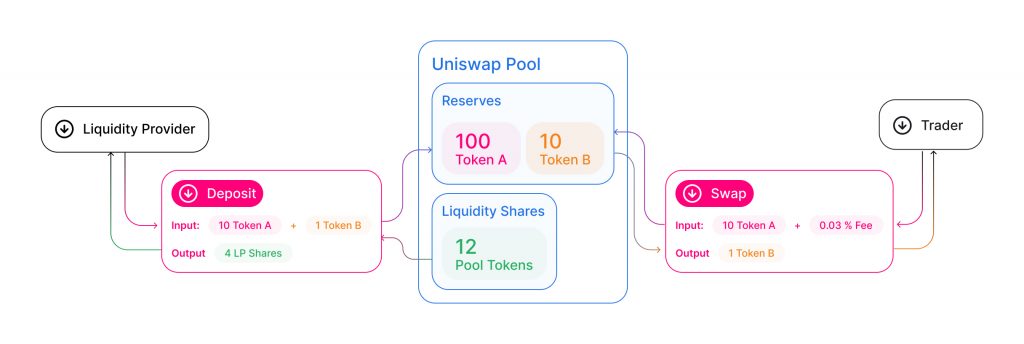

Liquidity pools are collections of funds locked in smart contracts. It is used to facilitate lending activities, decentralized transactions, and many other functions. Currently, liquidity pools are an important component of many DeFi exchanges, such as Uniswap.

Liquidity providers are users, adding an equal value of two tokens in the pool to create a market. In exchange for providing them with funds, users receive a transaction fee when transactions in the pool are made, and this fee is proportional to their share of funds in the pool.

Any user can become a liquidity provider. AMM makes market access simpler. Bancor is one of the first protocols to use liquidity pools; however, it was not until Uniswap that this concept became popular.

Other exchanges use liquidity pools on Ethereum, SushiSwap, Curve, and Balancer. The liquidity zones in these locations all contain ERC-20 tokens. Similar products on Binance Smart Chain (BSC), such as PancakeSwap, BakerySwap, and BurgerSwap, will contain BEP-20 tokens in the pool.

Compare Liquidity Pool and Order Book

An order book is an option that can be applied to DeFi systems, but its disadvantages are that it is expensive, slow and stressful for participants. Currently, market makers tend to cancel orders and increase prices of users on the exchange. This is really unfair. Many cryptocurrencies would not be ideal for participating in this model.

For example, ETH has gas that counts on interactions with smart contracts, slowing down transactions and multiple requests, making it difficult for users to update orders.

Liquidity Pools aims to solve these fundamental problems of the Order Book model. Liquidity Pools are an upgrade and are completely decentralized. Transactions in the cryptocurrency market are performed faster, more securely, and with better user experiences.

How Liquidity Pool works

The liquidity pool consists of tokens and each pool is used to create a market for these tokens. For example, each LP can contain ETH and an ERC-20 token like USDT, both of which are available on the exchange. For each pool created, the provider gives the initial price of the assets available in the pool. And they will set equal value of both tokens to the pool.

In the example above, ETH sets the price of assets in the pool and provides the peer-to-peer value of ETH and USDT on a given DeFi platform (like Uniswap). Every liquidity provider is interested in adding tokens to the pool and then maintaining the initial rate set for providing tokens to the pool. When liquidity is provided in the pool, the provider will receive a unique liquidity pool notification code. Liquidity pool token holders receive a 0.3% fee distributed depending on the amount of input. Providers must compulsorily burn their liquidity tokens in exchange for hidden tokens and each rate earned for participation.

The price adjustment mechanism of the Liquidity Pool in DeFi is determined by the AMM (Automated Market Maker). A lot of liquidity pools have used their own constant algorithm to help determine the number of tokens for both sides. Thanks to this, the price of the tokens in the pool increases as the number of tokens increases.

token ratio determines the value of tokens in every Liquidity Pool. The size of the transaction is proportional to the pool size, which also determines the value of the token. A pool with fewer and larger transactions means the cost of the tokens decreases. There are pools with large and smaller transactions that will have high token costs.

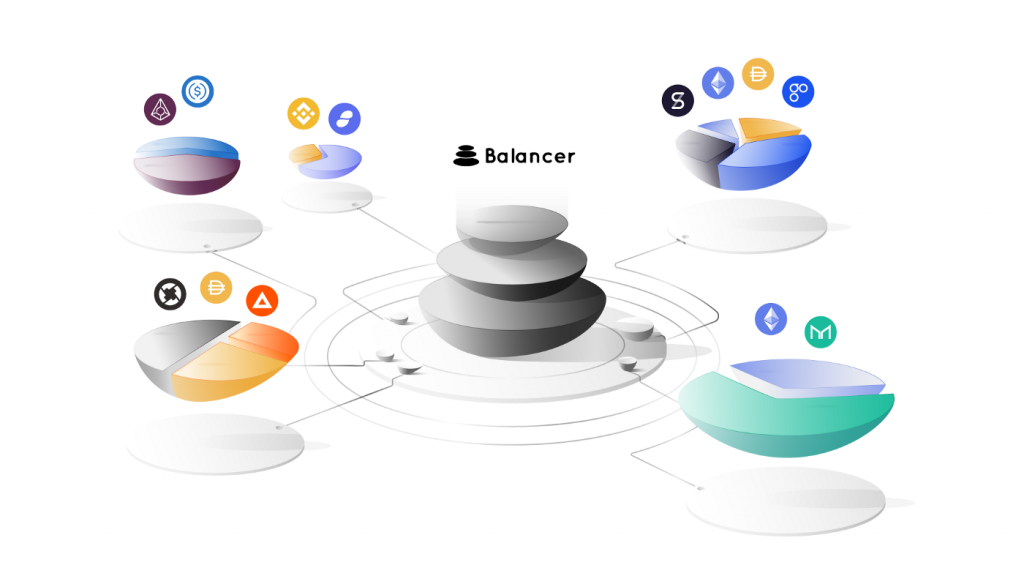

Today DeFi platforms are looking for solutions to increase the amount of liquidity because, sooner or later, large Liquidity Pools will significantly reduce slippage and help enhance the trading experience. To supplement the liquidity provided to pools, protocols like Balancer reward providers with tokens.  Balancer is a mechanism that helps promote liquidity for DeFi

Balancer is a mechanism that helps promote liquidity for DeFi

Introducing liquidity pools to the DeFi market will help eliminate many problems, such as traders having to wait for market makers before trading. AMMs and liquidity pools are an important improvement on the order books used in traditional financial markets. There are currently many liquidity pools that DeFi exchanges can choose from, helping users trade faster and easier.

Conclude

It can be said that liquidity is one of the cores of the current decentralized financial market. It helps decentralized transactions, lending, and many more functions be performed. Smart contracts are everywhere in the DeFi market and will play an even bigger role in the future.

Hopefully, through the article, readers can better understand the outstanding features and how the liquidity pool works. I wish you a successful investment and don't forget to ask any questions about the crypto market, Please comment below