The Nexus Between Cryptocurrency and Crime

Unraveling the Nexus Between Cryptocurrency and Crime

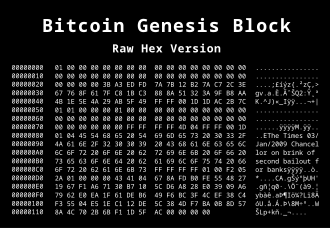

A cryptocurrency, crypto-currency, or crypto[a] is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it.[2] A logo for Bitcoin, the first decentralized cryptocurrency

A logo for Bitcoin, the first decentralized cryptocurrency

Cryptocurrency, with its promise of decentralization and anonymity, has undeniably revolutionized the financial landscape. However, this innovative technology has also inadvertently become entwined with various forms of criminal activities, posing significant challenges to law enforcement agencies worldwide.

The Dark Side of Cryptocurrency:

1. Money Laundering: Cryptocurrencies offer a veil of anonymity, making them attractive vehicles for money laundering. Criminals can easily transfer ill-gotten funds across borders with minimal oversight. Mixing services and privacy coins further obscure the transaction trail, complicating efforts to track the origin and destination of illicit funds.

3. Dark Web Markets: Cryptocurrencies serve as the primary medium of exchange on dark web marketplaces, where illegal goods and services, including drugs, weapons, and stolen data, are bought and sold. The anonymity provided by cryptocurrencies facilitates these illicit transactions, fostering a thriving underground economy beyond the reach of traditional law enforcement.

4. Ponzi Schemes and Scams: The cryptocurrency space is rife with Ponzi schemes, fraudulent ICOs (Initial Coin Offerings), and investment scams promising unrealistic returns. Unsuspecting investors fall victim to these schemes, lured by the allure of quick profits. Once funds are deposited into cryptocurrency wallets, they are often siphoned off by perpetrators, leaving investors with little recourse for recovery.

Regulatory Challenges and Responses:

1. Regulatory Ambiguity:

The decentralized nature of cryptocurrencies presents regulatory challenges for governments worldwide. Jurisdictional issues, conflicting regulatory frameworks, and the borderless nature of blockchain transactions complicate efforts to combat cryptocurrency-related crimes effectively.

2. Enhanced Surveillance and Enforcement:

Law enforcement agencies are increasingly investing in blockchain analytics tools and collaborations with cryptocurrency exchanges to monitor and track suspicious transactions. Enhanced regulatory measures, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, aim to mitigate the risks associated with illicit cryptocurrency activities.

3. Public Awareness and Education: Educating the public about the risks and pitfalls of investing in cryptocurrencies is crucial in combating fraudulent schemes. Increased awareness of common scams and best practices for securing cryptocurrency holdings can empower individuals to protect themselves from falling victim to criminal activities in the digital asset space.

Conclusion:

While cryptocurrency holds immense potential to revolutionize finance and empower individuals, its association with criminal activities underscores the need for robust regulatory frameworks, enhanced enforcement measures, and public awareness initiatives. Striking a balance between innovation and security is imperative to harness the transformative power of cryptocurrency while safeguarding against its misuse for illicit purposes. As the cryptocurrency landscape continues to evolve, proactive measures and collaborative efforts are essential to mitigate the risks and uphold the integrity of the financial system in the digital age.

References

- ^ Pagliery, Jose (2014). Bitcoin: And the Future of Money. Triumph Books. ISBN 978-1629370361. Archived from the original on 21 January 2018. Retrieved 20 January 2018.

- ^ Milutinović, Monia (2018). "Cryptocurrency". Ekonomika. 64 (1): 105–122. doi:10.5937/ekonomika1801105M. ISSN 0350-137X. Archived from the original on 16 April 2022. Retrieved 18 April 2022.

- ^ Jump up to:

- a b Andy Greenberg (20 April 2011). "Crypto Currency". Forbes. Archived from the original on 31 August 2014. Retrieved 8 August 2014.

- ^ Polansek, Tom (2 May 2016). "CME, ICE prepare pricing data that could boost bitcoin". Reuters. Archived from the original on 23 April 2022. Retrieved 3