Solana (SOL) Receives a Neutral Rating Sunday: Is it Time to Get on Board?

Sunday, March 31, 2024 06:35 AM | InvestorsObserver Analysts Solana (SOL) gets a neutral rating from InvestorsObserver Sunday. The Distributed Software Platform asset is up 0.32% to $196.86 while the broader crypto market is up 0.91%.

Solana (SOL) gets a neutral rating from InvestorsObserver Sunday. The Distributed Software Platform asset is up 0.32% to $196.86 while the broader crypto market is up 0.91%.

Solana has a Neutral sentiment reading. Find out what this means for you and get the rest of the rankings on Solana!

See Full Report

Neutral

Over the last five days, Solana has earned a Neutral rating on the InvestorsObserver Sentiment Score. The Sentiment Score measures the performance of Solana over the past five days by volume and price movement.

The Sentiment Score provides a quick, short-term look at the crypto’s recent performance. This can be useful for both short-term investors looking to ride a rally and longer-term investors trying to buy the dip.

Price Levels

Solana is currently trading near its five-day high of $199.730941772461. The Distributed Software Platform asset is 1.44% off its five-day high and is 9.11% higher than its five-day low of $180.42.

Solana price is comfortably positioned between support and resistance. With support set around $191.72 and resistance at $200.24, has some room to run before facing resistance.

Solana has traded on low volume recently. This means that today's volume is below its average volume over the past seven days.

What is a coin?

A coin is a cryptocurrency that exists on its own blockchain. These are typically used for payments. Depending on the cryptocurrency, what those payments are use for may vary from general use in the Digital Money sub-class to a more specific use in some other sub-classes.

Due to a lack of data, this crypto may be less suitable for some investors.

Click here to unlock the rest of the report on Solana

SOL, XRP, DOGE, 1000SATS Price Analysis for the New Week

KEY POINTS:

- The Fibonacci indicator on the SOL/USD chart suggested an increase toward $223.

- XRP formed a bullish pennant suggesting a breakout while DOGE might decline to $0.19.

- The Bollinger Bands indicated that SATS was overbought and the token might drop to $0.00050.

With the market heating up, Coin Edition takes a closer look at assets generating widespread interest. Here is a thorough analysis of four cryptocurrencies and how they might perform going forward.

Solana (SOL)

Solana (SOL) broke out of the $190.94 resistance on March 29 after consolidating for some days. However, the Relative Strength Index (RSI) showed that the previous bullish momentum had been halted.

In a case like this, SOL’s price might decline below $195 in the short term. But if buying pressure comes back the value of the token might drive northward. Indications from the 0.618 Fibonacci level suggested that a significant pullback might not occur.

Instead, the price of SOL might climb as other Fib levels indicated. Going forward, bar any market collapse, SOL could increase to $223. If the market is highly bullish, the price might tap $293. Coin Edition

Coin Edition

Ripple (XRP)

From the 4-hour chart, Ripple (XRP) had formed a bullish pennant pattern, signaling the extension of its recent uptrend. With this pattern in place, the value of XRP might increase by 6.23% while hitting 0.66.

However, traders might need to be watchful. In a case where bears come in to dominate, XRP might defy the forecast and possibly drop to $0.60.

At press time, the On Balance Volume (OBV) remained flat, indicating the dearth of buying or selling pressure. Should this continue, XPR might swing between 0.61 and $0.63 in the short term. Coin Edition

Coin Edition

Dogecoin (DOGE)

Dogecoin’s (DOGE) performance all month long has been impressive. However, profit booking drew the price back to $0.19 earlier before the meme coin recovered to hit $0.20. Accoridng to the 4-hour DOGE/USD chart, the recent attempt to retest $0.22 might be invalidated.

One of the reasons for this prediction was the Awesome Oscillator (AO). At press time, the AO was postive but with visible red histogram bars. This indicates decreasing upward momentum, which means DOGE might decline to $0.19 again.

However, the RSI showed that buyers were trying to outpace sellers. A successful attempt by buyers might quench the aforementioned decrease. In this instance, DOGE might revisit $0.21. On the other hand, failure could cause bears to drive DOGE as low as $0.16. Coin Edition

Coin Edition

1000SATS (SATS)

The trading volume of 1000SATS (SATS) increased by a whopping 247% in the last 24 hours. Likewise, the price jumped by 11.62%, according to CoinMarketCap.

From a technical point of view, the Bollinger Bands (BB) showed that the token might find it hard to extend higher than $0.00057 as it was overbought. As it stands, SATS might drop to $0.00050. However, if the volume continues to increase and the price bounces from $0.00055, SATS might attempt to hit $0.00060. Coin Edition

Coin Edition

However, the RSI had turned down at press time, suggesting that the token might lose its previous buying momentum. If this is the situation. SATS’ decline to $0.00050 might be validated.

Coin Edition

Crypto

Read more from Coin Edition

Litecoin Soars Past $105 – Is LTC Set For Epic Rally This April?

Litecoin (LTC), the “silver” to Bitcoin’s “gold,” has surged in recent weeks, buoyed by a combination of technical factors, strong investor interest, and strategic accumulation by miners.

The LTC price jumped 12% in the past 24 hours, reaching $106.40. This uptick follows a 40% year-to-date gain, with most of the growth concentrated in the last week. Daily trading volume has also skyrocketed by 175%, indicating a significant influx of investors into the Litecoin market.

Will April Be A Good Month For Litecoin?

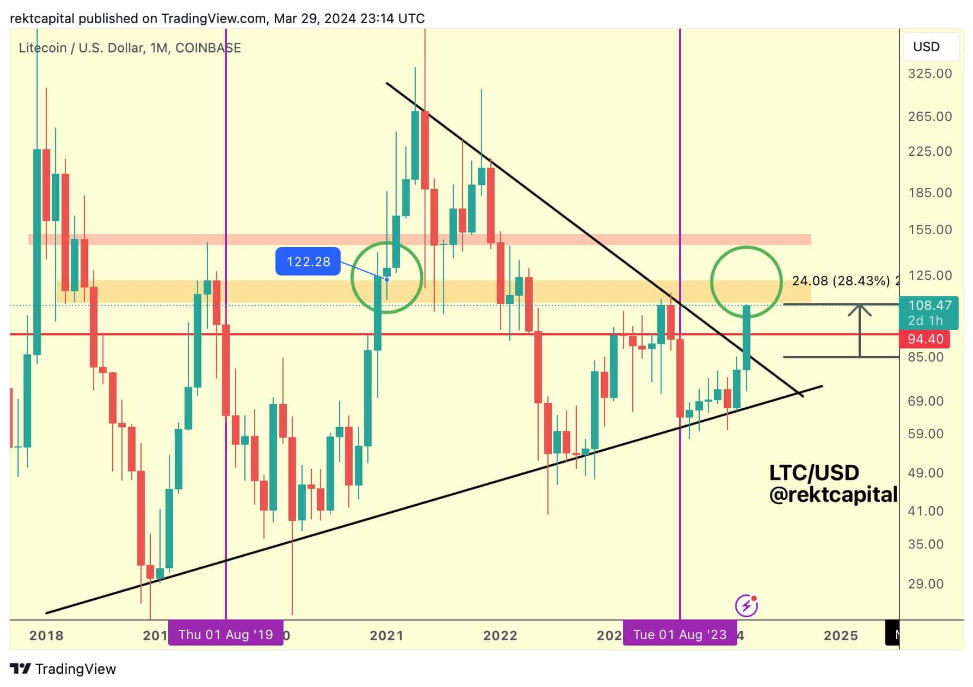

Analysts are particularly excited by a potential breakout from a multi-year downtrend. If LTC can maintain its position above $94, some believe it could usher in a new era of sustained growth.

A decisive break and hold above the $122 resistance level could trigger further gains, with some analysts predicting a surge towards $150 or even higher. This price pattern mirrors a successful breakout observed in 2020/2021, adding fuel to the bullish fire.

Related Reading: From $90 To $400 Litecoin: Analysts Bullish On LTC Soaring Trajectory

Popular crypto analyst Rekt Capital has also chimed in, noting the historical significance of similar price breakouts for LTC. He believes a successful retest of the downtrend and subsequent establishment of support could be indicative of a promising uptrend for the cryptocurrency.

Miners Fueling The Rally

One of the key drivers behind the recent surge is the behavior of Litecoin miners. Data from IntoTheBlock reveals that miners have been accumulating LTC at a healthy pace throughout March. They’ve added a whopping 150,000 LTC to their reserves, bringing their total holdings to 2.2 million.

This accumulation strategy reduces the selling pressure of newly minted coins and signals the miners’ confidence in the future price trajectory of LTC.BitStarz Player Lands $2,459,124 Record Win! Could you be next big winner?

Total crypto market cap is currently at $2.573 trillion. Chart: TradingView

Open Interest On The Rise

The prevailing bullish sentiment finds reinforcement in the remarkable surge in open interest on Litecoin (LTC) futures contracts. Latest data shows a staggering 45% increase in open interest, signaling a growing optimism among traders regarding the coin’s future trajectory.

This surge in open interest not only reflects heightened confidence in LTC’s potential but also underscores traders’ readiness to explore new positions or bolster existing ones.

Such a robust increase in open interest amplifies the potential for sustained growth, as market participants eagerly position themselves to capitalize on anticipated bullish movements in LTC’s value.

Related Reading: Bullish Winds Blow: Bitcoin Bull Flag Points To New $77,000 ATH: Analyst

The Road Ahead

Litecoin could be headed to a strong April performance, with strong technical indicators and bullish sentiment driving the current rally. However, responsible investors should always conduct their own research and exercise caution when navigating the ever-turbulent world of cryptocurrency.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Tags: altcoinscryptoLitecoinltc

Dogecoin Open Interest Hits Record $2.2 Billion – What’s Next For DOGE Price?

The Dogecoin open interest has been on the rise over the past few weeks, breaking and setting new all-time highs twice this March. Unsurprisingly, the price of the meme coin has been reflecting the growth seen by its open interest.

This recent bullish momentum pushed the price of DOGE to break the $0.22 mark, its highest point in three years. However, the question is – how far can this rally go for the foremost meme token?

Dogecoin Open Interest Breaks Above $2 Billion

According to data from CoinGlass, the Dogecoin open interest broke through the $2 billion mark on Friday, March 29. Although DOGE’s open interest stands at around 1.96 billion at press time, it rose as high as $2.21 billion on Friday, a new record for the meme coin.

Related Reading: Prepping For $100,000: Bitcoin Shark And Whales Spend Over $18 Billion To Buy BTC

Open interest is a metric that measures the total number of futures or options contracts of a particular cryptocurrency (Dogecoin, in this case) in the market at a given time. It provides insight into the amount of money investors are pouring into DOGE derivatives at this time.

The meme token’s open interest has had quite a performance since the start of March. DOGE’s open interest rose to $1.6 billion (an all-time high at the time) earlier in the month before retracing to below $1 billion by March 20.

It is worth noting that there has been a high correlation between open interest and Dogecoin’s price, with both climbing at the same time and at almost the same pace. Typically, a rising open interest can suggest a continuation of the trend around the asset’s price at the moment.

Ultimately, the current high open interest for DOGE could mean a rapid price movement for the meme coin in the near future. However, it would be difficult to tell the direction in which this spurt of volatility would take the price of Dogecoin, especially as open interest is not the most optimal indicator of trends or price action.

DOGE Price Overview

As of this writing, the Dogecoin price stands at $0.204, reflecting a 4.6% decline in the last 24 hours. While the meme token’s price has somewhat struggled since hitting the three-year high, it has managed to retain most of its profit from the past week.

Related Reading: Panel Of Experts Reveal When The Cardano Price Will Reach $3

According to CoinGecko data, the Dogecoin price is up by a whopping 18% in the past seven days. This positive performance has strengthened DOGE’s position as the largest meme coin in the market, with a market capitalization of $29 billion.

Dogecoin price sees slight correction on the daily timeframe | Source: DOGEUSDT chart on TradingView

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Tags: dogeDoge priceDogecoinDogecoin open interestdogecoin pricedogeusdt

Analyst: Avalanche (AVAX) In ‘Healthy’ Retreat, Potential Rebound Lies Ahead

AVAX, the native token of the Avalanche protocol, presented a mixed experience for investors in the month of March. The altcoin initially rose by over 64% to trade above $65 for the first time since May 2022 before declining by 18.44% in the last two weeks.

Unsurprisingly, AVAX’s price movement has drawn much attention from investors and market experts alike. Notably, a popular crypto analyst with the X handle Rekt Capital has advised against panic, stating the recent decline of the altcoin could prove to be rather beneficial for investors.

Related Reading: AVAX Price Soars To Highest In Nearly 2 Years, Over 80% Of Holders In Profit

AVAX To Return To $65-$70 Price Zone, Analyst Stands Confident

In a post on X on March 30, Rekt Capital shared that AVAX has suffered an overall decline since encountering the $65-$70 price zone in mid-March. However, the analyst has described this price drop as a “healthy dip,” which could result in the token returning to previously high levels.

$AVAX

Avalanche rallied to the $65-$70 area

And is now dipping towards the December 2023 highs (red)

This is a healthy dip to set AVAX up for the next uptrend back to the $65-$70 area again, over time#AVAX #Crypto #Avalanche https://t.co/o7s9sU4eIN pic.twitter.com/5QJG2e581Y

— Rekt Capital (@rektcapital) March 30, 2024

Currently, AVAX trades in the range of $52-$54, but Rekt Capital predicts the altcoin is heading to the region of $44-$49, which represents its highest price points recorded in December 2023. On entering this price zone, Rekt Capital expects the token to find support and embark on an uptrend back to the $65-$70 region.

However, in the presence of overwhelming bearish pressure, the analyst technical analysis revealed that AVAX could drop further to around $32.66, indicating a potential price decline of 39.62% and 49.9% from the coin’s current price and its peak price in March, respectively

Related Reading: Avalanche Unleashes Durango Upgrade, AVAX Price Rockets 8% With ‘Teleporter’ Debut

Avalanche (AVAX) Price Overview

At the time of writing, AVAX trades around $53.50 with no significant price movement in the last day, while recording a 0.51% decline over the past week based on data from CoinMarketCap. Meanwhile, the crypto asset’s trading volume is down by 16.62% and valued at $370.86 million.

However, AVAX has generally been one of best best-performing assets in the last six months boasting a market gain of 471.35% within this period. Notably, in December 2023, the altcoin rose by about 150% to move from $20.41 to a monthly high of $49.98.

Off the market, AVAX has also scored some positive strides. Most recently, the Avalanche network announced a collaboration with fellow blockchain Chainlink and the prestigious Australia and New Zealand Banking Group (ANZ) targeted at exploring the use of crypto assets in global financial settlement systems. The use of AVAX in such a project would largely amplify the token’s adoption, which would elicit a positive effect on its market price.

AVAX trading at $53.30 on the daily chart | Source: AVAXUSDT chart on Tradingview.com

Featured image from Zipmex, chart from Tradingview

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

![RichBeak News [EN]:How options expiration will affect BTC and ETHA large number of bitcoin (BTC)](https://cdn.bulbapp.io/frontend/images/e128f363-f0c0-413d-a2da-4e9ba9c1e258/1)