Bitcoin ETF Inflows Stagnant, Only BlackRock Receives Funds

Bitcoin ETF Inflows Stagnant, Only BlackRock Receives Funds

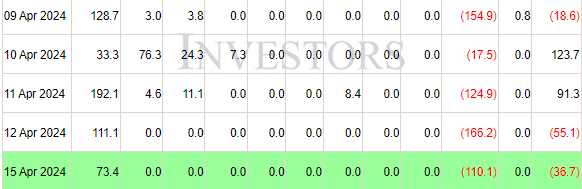

Recent data indicates a stagnation in the flow of funds into Bitcoin Exchange-Traded Funds (ETFs). According to data from Farside, only the Bitcoin spot ETF, BlackRock's iShares, recorded inflows of $73.4 million on April 15, although this figure declined from $111.1 million recorded the previous day. In contrast, eight other ETFs, excluding Grayscale, reported no inflows during this period.

However, despite the inflows into IBIT, it still couldn't offset the outflows from the Grayscale Bitcoin Trust (GBTC), which saw outflows of $110.1 million on April 15, down from $166.2 million outflows on April 14.

Collective trends on April 12 and 15 show ten Bitcoin spot ETFs experienced net outflows, amounting to $55.1 million and $36.7 million, respectively.

The stagnation in ETF inflows coincides with a period of increased volatility for Bitcoin, which has dropped by 11.6% over the week, trading around $63,410.

Outflow of Bitcoin Investment Products Touches $110 Million

Moreover, the global landscape for Bitcoin investment products is also facing challenges, with outflows of $110 million reported for the week ending April 12.

This phenomenon, as noted by James Butterfill, head of research at CoinShares, reflects investor uncertainty amid crises.

Butterfill reported that all combined crypto investment products experienced net outflows of $126 million last week, with weekly volumes increasing from $17 billion to $21 billion.

The recent decline in Bitcoin prices, which peaked at a three-week low of $61,918, was caused by various factors, including geopolitical tensions such as Iran's retaliatory strike against Israel on April 13.

Additionally, anticipation surrounding the upcoming Bitcoin halving event on April 20, where issuance will be halved, has added market uncertainty, prompting traders to carefully monitor its potential impact on price dynamics.

Conclusion

recent data reveals a concerning stagnation in the inflow of funds into Bitcoin Exchange-Traded Funds (ETFs), with only BlackRock's iShares recording notable inflows while the majority of ETFs experienced no such activity. Despite some inflows into IBIT, they were insufficient to offset the significant outflows from the Grayscale Bitcoin Trust (GBTC), contributing to a collective trend of net outflows from Bitcoin spot ETFs.

This stagnation in ETF inflows aligns with a period of heightened volatility for Bitcoin, marked by an 11.6% decrease in price over the week, trading at around $63,410. Additionally, the global landscape for Bitcoin investment products faces challenges, as evidenced by significant outflows reported for the week ending April 12, reflecting investor uncertainty amid ongoing crises.

James Butterfill of CoinShares notes that all combined crypto investment products experienced net outflows, totaling $126 million last week, despite an increase in weekly volumes. The recent decline in Bitcoin prices, attributed to various factors including geopolitical tensions, underscores the market's vulnerability to external events.

Moreover, anticipation surrounding the upcoming Bitcoin halving event on April 20 adds to market uncertainty, prompting cautious monitoring of its potential impact on price dynamics. Overall, these developments highlight the delicate balance between investor sentiment, market volatility, and external factors influencing the cryptocurrency landscape.

*Disclaimer:

This content aims to enrich reader information. Always conduct independent research and use disposable income before investing. All buying, selling, and crypto asset investment activities are the reader's responsibility.