Technical vs On-chain Analysis.

That feeling after reading numerous news articles and studying price charts just so you can predict where the market is heading, but still you are not getting the result you want. What if I say, it’s because you are missing a tool in your analysis? Let’s find out!

Copy trading bots from the top traders. Try it for FREE.

WHAT IS ON-CHAIN ANALYSIS

WHAT IS ON-CHAIN ANALYSIS

The blockchain is an open ledger that keeps records of every transaction as stored data. Using metrics to make sense of this data and using it to make informed decisions and predictions is known as "on-chain analysis."

On-chain analysis is simply analyzing and forecasting the market using data from a blockchain ledger.

Technical Analysis vs On-chain Analysis

Technical analysis is mainly used by traders to spot buy and sell entries, and it involves analyzing the historical price of cryptocurrencies using indicators, charts, and candlestick patterns to ascertain the current trading environment and predict potential price movement. The problems with technical analysis include

- Most of the indicators are lagging: Some indicators give delayed feedback on what has already passed and not what is about to come.

- False Move: When a large amount of an asset is bought or sold by a single wallet, it’s still registered on the chart as a bullish or bearish move which actually could be a pump-and-dump.

- Wash trades will show on the chart: Some traders can repeatedly buy and sell the same asset to increase the volume which will be recorded on the chart, making traders believe the asset is gaining momentum.

On-chain analysis has metrics that give the overall picture and the reason behind what is going on in the chart, which include:

- What actions miners are taking.

- Percentage loss or win amongst whales and retail traders.

- The number of transactions in real-time.

All of these provide the missing context you need to differentiate between the speculative value and raw utility value of a cryptocurrency.

I’m not saying I don't use technical analysis, but on-chain analysis just helps in removing the noise and gives you real data to analyze and make predictions with.

Platforms to carry out On-chain Analysis

There are numerous platforms out there to carry out on-chain analysis. Below are some that I’ve used, and they have a very easy interface.

- Glassnode (Pricy)

- Defillama (Free)

- Nansen (Pricy)

- Into the block (Free)

- Cryptoquant (Pricy)

Simple Indicators for On-chain Analysis

With a lot of activity going on in the blockchain, a lot of on-chain indicators and metrics exist out there, but I will highlight the few that I use so you can master them on time.

Exchange Flows: The exchange flow indicator simply tracks funds going in and out of exchanges. And most of the time, spikes in inflows mean holders are sending their crypto to exchanges to sell off. Outflows mean investors are withdrawing their assets or profits into their wallets for safekeeping.

For you to access the indicator, follow these steps below;

- I will be using the platform IntotheBlock since it’s completely free.

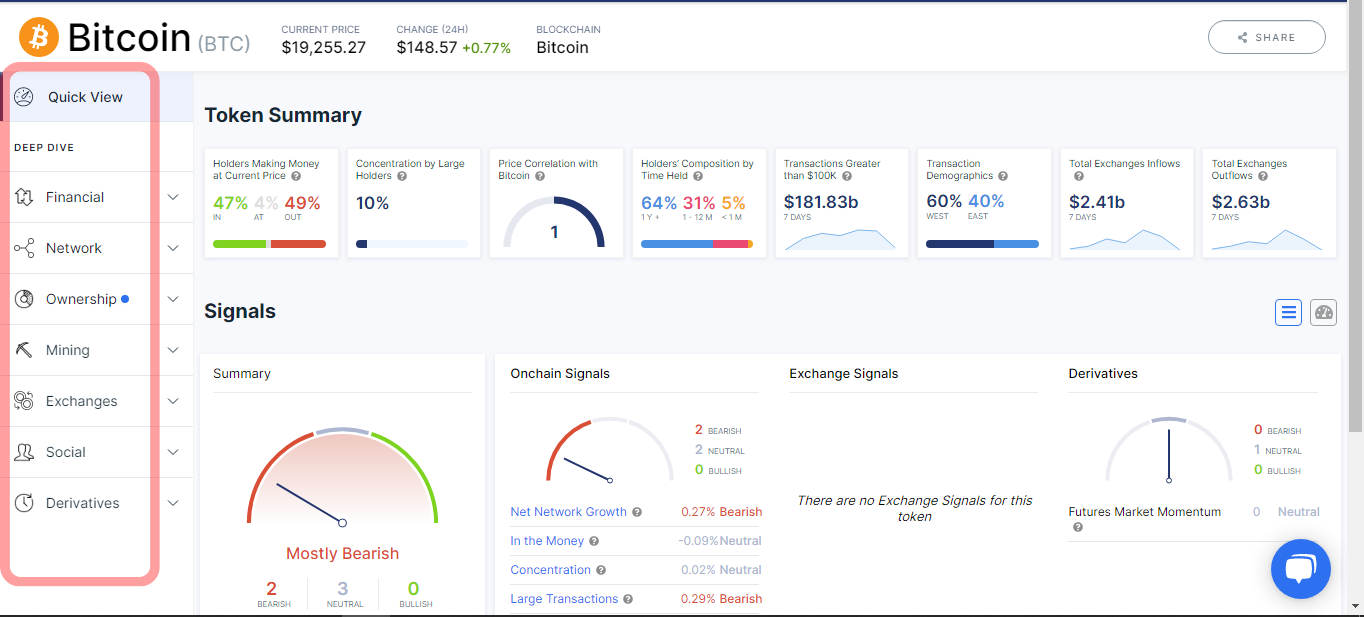

- After signing up, click on any cryptocurrency to get access to the indicators. I will be using BTC for this example.

- From the left panel, select Exchanges and from the drop-down menu select Inflow or Outflow volume. It shows you the option to choose from major centralized exchanges and to specify the time frame you prefer.

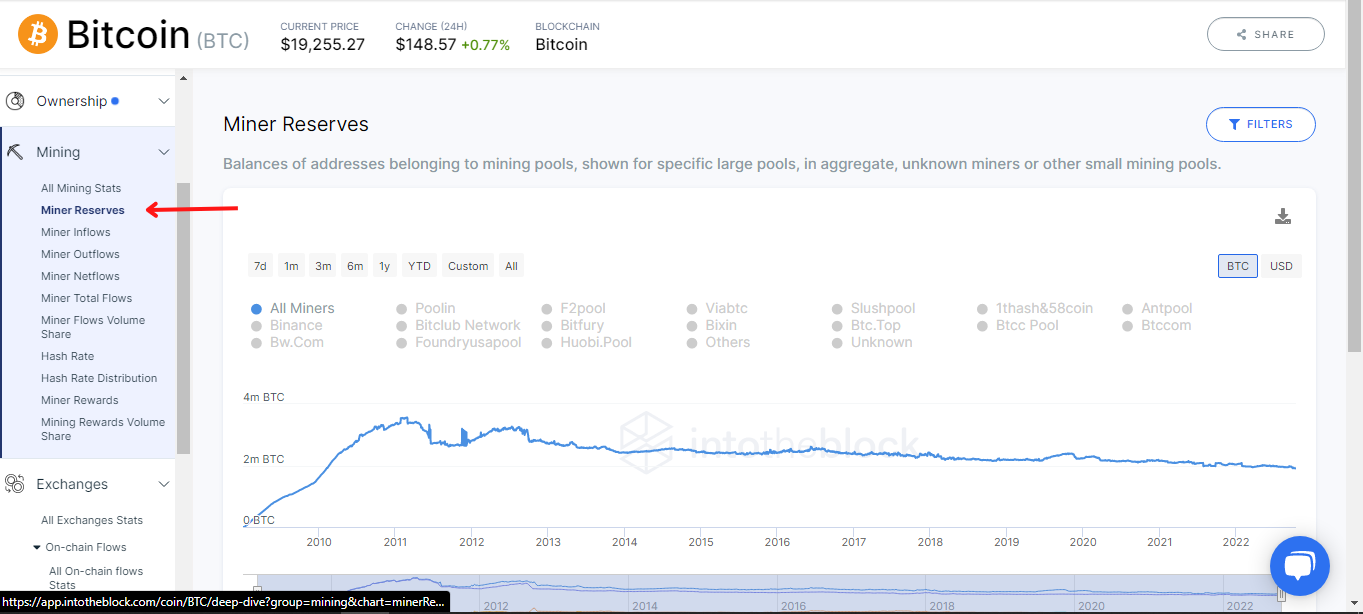

Miner Reserves: Miners of a particular cryptocurrency invest a lot of equipment and energy and from time to time sell out of their balances, which could affect the market and no amount of technical analysis can predict that. This indicator shows the balances of addresses belonging to specific large mining pools. How can you access it for free? Same procedure as above.

Miner Reserves: Miners of a particular cryptocurrency invest a lot of equipment and energy and from time to time sell out of their balances, which could affect the market and no amount of technical analysis can predict that. This indicator shows the balances of addresses belonging to specific large mining pools. How can you access it for free? Same procedure as above.

- It shows the major mining pools and aggregated forms which you can use for your analysis across various time frames.

This indicator identifies the average price (cost) at which tokens were purchased by an address and compares it with the current price. If the current price is greater than the cost, that particular address is “in the money.” If the current price is lower than the cost, that particular address is “Out of the Money”. When most addresses are out of the money (in loss), the selling pressure will be high since many of these addresses just want to reduce their loss and break even on their positions. When most addresses are in the money (in profit), the selling pressure will be less as they want to hold on to their positions.

This indicator identifies the average price (cost) at which tokens were purchased by an address and compares it with the current price. If the current price is greater than the cost, that particular address is “in the money.” If the current price is lower than the cost, that particular address is “Out of the Money”. When most addresses are out of the money (in loss), the selling pressure will be high since many of these addresses just want to reduce their loss and break even on their positions. When most addresses are in the money (in profit), the selling pressure will be less as they want to hold on to their positions. Limitations of On-chain Analysis

Limitations of On-chain Analysis

- Not enough data: On-chain analysis is new and some cryptocurrencies just don’t have enough data yet.

- Numerous metrics: With a lot going on in the Blockchain, there are lots of metrics and they could all be telling different stories. It’s up to the trader or investor to build a strategy and decide.

Generally, on-chain analysis is effective over a longer time frame of weeks and months, and it is all just about human activities on the blockchain.

Leave your comments below, and reach out to me if you have any questions.

Follow me on Twitter (X): Cryptonalyses

Join Coinmonks Telegram Channel and Youtube Channel learn about crypto trading and investing

Also, Read

- Bitsgap review | Quadency Review | Bitbns Review

- Crypto Copy Trading Platforms | Coinmama Review

- Crypto exchanges in India | Bitcoin Savings Account

- OKEx vs KuCoin | Celsius Alternatives | How to Buy VeChain

- Binance Futures Trading | 3Commas vs Mudrex vs eToro

31

Cryptocurrency

Blockchain

Blockchain Technology

Onchain Analysis

Trading

31

Follow

Follow

Written by Cryptonalyses

13 Followers

·

Writer for

Coinmonks

I’m a blockchain analyst and researcher. I write about projects and break down complex blockchain terms and processes for anyone to read and understand.

More from Cryptonalyses and Coinmonks

Cryptonalyses

Cryptonalyses

in

Coinmonks

Namada — redefining privacy

Namada might be the best solution to having some privacy on-chain

3 min read

·

Oct 30, 2023

2

1

Shantanu Gupta

Shantanu Gupta

in

Coinmonks

Which Crypto Will Explode in 2024? Here Are Some Of MyTop Picks.

As we approach the end of the year, investors worldwide are gearing up for the anticipated bull run in the crypto market, eyeing the next…

4 min read

·

Dec 19, 2023

607

2

Velvet.Capital

Velvet.Capital

in

Coinmonks

🚨Velvet.Capital Token Distribution (Airdrop)🚨

🚨 Airdrop Alert🚨: DeFi Asset Management Done right! Everything you need to know for Velvet.Capital’s Token Distribution & Airdrop!

4 min read

·

Dec 30, 2022

31K

827

Cryptonalyses

Cryptonalyses

in

Coinmonks

Harnessing the News: A Trader’s Guide to News Trading

This article demystifies how traders leverage breaking news in trading and reveals top-notch tools and platforms that provide an edge.

4 min read

·

Jul 24, 2023

1

Recommended from Medium

DecentralBytes

DecentralBytes

Navigating the Crypto Seas: A Comprehensive Guide to Technical Analysis of Cryptocurrency Charts…

When cryptocurrency trading, investors and traders often turn to technical analysis as a compass to navigate the tumultuous seas of price…

·

3 min read

·

2 days ago

70

2

Andrey Plat

Andrey Plat

Bitcoin Ordinals under the hood. How Inscriptions and BRC20 workIntroduction.

One of the most talked about narratives in recent weeks is tokens on the Bitcoin blockchain. It is so popular simply because it has already…

12 min read

·

Dec 25, 2023

152

2

Lists

Modern Marketing52 stories

Modern Marketing52 stories

·

366

saves

My Kind Of Medium (All-Time Faves)58 stories

My Kind Of Medium (All-Time Faves)58 stories

·

183

saves

Generative AI Recommended Reading52 stories

Generative AI Recommended Reading52 stories

·

617

saves

Abdus Salaam Muwwakkil

Abdus Salaam Muwwakkil

in

Rather Labs

The Top 10 Blockchain Trends in 2024 that Everyone Must Be Ready For

Exploring BaaS, DeFi Expansion, Scalability Solutions, and Regulatory Trends in Blockchain’s Enterprise Adoption through 2024.

12 min read

·

Jul 18, 2023

738

18

101Blockchains

How long does it take to learn Solidity?

The time it takes to learn Solidity, like any programming language, can vary widely depending on your prior programming experience, your…

2 min read

·

Aug 25, 2023

16 Airdrop X Meta

Airdrop X Meta

TOP BEST AIRDROP 2024

- POLYHEDRA

6 min read

·

6 days ago

156

CryptoCred

CryptoCred

Comprehensive Guide to Crypto Futures Indicators

Understanding open interest, liquidations, funding, and cumulative volume delta.

13 min read

·

Dec 13, 2023

443

5