Real World Assets (RWA)

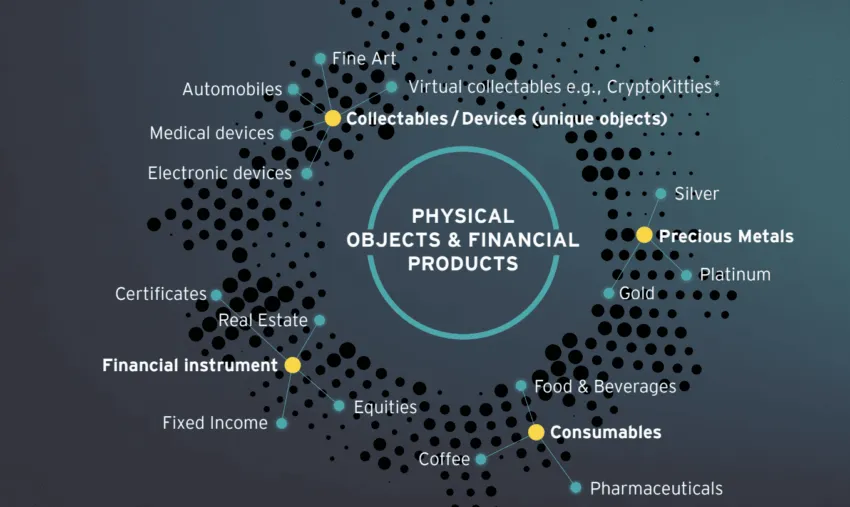

Real World Asset (RWA) is any asset that can be tokenized and represented on the blockchain using blockchain technology. These assets generally refer to traditional financial assets such as real estate, industrial machinery, stocks, bonds, commodities and even services.

Blockchain technology can completely digitize Real World Assets (RWAs) to make them more accessible, trustworthy, transparent and easily trackable. This allows those who want to invest in these assets to make transactions. This allows them to reduce the costs associated with the use and operation of assets.

To give examples of the most popular Real World Entities, we can list them as follows:

- Metal (Silver, gold, etc.)

- Real estate

- Insurance

- found

- Salaries and Invoices

- Credit Scores

- Corporate Debt

- Copyrights etc.

RWAs generate the vast majority of global financial value. For example, the estimated value of the fixed income debt market is $127 trillion, and the total value of global real estate is approximately $362 trillion.

How to Use Real World Assets (RWAs) in DeFi?

The term Real World Assets was coined in recent years to differentiate cryptocurrencies from traditional financial assets. Unlike cryptocurrencies that exist only in digital form, RWAs are generally tangible and linked to real-world organizations.

However, blockchain technology has unlocked the possibility of combining real-world assets with DeFi. Developers often choose to use smart contracts to create a coin that represents an RWA, providing an off-chain basis that the given coin is always available for the underlying asset.

Stablecoins are a great example of successful real-world asset usage in DeFi. Apart from this, synthetic tokens symbolize another use case that involves bridging Real World Assets with DeFi. It allows on-chain trading of derivatives linked to synthetic assets, stocks, commodities and currencies.

However, another adoption of RWA in DeFi involves lending protocols. Unlike primitive lending protocols that rely on crypto-native borrowing, RWA-focused DeFi platforms serve borrowers with real-world businesses. This model provides relatively more stable returns that are absorbed from crypto volatility.

What are the benefits of incorporating RWAs into the DeFi industry?

- he benefits of incorporating RWAs into the DeFi industry are many. First, it creates an opportunity for greater transparency and accessibility in the global financial system. Blockchain technology, which underpins DeFi, makes it easier to verify the ownership and authenticity of assets by providing transparency in transactions and data tracking. Additionally, DeFi applications leverage atomic consensus, transparency, user control, low costs, and composability, enabling efficient market mechanisms and low switching costs.

- Second, the inclusion of RWAs in DeFi creates new investment opportunities for participants. Investors can buy and sell smaller units of assets through fractional ownership made possible through tokenization. They can also make it easier to invest in a diversified portfolio. This increases financial inclusion by providing investment opportunities to a wider range of investors who were previously unable to access these assets due to high barriers to entry.

- Third, RWAs involved in DeFi can help reduce risks associated with crypto's volatility. RWAs are typically less volatile than cryptocurrencies. This makes them more attractive to risk-averse investors. Additionally, by tokenizing these assets, investors can reduce their risk by diversifying their portfolios, thereby reducing overall portfolio risk.

- However, incorporating RWAs into DeFi presents several challenges. First, regulatory frameworks may not be fully developed to accommodate the tokenization of RWAs. This creates legal uncertainties. Secondly, a lack of standardization in tokenization processes can lead to interoperability issues, limiting the efficiency of DeFi applications. Finally, the immutability of blockchain technology can create difficulties in the event of disputes or fraud.

Does DeFi allow Real World Assets to be converted into liquidity through tokenization on DeFi platforms?

Real World Assets (RWAs) can be used across many different applications and platforms in the DeFi ecosystem. DeFi eliminates traditional financial intermediaries. It carries out financial transactions using blockchain technology with the aim of creating a decentralized financial system.

DeFi platforms tokenize RWAs with blockchain technology, enabling them to be used as digital assets. With this tokenization process, RWAs become liquid assets that can be traded with other DeFi assets. RWAs' association with DeFi enables these assets to be used in blockchain-based financial applications.

For example, thanks to blockchain technology, a Real World Asset (RWA) such as a real estate asset can be fully digitized. It can be made available on a DeFi platform. In this way, the tokenized real estate asset can be used as collateral for lending or borrowing on the DeFi platform. Similarly, RWAs enable traditional financial instruments, such as insurance policies and bond issuance, to be usable on DeFi platforms through smart contracts on private blockchains.

How Are RWAs Served?

Before we dive into the uses of RWAs in DeFi, let's examine how they are served, specifically how we can ensure that they are legitimate tokens of the real-world assets they represent. The whole process can be divided into three stages: off-chain formalization, information bridging, and RWA protocol supply and demand.

Off-chain formalization

- Before a real-world asset can be integrated into a digital ledger , its value, ownership, and legal status must be precisely determined in the physical world.

- The asset's market price, performance history, and physical condition are some of the factors taken into account when estimating the value of a RWA. In addition, the legal ownership of the asset must be undisputed and this must be documented with title deeds and invoices.

Information bridging

- This stage is the tokenization process, where the asset's information is converted into a digital token. Data regarding the asset's value and ownership rights are processed into the token's metadata . Thanks to the transparency of the blockchain, anyone can verify the authenticity of the token based on metadata.

- In assets that are within the scope of regulation or classified as securities, it is necessary to use regulatory technologies. These may include working with licensed institutions that issue tokens, complying with crypto-specific KYC (Know Your Customer) and KYB (Know Your Business) standards, and utilizing approved security token exchanges.

Supply and demand in RWA protocol

- In the last stage, which is entirely related to supply and demand, DeFi protocols focusing on RWAs come into play. These protocols have two functions: First, they enable new RWAs to emerge, that is, to make more of these digital assets available. They also work to get investors interested in buying and selling these assets. Thanks to this three-stage approach, RWAs cease to be just an abstract concept and become a practical, functional and important element of the DeFi world, bringing the weight and trust of real-world valuation and legal frameworks to the decentralized digital world.

Reasons RWAs Are Changing the Game for DeFi

One of the most important metrics in DeFi is “ Total Value Locked ” or TVL for short. The TVL metric measures the amount of capital locked in various DeFi protocols. A higher TVL means more usable space. In November 2021, total TVL reached its peak of approximately 180 billion USD, with the rising wave called the “Summer of DeFi”.

As the markets subsequently declined, DeFi TVL decreased to 49.87 billion USD as of June 2022. This means there was a 72.3% decrease in valuation in 7 months. The movement of liquidity away from the market as a result of some DeFi protocols not having real usage areas and weak token economies also contributed to this.

As a result, the perspective of typical DeFi investors has changed significantly. A growing number of these investors are focusing on stable, long-term investment opportunities rather than chasing quick gains. This trend is particularly evident after 2021, where the shift towards more stable asset classes such as RWAs has clearly increased.

Below are some facts and figures that show increasing interest in the RWA market.

- The on-chain value of RWAs (excluding stablecoins) reached 1.05 billion USD in 2023.

- USD 855.7 million (82%) of this came from return-generating assets such as treasury bills, real estate and private loans.

According to a research conducted by analysts between January 1 and September 30, 2023:

- Active on-chain private loans increased by 210.5 million USD.

- Treasury bills and other bonds grew by 557 million USD

What is RWA Issuer?

RWAs come to life on the blockchain through the efforts of issuers operating in three key areas:

- They purchase material assets from the physical world.

- They transform these assets through tokenization.

- They distribute tokens to users within the blockchain network.

Some of the companies operating in the world of RWA issuance include:

- Centrifuge : One of the largest on-chain private loan issuers.

- Franklin Templeton : It is a TradFi giant founded in 1947. It has over USD 1.5 trillion in assets under management (AUM). It has recently started issuing tokenized treasury tokens.

- WisdomTree : It is the market leader in exchange-traded products with approximately 96 billion USD AUM.

Advantages of Using RWA in DeFi

Tokenization of Real World Assets (RWA) offers attractive advantages that are reshaping investment strategies and the world of crypto finance.

- Increasing liquidity : Tokenizing assets such as real estate turns assets that are often illiquid and slowly change hands into tokens. These tokens allow a broader pool of investors to trade the underlying asset.

- Share ownership : Share ownership is one of the most interesting uses of RWAs. It lowers the barriers to entry for ordinary users by separating assets such as real estate into tokens. Therefore, a group of investors can pool their funds to jointly own a property denominated in tokens.

- Transparency : Blockchain's transparent ledger ensures that all transactions and ownership information on an RWA are recorded and can be clearly verified.

- Inclusion : The exchange of tokenized assets through DeFi channels paves the way for new markets and financial instruments. This not only opens up new opportunities to existing investors, but also increases the overall stability and growth potential of the financial ecosystem by attracting new participants.

Understanding the Tokenization Concept

Before talking about RWA-based tokens, it is necessary to understand tokenization . While the process of digitally representing an asset is not new, distributed ledger technology (DLT) and blockchain have taken tokenization one step further.

Tokenization acts as a bridge to store, trade and transfer real-world assets directly into the digital space. The process converts the value associated with tangible or intangible assets into a token. It then allows you to freely use the real-world token in a specific DLT domain. To briefly summarize, thanks to tokenization , you can turn any asset into a digital token. In this way, you can ensure smooth transfers, high liquidity and partial ownership without the need for third parties, and also easily store your assets.

Once backed by real-world assets, each token represented is called a real-world asset.

What is RWA Token?

Thanks to tokenization, you can interact with and represent real-world assets on - chain. So RWA-backed tokens can be converted into almost anything. Examples include collectibles, oil and real estate.

What are Real World Asset Examples?

RWAs include tangible assets, which can include anything of physical significance. Examples of these include:

- Cars

- Collections

- real estate

- Metals

- Silver

- Gold

Additionally, stocks , carbon credits and bonds, which are intangible but have a relevant physical asset, are also examples of RWA.

For a more tangible explanation, imagine you want to invest in a luxury New York property worth over $10 million. It will be difficult for a person with an average income to get a share of this property. However, when the real estate in question is tokenized, partial ownership is also allowed. It is possible to own a 0.0001% stake of a top-tier property in RWA-backed tokens with a supply of 1 million . At this rate your contribution will be $10.

Many major sectors can be tokenized, including the maritime sector. This makes investments possible that would otherwise be difficult for individuals to achieve.

Steps of Tokenization

After understanding the token standards, we can now focus on the step-by-step tokenization process:

- It all starts with asset selection. If you are planning to launch your first real world asset, you must first choose the right asset you want to tokenize. For example, your options may include artwork, commodities or real estate.

- Once you have made your choice, you need to pay attention to the legal framework . This includes determining the rights of token holders and the legal status of the asset.

- The next step is to have the asset professionally evaluated. This step is quite important because the value of your tokens will be directly pegged to the total value of the asset.

- Once you have made your assessment, you need to write and audit the smart contracts associated with the tokens. This is the point where you fix the offering, token launch, liquidation rules, and other guidelines regarding RWA token usage.

- Finally, you can initiate a token sale through a dedicated platform or even a cryptocurrency exchange, provided you comply with the listing rules.

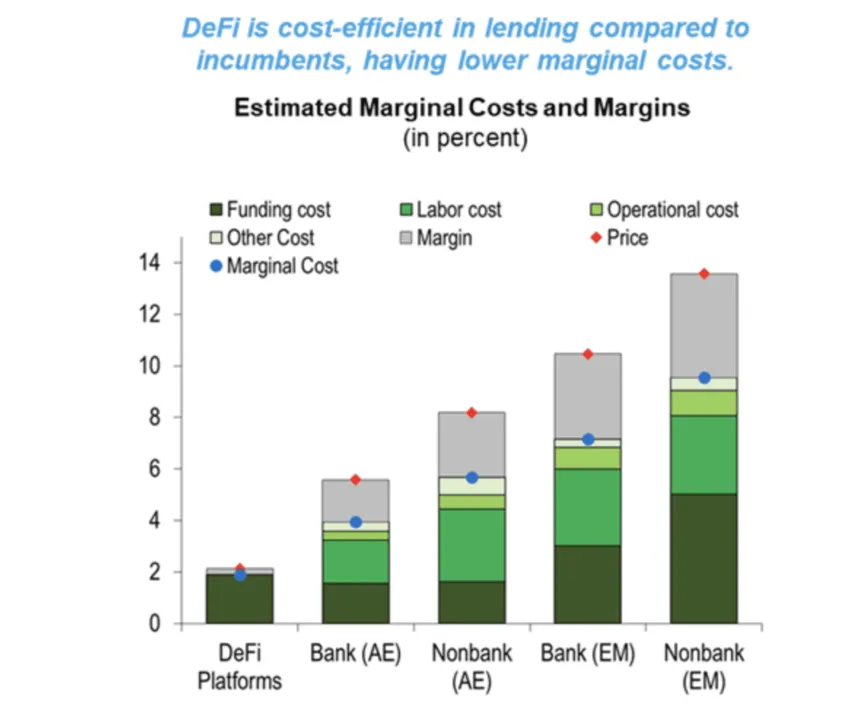

RWA-backed tokens can engage even those inexperienced in the DeFi ecosystem . Real world entities; It falls under the category of Traditional Finance ( TradFi ) , an area plagued by regulations, intermediaries, and more . Tokenization aims to bring these assets to the decentralized world and make them a part of the ever-growing DeFi ecosystem. Unlike banking systems and other traditional financial institutions, DeFi means savings in margin, labor and operational costs that are almost negligible.

Cost efficiency of DeFi: IMF

Cost efficiency of DeFi: IMF

DeFi protocols and tools such as Automated Market Makers (AMM) and liquidity pools allow for instant completion of transactions. This is something that the TradFi world has been missing for a while. Thanks to RWA-backed tokens, it becomes possible to match the advantages and accessibility of real-world assets with the innovative aspects of DeFi.

RWA Based Token Types

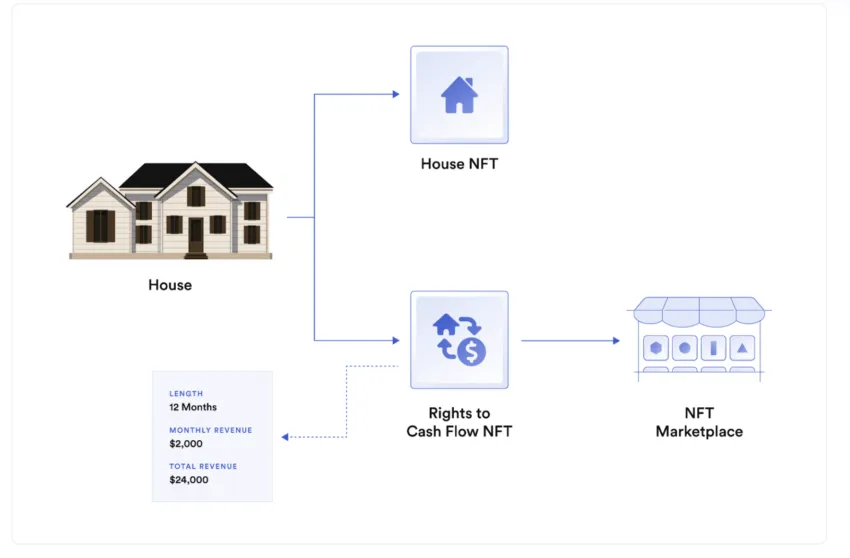

Real Estate Tokens

These tokens represent partial ownership in a real estate-backed asset. Tokens can be pegged to land, commercial properties or anything else you can think of. Because tokens must comply with federal regulations, the token model must be chosen carefully. They are also called security tokens because they get their value from another asset . Real-world asset token and fractional ownership concept:Chanlink

Real-world asset token and fractional ownership concept:Chanlink

Real estate tokenization has a wide range of possibilities. In fact, you can perceive the mentioned tokens as NFTs. In other words, you can think of them as dynamic NFTs that automatically update their data based on housing conditions. Or real estate tokens can be small pieces of a larger property. This paves the way for a user with an average income to own something special. Real estate tokens can also be used for regular cash flow or passive income. Investors can lend and stake home-based NFTs to others for a rental-based income or royalty.

Art and Collectible Tokens

These tokens are tied to collections. They can also be viewed as utility tokens because they are primarily associated with a product or service . Various platforms are actively tokenizing high-value artworks from Banksy, Warhol, and others. Thus, they offer partial investment flexibility to individuals.

Commodity Tokens

Commodity Tokens If the asset represented by the tokens represents ownership in physical and tangible products, which may include gold, agricultural products, oil or any other examples, these tokens are called commodity tokens. In fact, stablecoins pegged to gold and even those pegged to fiat money can be called commodity tokens.

Benefits of RWA Based Tokens

RWA-based tokens have several advantages. Although many items can be listed in secondary and tertiary terms, their main benefits can be listed as follows:

- Improved liquidity: Having a large number of tokens is often more accessible than a high-value tangible or intangible asset.

- Democratized investing: Allows a greater number of individuals to participate, with a strong focus on liquidity and fractional ownership.

- Improved market efficiency: Provided by better security, transparency regarding pricing and subsequent 24-hour trading opportunities.

- Better traceability: Blockchain's immutability ensures that records are free from disputes and fraud.

- Built-in compliance: Certain legal requirements can be hard-coded into the token itself, provided you choose the right token model and smart contracts.

- Programmability: Everything can be translated into a trust-based relationship, including the distribution of dividends and returns.

- Lower costs and barriers to entry: Tokenization aims to eliminate intermediaries.

An exciting development for DeFi, RWAs can expand the possibilities and audience of DeFi. Thanks to these assets, a more interconnected financial world can be created where traditional and decentralized finance come together. But reaching this point will require overcoming significant hurdles, including strict compliance with regulations and ensuring market integrity.

Matthijs de Vries, co-founder of AllianceBlock, which rolled up its sleeves to offer a decentralized tokenized market service , said in a statement that such statistics give an idea of the effects that institutional-level investments can have on the industry:

“This trend is expected to result in exponential growth in the tokenized RWA industry , especially as more liquidity flows into the space . “This will lead to a more sustainable bull market with less capital flight at the top.”

The growth of the RWA sector continues to gain momentum due to increased regulatory clarity and successful pilot projects in certain jurisdictions such as Switzerland. De Vries said unsustainable returns on decentralized finance platforms ( DeFi) , which have led to the collapse of many major crypto projects in 2022 , are driving investors to seek sustainable and real returns, such as in the tokenized RWA sector:

“Investors are now looking for transparent disclosures about where these returns are coming from, making tokenized RWAs more attractive due to their clear source of returns and greater recognition by traditional players.”

https://www.bulbapp.io/u/BYqeEQZZWzQn7MVpopges4zH3qe3yeNDunPVY9f3FixS/erendurden

https://www.bulbapp.io/p/2cc279f7-eff9-4b9d-87a9-495374b9fbe2/kobe-bryant?s_id=f17760dc-f6ee-4b7d-a72a-c24242763feb

https://www.bulbapp.io/p/03850db1-0530-45c2-8ae9-2577fd8f187d/what-is-ripple?s_id=57525614-ce1b-4d58-940d-94b682d552d9