What is a Crypto Sniper Bot and how to snipe in crypto ?

What is a Crypto Sniper Bot and how to snipe in crypto ?

The ultimate guide to understand what is a Sniper bot and how to use it.

through this guide, we will use Prodigy Sniper bot available on 18+ chains

What is a crypto Sniper bot: Introduction

You heard about those “crypto sniper bot” on blockchain but you don’t totally understand what that is?

Well you are not alone.

In this article, you will find all the informations you need to understand sniper bots and start using it.

The Concept of a Crypto Sniper bot in Cryptocurrency

At its core, a Crypto Sniper bot is an automated trading tool designed for the cryptocurrency market.

Its primary function is to execute buy or sell orders at extremely high speeds, often in response to market events or specific conditions that are favorable for trading.

The term ‘sniping’ in this context refers to the bot’s ability to quickly ‘shoot’ and execute trades at the most opportune moments, much like a sniper in a military context who waits patiently for the perfect shot.

Why do people use a Sniper bot in crypto?

The cryptocurrency market is known for its volatility and rapid price fluctuations. Traditional trading methods can often fall short in capitalizing on sudden market movements due to the time it takes a human trader to analyze, decide, and execute a trade.

Crypto Sniper bot fill this gap by automating the process, executing trades based on pre-set criteria with speed and precision that is humanly impossible to achieve.

This makes them particularly useful for strategies that require quick reactions to market changes, such as taking advantage of price discrepancies across exchanges (arbitrage) or buying newly listed tokens before others do.

The Rise of Sniper Bots in Crypto Trading

Sniper bots have gained popularity as the cryptocurrency market has matured. With an increasing number of assets, exchanges, and complex market dynamics, the need for automated tools to facilitate efficient trading has become more pronounced.

A Crypto Sniper bot not only provide the speed required in a market that operates round the clock but also bring a level of accuracy and consistency to trading strategies.

Here are the key features you can find on a snipe bot:

Key Features of a Crypto Sniper bot

- Speed: The ability to execute trades in milliseconds.

- Automation: Operating based on predefined rules and conditions, reducing the need for constant monitoring by traders.

- Precision: Executing trades at specific price points, quantities, and times, as programmed by the trader.

- Consistency: Removing emotional and psychological factors from trading, leading to more disciplined and consistent trading strategies.

Crypto Sniper bots are constantly evolving

The Evolution of Trading Bots

The concept of automated trading is not new; it has been a part of the financial markets for decades.

However, the evolution of trading bots, especially in the realm of cryptocurrency, is a story of continuous innovation and adaptation to a unique and rapidly changing market.

Understanding this evolution is crucial in appreciating the role and capabilities of a modern Crypto Sniper bot in cryptocurrency trading.

Early Beginnings in Traditional Markets

Trading bots initially emerged in traditional financial markets.

These early bots were simple automated systems designed to execute trades based on specific, pre-programmed criteria such as price, volume, or time. They were primarily used to increase efficiency and reduce the emotional impact of trading decisions.

Transition to the crypto market

With the advent of cryptocurrency markets, which operated 24/7 and exhibited high volatility, the need for more sophisticated trading bots became apparent.

The early crypto trading bots were adaptations of traditional market bots but soon evolved to cater to the unique demands of the crypto market, such as handling the high frequency of trades and the need for rapid execution.

The Rise of Sophisticated Crypto Sniper bot’s Algorithms

As the crypto market matured, so did the complexity of trading bots. Developers began to incorporate more sophisticated algorithms, capable of complex decision-making processes.

These included bots based on machine learning algorithms that could analyze market trends and adapt their trading strategies accordingly. Developers also had to master the complexity of the blockchain network to adapt those trading and snipe bots.

The Emergence of Crypto Sniper bots

A Crypto Sniper bot represent the pinnacle of this evolution.

Born out of the need to capitalize on very short-lived trading opportunities, these bots are designed to act faster than the market.

They can detect changes in blockchain information, such as pending transactions or new token listings, and execute trades instantly.

Let’s do a quick recap of the evolution of trading bots

Key Milestones in the Evolution of Trading Bots

- Automated Trading in Traditional Markets: The early use of bots for automating stock trades.

- Adaptation to Crypto Markets: Initial bots catered to the basic needs of the 24/7 crypto markets.

- Algorithmic Advancements: Incorporation of complex algorithms, including predictive analytics.

- Real-Time Data Processing: The ability to process and act on real-time market and blockchain data.

- Integration with Blockchain Technology: Direct interaction with blockchain networks for sniping opportunities.

This journey from basic automated systems to advanced Crypto Sniper bot in the cryptocurrency market highlights the rapid technological advancements and the ever-growing sophistication of trading tools. Crypto Sniper bot, as we know it today, is the culmination of this evolution, equipped to navigate and capitalize on the complexities of modern crypto markets.

How to snipe with a Crypto Sniper bot: Basics and Beyond

Sniper bots in the world of cryptocurrency represent a fusion of speed, strategy, and technological advancement.

To fully understand a Crypto Sniper bot, it’s essential to delve into their basic functionality, and the strategic edge they offer in crypto trading.

For this guide, we will snipe using Prodigy bot. This bot is integrated on Telegram so you don’t have to download anything and no payment is required. (note that the bot charge a small % fees on your trades)

Quick Setup Guide: Launch Your Sniper Bot in Just 5 Minutes Across Multiple Chains

Getting your sniper bot up and running via Telegram is a simple and quick process, achievable in under five minutes. Follow this easy guide to begin:

- Acquire the Bot: Start by accessing the Prodigy sniper bot on the user-friendly Telegram platform. This bot stands out from its competitors due to its multi-chain compatibility, functioning on over 18 chains including Ethereum (ETH), Arbitrum (ARB), Metis (METIS), Solana (SOL), Avalanche (AVAX) and many more.

- Integrate Your Wallet: Kick off the setup with the /start command in Telegram. Choose to either create a new wallet for trading or import an existing one from other crypto platforms. This versatility ensures smooth integration with your existing trading framework.

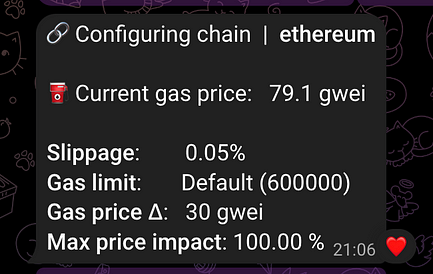

- Customize the Bot: Tailoring your bot is crucial for it to match your trading approach. Adjust settings like gas price and limit, and slippage through the /config command. Enhance your trading security and efficiency by enabling features such as Anti-Rug and Anti-MEV.

- Scan Contracts: Analyze any token or pair contract by simply inputting its address. This bot feature offers an in-depth menu for the primary token, incorporating tools like Dextools or Dexscreener for thorough contract analysis.

- Initiate Sniping: After entering a token contract, access the Snipe menu to configure the bot for specific events like Liquidity additions or Launch methods. The bot keeps an eye on the mempool for buy orders, providing timely information on the token’s marketability.

- Monitor Your Trades: Stay updated with real-time market movements and dynamically track your profits and losses. The bot’s interface enables strategic decision-making, such as automating sell orders based on specific profit percentages.

For a more informations, consult the detailed documentation on our website.

Mastering Token Sniping with Prodigy bot

Here’s a closer look at effectively sniping tokens

A. Setting Up Your Snipe: Choose your target event type (like liquidity or launch) and your trade execution method (such as spend amount or token percentage).

B. Selecting the Trigger Mechanism: After picking your target token, decide on the trigger. You can enable one or several methods, with the sniping starting upon any method’s activation.

- Liquidity Monitoring: This option vigilantly tracks liquidity-related events, triggering the bot into action immediately.

- Method-Based Sniping: Choose a specific contract function to initiate a buy order, ideal for reacting to common contract functions.

- Launch Detection: This tool proactively monitors for “enable trading” methods, ensuring prompt snipe execution.

C. Determining Your Investment: Decide on your investment amount, whether a specific sum, a number of tokens, or a portion of the total supply.

D. Advanced Customization: Refine your strategy by adjusting parameters like slippage and adding extra gas for quicker transactions. Employ safety features like Anti-Rug and Anti-MEV for added security.

Now that you know how to trade and snipe on any chain, let’s go deeper into the technology behind a sniper bot

The Technology Behind a Crypto Sniper bot

The effectiveness of a Crypto Sniper bot in cryptocurrency trading lies in the sophisticated technology that powers it. This technology encompasses various aspects of software engineering, data analysis, and blockchain interaction, making sniper bots incredibly potent tools in the hands of traders.

Algorithmic Complexity

- Trading Algorithms: At the heart of every Crypto Sniper bot is a set of complex algorithms. These algorithms dictate how the bot reacts to market conditions, analyzes data, and executes trades.

- Machine Learning and AI: Advanced Crypto Sniper bot incorporate machine learning and AI to learn from market patterns and improve their decision-making over time.

Real-Time Data Processing

- Market Data Analysis: Snipe bots are equipped to analyze vast amounts of market data in real-time, identifying potential trading opportunities as soon as they arise.

- Blockchain Interaction: Unlike traditional trading bots, a Crypto Sniper bot interact directly with blockchain networks, enabling to execute trades at the very moment conditions are met.

User Interface and Experience

- Ease of Use: Despite the complexity of their backend processes, a Crypto Sniper bot often feature user-friendly interfaces, making it accessible to traders of varying skill levels.

- Customization and Control: Traders can customize various aspects of the bot, such as trading strategies, risk levels, and specific assets to target.

Security and Reliability

- Secure Operations: Security is paramount for a Crypto Sniper bot, as they handle sensitive financial transactions. Encryption and secure communication channels are standard features.

- Uptime and Reliability: Given the 24/7 nature of the crypto market, sniper bots are designed for high uptime and reliability, ensuring they are always operational when needed.

The technology behind a Crypto Sniper bot is a blend of cutting-edge software development and an in-depth understanding of cryptocurrency markets and blockchain technology. This combination is what makes sniper bots not just functional, but formidable tools in the crypto trading landscape.

Some people can wonder how to stop Crypto Sniper bot, especially when you are owning a cryptocurrency project. You can read this detailed article to learn how to stop sniper bot

Crypto Sniper bot vs. Traditional Trading Bots

In the diverse world of automated trading, understanding the distinctions between sniper bots and traditional trading bots is crucial. While both are designed to automate the trading process, their functionalities, objectives, and areas of specialization differ significantly.

Key Differences

- Speed and Execution:

- Crypto Sniper bot: They are optimized for ultra-fast execution, crucial for strategies that depend on speed, like sniping new token listings or exploiting short-lived arbitrage opportunities.

- Traditional Bots: Generally focus on longer-term strategies like trend following or market making, where millisecond-level execution speed is less critical.

- Trading Strategies and Focus:

- Crypto Sniper bot: Highly specialized in executing a specific type of trade at the best possible moment, often based on real-time market events.

- Traditional Bots: Employ a broader range of strategies, from simple rule-based methods to complex algorithms based on technical analysis or statistical arbitrage.

2. Market Analysis and Data Usage:

- Crypto Sniper bot: Rely heavily on real-time data and quick responses to market changes. They often require direct access to blockchain data or high-speed market feeds.

- Traditional Bots: Utilize historical data and longer-term market trends for decision-making. Real-time analysis is important but not always at the core of their operation.

Comparing Effectiveness

- Adaptability: Traditional bots are generally more versatile across various market conditions, while sniper bots excel in specific, often high-volatility scenarios.

- Risk Profile: Sniper bots may engage in riskier strategies due to the nature of their targets and speed, whereas traditional bots often have more built-in risk management features.

- Profit Potential: The quick-hit nature of sniper bots can lead to high profits in a short time, but with higher risks. Traditional bots aim for steady gains over a longer period.

Choosing the Right Crypto Sniper bot

The choice between a Crypto Sniper bot and a traditional trading bot depends on a trader’s strategy, risk tolerance, and goals. While sniper bots offer the excitement and potential of quick gains, traditional bots appeal to those looking for a more measured approach to trading.

To get started with bot on cryptocurrency, we recommend using our Sniper bot

The Role of Speed in Crypto Sniper bot Operations

In the realm of Crypto Sniper bot, speed is not just a feature; it’s the very essence that defines their effectiveness and purpose. The crypto market’s inherent volatility and the fleeting nature of certain trading opportunities make speed an indispensable element in sniper bot operations.

Why Speed Matters

- Capturing Fleeting Opportunities: Many profitable trades in the crypto market are ephemeral, lasting only seconds. A Crypto Sniper bot is designed to detect and act on these opportunities faster than any human trader could.

- Minimizing Slippage: In fast-moving markets, the price at which a trade is executed can differ significantly from the price at the time the order is placed. Speedy execution by sniper bots helps minimize this slippage, ensuring more accurate trade execution.

- Reacting to Real-Time Events: Whether it’s a sudden market shift due to news announcements or the launch of a new token, sniper bots can capitalize on these events in real-time.

How a Crypto Sniper bot Achieve Speed

- Direct Blockchain Interaction: Many sniper bots interact directly with blockchain networks, allowing them to execute trades at the blockchain level, which can be faster than through traditional exchange interfaces.

- Optimized Algorithms: The algorithms driving sniper bots are optimized for speed, from market analysis to order execution.

- High-Frequency Trading (HFT) Capabilities: A Crypto Sniper bot often employ HFT techniques, processing large numbers of orders at extremely high speeds.

Speed vs. Accuracy

While speed is crucial, it must be balanced with accuracy. A sniper bot that executes trades rapidly but inaccurately is counterproductive. The best sniper bots achieve a harmonious balance, executing trades swiftly while maintaining a high level of precision.

The Impact of Network Congestion

One challenge for sniper bots, especially on congested networks like Ethereum, is the variability in transaction speeds due to network load. Advanced Crypto Sniper bot account for this by adjusting their strategies in response to current network conditions.

Algorithmic Strategies in Crypto Sniper bot

Sniper bots in cryptocurrency trading are not just about speed; they are also about the intelligent application of various algorithmic strategies. These algorithms define when and how a sniper bot should execute trades, making them sophisticated tools capable of navigating the complexities of the crypto markets.

Check our Prodigy documentation to understand How to use a crypto sniper bot

Types of Algorithmic Strategies

- Market Monitoring Algorithms:

- Continuously scan the market for specific conditions or indicators, such as sudden price changes, volume spikes, or news releases.

- Are particularly useful for sniping new token listings or catching early movements in the market.

- Predictive Algorithms:

- Employ statistical models or machine learning techniques to predict future market movements based on historical data.

- Useful in anticipating market trends and setting up sniper trades in advance.

- Arbitrage Algorithms:

- Identify price discrepancies across different exchanges or trading pairs.

- Enable Crypto Sniper Bot to buy low on one platform and sell high on another, capitalizing on these differences.

- Order Book Analysis:

- Analyze real-time data from exchange order books, identifying potential buy and sell walls.

- Help in understanding market depth and liquidity to optimize trade execution.

Implementing Algorithmic Strategies for a Crypto Sniper Bot

- Customization and Flexibility: Traders can often customize the algorithms used by sniper bots, tailoring them to their specific trading style and risk appetite.

- Integration with Market Data: Sniper bots integrate with various sources of market data, from exchange APIs to blockchain feeds, ensuring that their algorithms are informed by the most current information.

The Role of Backtesting**

- Backtesting allows traders to test their algorithmic strategies using historical data to gauge their effectiveness.

- It’s a crucial step in refining a crypto sniper bot’s algorithms, ensuring they perform well under different market conditions.

Challenges and Considerations

- Market Volatility: High market volatility can impact the effectiveness of certain algorithmic strategies, requiring constant adjustment and refinement.

- Regulatory Landscape: The use of advanced algorithmic strategies in crypto trading must navigate the evolving regulatory landscape to ensure compliance.

Customization and Configuration of a Crypto Sniper Bot

The ability to customize and configure a Crypto Sniper Bot is a critical feature that caters to the diverse needs and strategies of individual traders.

This flexibility allows traders to tailor the bot’s operations to their specific trading goals, risk tolerance, and market conditions.

Crypto Sniper Bot configuration

Personalizing Trading Strategies

- Setting Parameters: Traders can set various parameters such as the assets to target, the size of trades, specific price points for entry and exit, and stop-loss limits.

- Adjusting to Market Conditions: Customization also involves adjusting the bot’s settings in response to changing market dynamics, such as increased volatility or new trends.

Configuration of a Crypto Sniper Bot for Specific Blockchain Networks

- Each blockchain network, such as Ethereum, AVAX, or Solana, has its unique characteristics. Configuring a Crypto Sniper Bot to align with the specific features of each network (like transaction speeds and fee structures) can optimize their performance.

Risk Management Customization

- Traders can configure sniper bots to incorporate their risk management strategies, setting limits on trade sizes, dictating the diversification across assets, and defining parameters to manage losses and protect profits.

User Interface and Experience

- Ease of Use: Despite the complexity in their backend, a Crypto Sniper Bot often offer intuitive user interfaces, making it easy for traders to configure and monitor their operations.

- Real-Time Feedback: Many sniper bots provide real-time feedback on their performance, giving traders insights into how their customized settings are playing out in the market.

The Importance of Testing

- Before deploying a sniper bot in live trading scenarios, it’s crucial to test the configured settings, ideally in a simulated environment or with small-scale trades. This helps in identifying any flaws or needed adjustments in the strategy.

Keeping Up with Market Evolution

- The crypto market is continuously evolving, and so should the strategies employed by sniper bots. Regular updates and tweaks to the bot’s configuration are necessary to maintain its effectiveness.

Conclusion: The Transformative Impact of Crypto Sniper Bot in Crypto Trading

- Crypto Sniper Bots have undeniably revolutionized the landscape of cryptocurrency trading. By combining high-speed transaction capabilities with sophisticated algorithmic strategies and customizable settings, they provide traders with a powerful tool to capitalize on the market’s volatility and opportunities. The evolution from traditional trading bots to advanced sniper bots mirrors the dynamic and fast-paced nature of the crypto market itself.

The introduction of a Crypto Sniper Bot has opened up new avenues for traders, allowing them to execute complex strategies that were previously unattainable. Whether it’s taking advantage of minute price discrepancies across exchanges or quickly buying into new token listings, sniper bots have empowered traders to operate with greater efficiency, precision, and speed.

However, it’s crucial to remember that with great power comes great responsibility. The use of a Crypto Sniper Bot requires a thorough understanding of market dynamics, a well-thought-out trading strategy, and ongoing management and adjustment. Moreover, the ethical and regulatory considerations surrounding automated trading should always be kept in mind.

As we look to the future, it’s clear that sniper bots will continue to play a significant role in crypto trading. Their evolution will likely parallel advancements in blockchain technology and the ever-changing landscape of the cryptocurrency market.

Further Reading and Resources about Crypto Sniper Bot

To explore more about Crypto Sniper Bot and stay updated on the latest developments in crypto trading, the following resources can be invaluable:

- Crypto Trading Forums and Communities: Platforms like Reddit’s r/CryptoCurrency and Bitcointalk offer discussions and insights on the latest tools and strategies in crypto trading, including sniper bots.

- Blockchain News Websites: Websites like CoinDesk, Cointelegraph, and CryptoSlate provide up-to-date news on cryptocurrency markets, including advancements in trading technologies.

- Technical Blogs and Guides: Many online platforms offer detailed guides and technical insights into how sniper bots work and how to effectively use them. Medium and Towards Data Science are great places to start.

- Online Courses and Webinars: Platforms like Coursera, Udemy, and CryptoCurrency Market offer courses on cryptocurrency trading, including sections on automated trading bots.

- Developer Resources: For those interested in the technical side or in building their own bots, resources like GitHub and Stack Overflow offer code repositories and discussions on building trading bots.

- Official Websites and Documentation: For specific bots like Prodigy, visiting the official website and going through their documentation can provide detailed and reliable information.

A Crypto Sniper Bot trading is a testament to the innovative spirit that characterizes the cryptocurrency world. They embody the fusion of technology, finance, and strategy, marking a new era in trading where efficiency, speed, and intelligence reign supreme.