ETH Price Outlook(10/30/2023) - Lower Low Incoming?

Greetings! In this article, I will go over my technical analysis I did today and explain what indicators were notable and future potential scenarios of the Ethereum price action.

Lower Low Incoming?

During the past few days, Ethereum has been hanging around the 1.8k price levels. However, currently, there are small and large indicators that point to Ethereum falling in price and potentially forming a lower-low.

4-hour time frame:

In the 4-hour time frame, the RSI is back into neutral territories. The MACD is also within neutral territories after going into a bearish channel (With it forming a small bullish cross). These two indicators alone possibly hints at a slow bleed or a large retracement within the next couple of days for the Ethereum price action. These levels can include 1.74k and 1.66k.

24-hour time frame:

In the 24-hour time frame, the RSI is now slightly wanning from the overbought territories. The MACD, however, is forming a bearish cross with a lot of built-up momentum along with it. This means that when the bearish cross in the MACD is confirmed, it is likely that Ethereum will face a massive correction. This makes me think that even though Ethereum is over the 20, 50, and 200 EMA levels, it will drop below those levels once again. However, if Ethereum manages to find support along the 200 EMA whilst resetting both the RSI and MACD, it is likely that Ethereum will continue on its uptrend.

Weekly time frame:

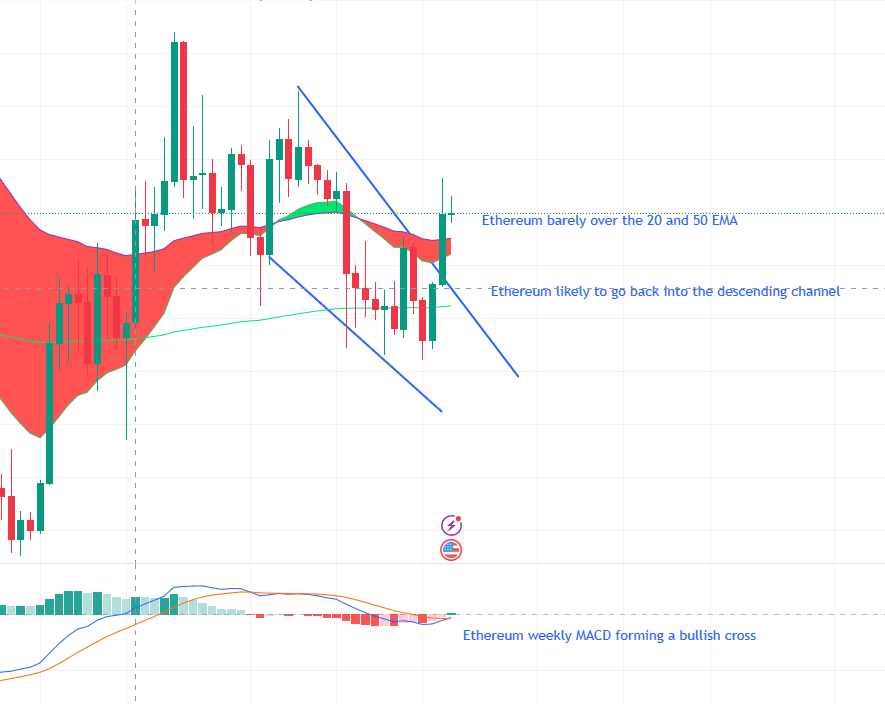

In the weekly time frame, the RSI (Still within neutral territories) is beginning to falter, which indicates that it will fall under the RSI resistance once again. However, the MACD just confirmed its first green bar after the MACD confirmed a bullish cross. Additionally, Ethereum is also over the weekly 200, 20, and 50 EMA levels. Despite this, however, Ethereum is currently barely breaking out of the 20 and 50 EMA regions, which combined with the current knowledge of the 24-hour time frame will most likely result in a break of those regions and a retracement to lower price targets, such as 1.5k - 1.62k.

Conclusion:

In conclusion, Ethereum in both the 24-hour and 4-hour time frames are indicating a retracement to 1.66k within the next couple of days and the weekly time frame is indicating that Ethereum will retrace back into the descending channel.

![RichBeak News [EN]:How options expiration will affect BTC and ETHA large number of bitcoin (BTC)](https://cdn.bulbapp.io/frontend/images/e128f363-f0c0-413d-a2da-4e9ba9c1e258/1)