GemCoin Spotlight - Centrifuge

Today, I will take a closer look at the Centrifuge Protocol, an infrastructure platform designed to enable decentralised financing of real-world assets on the blockchain.

Let's dive into the Centrifuge:

Centrifuge is an infrastructure designed to enable decentralized financing of real-world assets on the blockchain, eliminating unnecessary intermediaries for transparent transactions between borrowers and lenders. It offers fully collateralized asset pools, legal recourse for liquidity providers, and supports a wide range of asset classes, including mortgages, invoices, microlending, and consumer finance.

The protocol aims to reduce borrowing costs for businesses globally while providing DeFi users with a stable, collateralized yield independent of volatile crypto markets. By bringing the structured credit market onto the blockchain, @centrifuge

aims to create a more transparent, affordable, and limitless financial system, addressing the disparity in access to capital between large corporations and SMEs.

Centrifuge has led the creation of the Tokenized Asset Coalition, a collaboration between industry leaders such as Aave, Circle, Coinbase, Rwa_xyz and others. This coalition's goal is to advance real-world asset tokenization, aiming to bring a trillion dollars' worth of assets onto blockchain platforms, with a strong focus on education and advocacy.

*At the time of preparing this review, Centfrifuge's TVL was $246M.

Centrifuge Protocol

Tokenization and Private Data Sharing

- Borrowers issue NFTs to represent off-chain assets for financing.

- The on-chain data linked to NFTs is public, but private data is secured by the Private Data Layer.

- The Private Data Layer is a peer-to-peer network (PODs) for secure information sharing.

- Issuers and investors decide how and with whom to share asset data privately.

- On-chain transparency provides immutable records of financial transactions. On-Chain Securitisation

- Real world assets are illiquid, so pooling assets for financing is essential.

- Revolving pools allow for continuous investment and redemption orders.

- Mechanisms include periods for coordination and in-chain Net Asset Value (NAV) calculation.

- Pricing takes into account different loan types and asset defaults.

- Tranching allows investors to choose their risk profile and tokens represent tranches. Tranche tokens are securities and require KYC for their holders.

Built on Centrifuge Chain

- The Centrifuge Protocol is based on Centrifuge Chain is a private blockchain for real-world assets.

- Advantages include lower costs, flexibility, private block space and on-chain governance.

- CFG token holders manage the blockchain and pay transaction fees. Integrated with DeFi

- Centrifuge Protocol provides Connectors for direct integration with EVM blockchains.

- This enables DeFi protocols to invest in real-world asset pools.

- A multi-chain ecosystem is possible with multiple chain interactions.

Connected to the Real World

- Real-world legal structures such as special purpose vehicles (SPVs) mirror the protocol.

- Legal entities separate asset creators from financing activities.

- Recovery processes for defaulted assets vary by asset class.

- KYC and accreditation checks are required for investor onboarding.

- Third-party e-KYC providers assist with onboarding and verification.

Overview of Centrifuge Pools

Centrifuge's Liquidity Pools manage investments in tranches and each tranche has two key components:

▪️ Liquidity Pool: ERC-4626 compliant contract for the Stabilcoin liquidity pool.

▪️ Tranche Token: ERC-20 Tranche Tokens with restricted membership, reflecting pool interest and priced by Centrifuge mechanisms.

*The distribution, administration and investment management of these tranches is managed by a network of smart contracts as described below.

▪️ Investment Manager: The underlying contract for pool creation, tranche distribution, investment management and token transfers.

▪️ Pool Manager: Secondary contract for precise currency accounting, tranche management and seamless transfers.

▪️ Gateway: Intermediary contract for efficient data routing between Centrifuge, improving ecosystem communication.

▪️ Routers: Routers assist operations by providing seamless information flow with the Centrifuge Chain. Liquidity Pools @centrifuge Chain automates stablecoin swaps for efficient, diversified investment management with trust and effectiveness.

Active Pools

▫️ BlockTower Series 4 - Structured Loan

▫️ BlockTower Series 3 - Structured Loan

▫️ New Silver Series 2 - Property Bridge

▫️ REIT Pool - Commercial Property

▫️ Branch Series 3 (1754 Factory) - Emerging Market Consumer Loans

▫️ Cauris Global Fintech Fund 1 - Fintech Debt Financing

▫️ Fortunafi Series 1 - Income Based Financing

▫️ ALT 1.0 SPV - Invoice Financing and Accounts Receivable

▫️ Port Commercial Loan Series 2 - Trade Receivables

▫️ ConsolFreight Series 4 - Shipping and Transport Invoices

▫️ data based FINANCING 1 - Branded Inventory Financing

Tinlake on Ethereum

Tinlake is Centrifuge's DeFi platform connecting asset pool issuers and investors. Tokenise real-world assets as NFT collateral for DeFi funding.

▪️ Tinlake for borrowers: tokenise real assets as NFT collateral for DeFi funding, simplifying financing and enabling diverse investments with varying terms.

▪️ Tinlake for Investors: Earn returns from TIN (risk) and DROP (return) tokens. TIN offers higher returns with higher risk, while DROP provides stable returns hedged by TIN. It follows the traditional junior/senior investment structure.

Centrifuge Prime

Centrifuge Prime bridges real-world assets and DeFi, offering diverse tokenized investment opportunities with returns from 4% to 13%+. It simplifies access, provides tailored portfolios, and pioneers DeFi's connection with real-world assets.

Join Beta: https://forms.gle/kt1GShLcWapMGzjs7

How it works

Centrifuge Prime allows a dedicated infrastructure to be built for DAOs and protocols that provides the necessary resources and functions to allocate, manage, and tokenize a robust and diversified portfolio of real world assets, at scale:

- Resilient and compliant legal infrastructure

- Robust and capable tokenization platform

- Ecosystem of credit and finance experts

- Institutional-grade assets and managers

Centrifuge Chain Overview

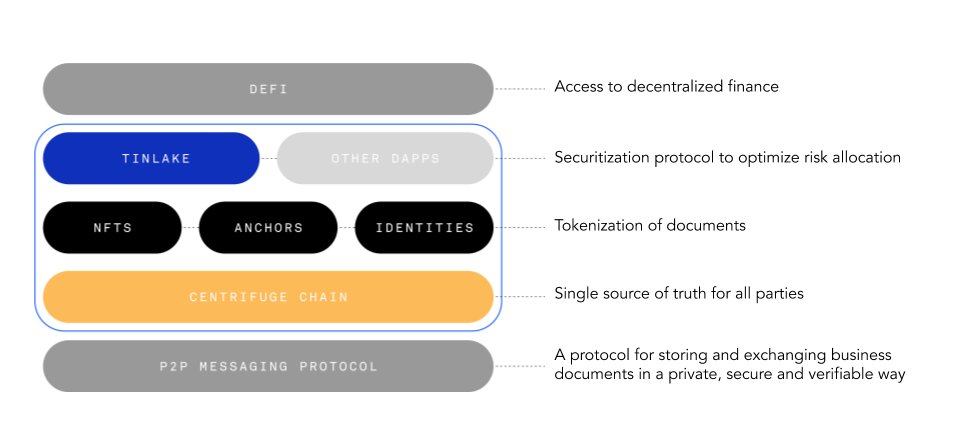

▫️ Centrifuge Stack: Centrifuge Stack combines a peer-to-peer messaging protocol for secure business document exchange. Built on top of Substrate, Centrifuge Chain acts as an immutable source of truth for document tokenisation and funding through dApps like Tinlake.

▫️ Centrifuge Chain: Centrifuge Chain acts as a gateway to the Blockchain Multiverse built on Parity Substrate with a bridge to Ethereum for greater interoperability.

▫️ Centrifuge Chain Efficiency: Centrifuge Chain is optimised for cost-effective, high-speed and privacy-focused transactions and is more suitable for the use case compared to Ethereum. Improved user and developer experiences. Despite some integration complexities with Ethereum and DeFi projects, the advantages outweigh the disadvantages.

Centrifuge POD (P2P Node)

Centrifuge's P2P network enables decentralized financial supply chain applications with censorship-resistant NFT-based financial documents. It ensures transparency, data sharing, and verifiability while using Substrate for document anchoring and a secure peer-to-peer network for document exchange.

Substrate

Substrate is a modular blockchain framework used for document anchoring in Centrifuge's protocol.

Centrifuge is Beta Software

Centrifuge is in beta, with ongoing changes and no guaranteed backwards compatibility. Exercise caution.

Protocol Architecture

Centrifuge Protocol components include Substrate Pallets and a peer-to-peer network via libp2p. Substrate Pallets manage identities, NFT minting, and state commitments.

- Centrifuge PODs: Centrifuge PODs offer an API to interact with the P2P network and Centrifuge Chain. They use a service bus to relay events and support connectivity to Centrifuge Chain for network applications.

- Centrifuge Identities: Centrifuge IDs are unique and track cryptographic keys. They're used for P2P messaging encryption and document signing. These IDs correspond to Centrifuge Chain account IDs.

- Documents within the protocol: Documents are structured data with defined types, supporting various document types. They are exchanged encrypted, accessible only to involved parties, with the ability to add, remove, update, and publish versions among collaborators.

NFTs on Centrifuge

NFTs in the Centrifuge ecosystem are user-mintable tokens created from Centrifuge Documents. They enable users to secure loans and engage in private, secure transactions with document assets. Key features include precise proofs for field verification and metadata storage in TokenData structures.

The structure of an NFT created with the Centrifuge privacy-enabled ERC721 library typically follows a specific format.

These are NFTs that users can create within the Centrifuge ecosystem. The creation of these NFTs is linked to Centrifuge Documents.

- Users can use these NFTs as collateral to obtain loans.

- The document provides a means to transact with assets in a private and secure manner.

In essence, Centrifuge's approach to NFTs involves user-mintable tokens linked to Centrifuge Documents, with a focus on privacy, secure verification, and potential use cases such as obtaining loans or engaging in private transactions.

The Centrifuge Protocol is a blockchain-based system for the financing of real-world assets, combining tokenisation, securitisation and liquidity integration, managed by token holders. It uses Centrifuge Chain, a layer-1 blockchain with CFG as the governance token. Real-world assets are tokenised as NFTs, linked to off-chain data, pooled, securitised and connected to other blockchains.

- Transparency: Moving capital structure, securitisation and debt servicing to the blockchain with multi-switching, NAV tracking and privacy-focused tokenisation for clear reporting.

- Lower Cost of Capital: Building decentralised infrastructure to reduce the costs associated with traditional securitisation, leveraging open source solutions for cost reduction and simplification of traditional finance.

- Equal and Open Participation: Decentralised on-chain governance promotes equal and accessible participation for all stakeholders in securitisation, including new issuer offerings, underwriting and servicing.

- DeFi Liquidity Access: Obtaining senior and super-senior capital from leading DeFi stablecoin protocols improves ecosystem efficiency and resilience.

- Diversification: Expanding collateral with assets associated with real-world assets for long-term value stability and protocol health.

- Security: Protocol compliance with legal, regulatory and KYC standards, including sanctions screening, accredited investor checks and rigorous technical audits for reliability.

CFG token is at the core of Centrifuge's decentralized platform, providing utility as transaction fees and governance participation. The token supply grows through minting, which is influenced by factors like security and liquidity. Some transaction fees are burned to maintain token supply balance, decided by on-chain governance.

The Centrifuge Network Foundation initiated #CFG distribution with 400 million tokens, aiming for broad decentralization. CFG tokens often come with long lockup periods, aligning with the platform's long-term growth. They play a vital role in network security and governance through on-chain voting.

Centrifuge Chain users pay CFG for transaction fees, with a portion stored in an on-chain treasury. The rate at which a percentage is burned is determined by CFG holders, ensuring sustainability and supply management.

Snapshot of $CFG Distribution post-genesis: 425M tokens:

Governance and Management

The Centrifuge DAO's governance process involves both off-chain and on-chain components. Off-chain governance begins with a Request for Comments (RFC) on the forum, followed by a proposal submission to the Centrifuge Proposal Repository on GitHub.

After community discussion, a snapshot vote occurs on OpenSquare, and if no on-chain vote is needed, the snapshot vote is binding. On-chain governance involves creating an on-chain proposal, and a cooling-off period is observed after failed votes to allow for revisions. The process aims to ensure community input and transparency in decision-making.

Centrifuge Council

Centrifuge Council, comprising 9 members elected by CFG token holders, safeguards the network's interests by proposing referenda, vetoing harmful proposals, and voting on Treasury matters. Rolling elections every 7 days ensure ongoing representation, allowing any CFG token holder to run for a council position and vote for councilors.

Conclusion

Centrifuge's infrastructure stands out for enabling decentralized financing of real-world assets on the blockchain, fostering transparency and reducing reliance on intermediaries. With support for diverse asset classes such as mortgages, invoices, microlending, and consumer finance, the protocol proves versatile across various financial sectors. The ambitious goal of lowering borrowing costs worldwide, particularly for small and medium-sized enterprises, adds a compelling dimension.

Furthermore, by offering DeFi users a stable, collateralized yield unaffected by volatile cryptocurrency markets, Centrifuge presents a more predictable investment avenue. The leadership role in a coalition with industry giants to advance real-world asset tokenization enhances the potential for broader blockchain adoption and increased liquidity. However, accessibility constraints due to mandatory Know Your Customer (KYC) and accreditation checks, the regulatory burden associated with real-world legal structures, and the complexity of the governance process with both on-chain and off-chain components pose notable challenges for prospective users and decision-making processes.