Analyst Points To Possible 30% Bitcoin Correction, Calls For Caution

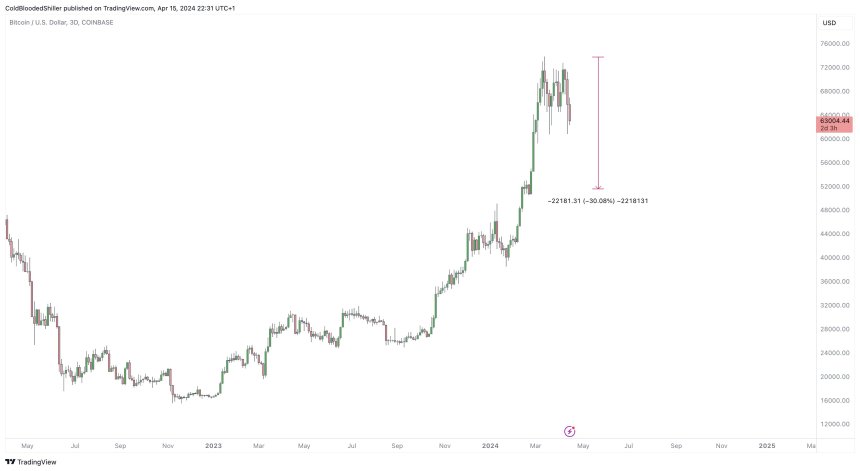

Popular cryptocurrency expert Cold Blooded Shiller has made a grim prediction that Bitcoin may be on the verge of a significant correction and could crash as low as 30%, given the current heightened volatility in the market.

Bitcoin Could Be Poised For 30% Pullback

Cold Blooded Shiller believes it is important to note that Bitcoin is holding up and now showing much more strength, regardless of the different factors influencing the nascent sector, such as ETFs, fundamentals, and Halving.

Related Reading: Analyst Expects Bitcoin Price Correction To Persist, Targets $57,000 Support

Given that pullbacks of 30% are historically common for BTC, Shiller foresees the potential for this to repite this cycle. Should the trend manifest, the price of BTC could fall as low as $51,000 in the upcoming months.

The post read:

With the historical tendency to produce -30% pullbacks, what happens to the landscape if BTC does head down for a -30% correction and into the $51,000?

Cold Blooded Shiller drew attention to a previous post offering investors insights on taking advantage of this development when it happens. Shiller is confident that BTC might undergo the correction mentioned above, and the impact on altcoins would likely be around -50%. Possible 30% correction | Source: Cold Blooded Shiller on X

Possible 30% correction | Source: Cold Blooded Shiller on X

The expert believes some investors are eager to profit in the bull cycle but neglect the risk involved in this period. “I keep referencing buy anywhere you want with risk management that supports -30% downside and ensure you can keep buying more,” he stated.

Thus, the analyst has stressed the need for investors to be well organized and understand what constitutes an opportunity-filled environment in a bull market. His post encourages investors to reassess their risk management and investing tactics to navigate the ever-changing crypto landscape successfully.

BTC Price Continues To Fall

The price of Bitcoin continues to move downward, falling to $63,000 after a recovery witnessed on Monday. Over the last 24 hours, the crypto asset has dropped by 5%, causing a general collapse in the market.

Related Reading: Bitcoin Halving RoadMap: Analyst Outlines 3 Phases For Market Dynamics

At the time of writing, BTC was trading at $63,854, indicating an over 10% decrease in the past week. On the last day, its trading volume increased by roughly 1%, while its market value fell by over 5%.

Given the current trajectory in the crypto market, BTC might suffer an even greater decrease in the next few days. Several analysts anticipate a further price decline before the Halving event in less than five days.BTC trading at $63,133 on the 1D chart | Source: BTCUSDT on Tradingview.com

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin Has Next Major Demand Zone At $56,000: Brace For Impact?

On-chain data shows the next major Bitcoin demand zone is around $56,000, a level BTC might end up revisiting if the decline continues.

Bitcoin Has Next Major On-Chain Support Around $56,000

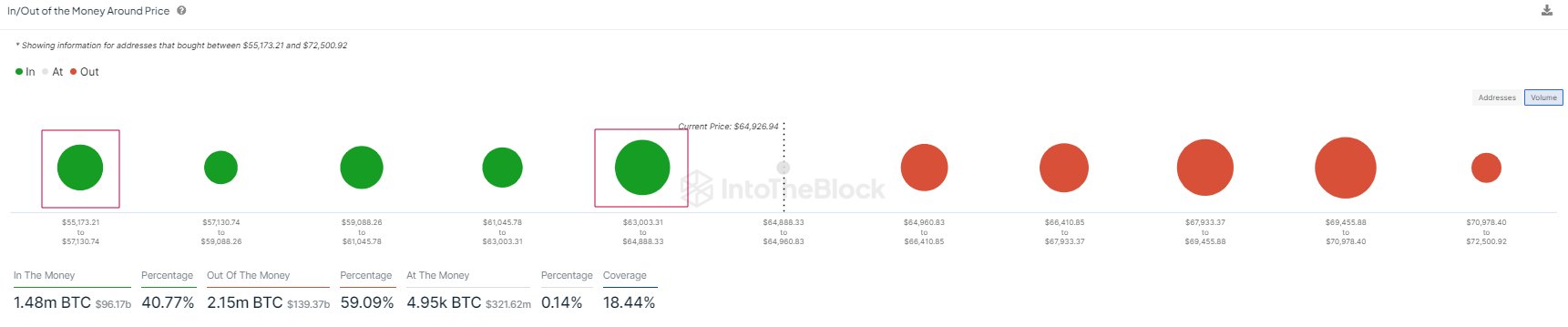

According to data from the market intelligence platform IntoTheBlock, BTC’s recent drawdown has meant that it may end up having to rely on the price range around $56,000 for support.

Related Reading: Bitcoin Whales Showing Different Behavior From Past Cycles, But Why?

In on-chain analysis, a level’s potential as support or resistance is based on the total number of coins that the investors last acquired there. Below is a chart that shows what the various price ranges around the current spot price of the cryptocurrency look like in terms of this cost-basis distribution.

The data for the BTC acquisition distribution across the various price levels | Source: IntoTheBlock on X

In the graph, the size of the dot represents the amount of Bitcoin that was purchased inside the corresponding price range. It would appear that the $63,000 to $64,890 level is currently thick with investors. To be more particular, 1 million investors acquired 530,000 BTC inside this range.

Generally, whenever the asset retests the cost basis of any investor, they may become more likely to make some kind of move, due to the importance the level holds for them.

Investors who were in profits just prior to the retest may be willing to make further bets, believing that if this level was profitable in the past it might be so again in the future.

Naturally, this buying effect would only be relevant for the market if a large amount of investors acquired coins inside a tight price range. The $63,000 to $64,890 range qualifies for this.

The range should have acted as a support point for the coin, but BTC has recently slipped under it, possibly suggesting that this support level may have broken down.

As IntoTheBlock has highlighted in the chart, the next major range of potential support is the $55,200 to $57,100 range. Thus, should the current drawdown continue, this may be the next relevant range.

“While this doesn’t mean that Bitcoin has to go this low, it is good to keep this range in mind while price is exploring recent lows,” notes the analytics firm. A decline to the average price of this range ($56,000) would mean a drawdown of almost 10% from the current spot value of the coin.

Related Reading: Bitcoin Rebounds After Nearing Cost Basis Of Short-Term Whales

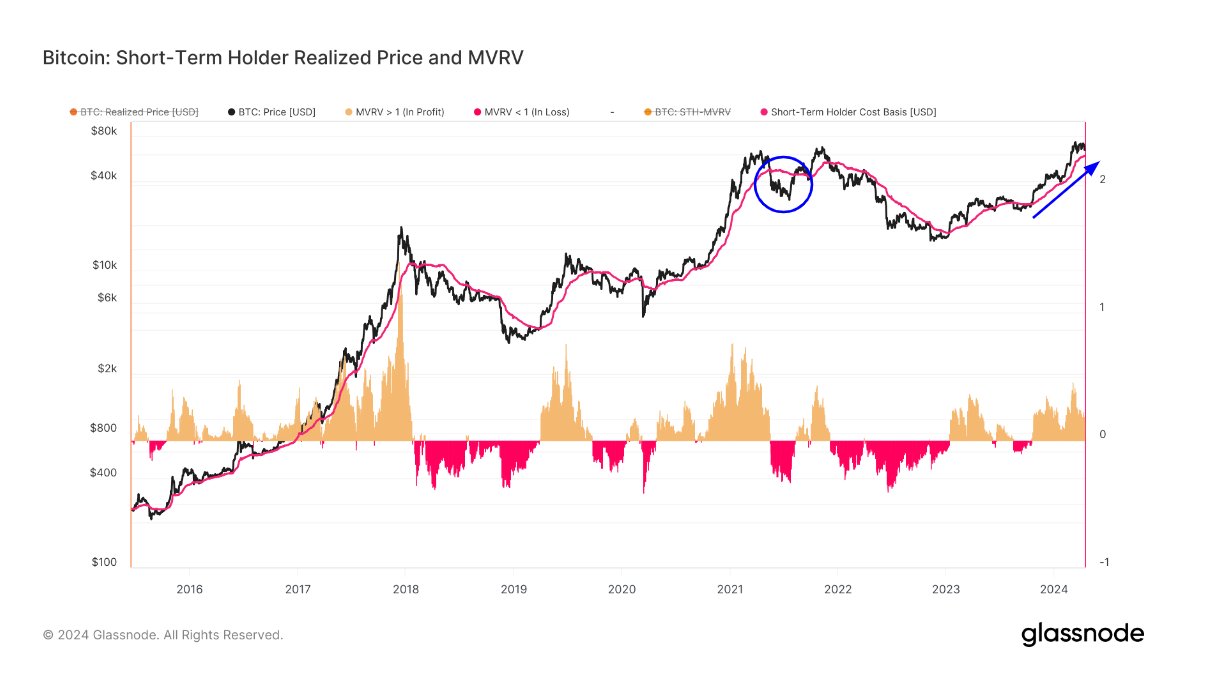

Before this level, though, there is another interesting on-chain level that BTC could end up revisiting. As analyst James Van Straten has pointed out in an X post, the Realized Price (the average cost basis) of the short-term holders is around $58,800 right now.

Looks like the value of the metric has been going up since a while now | Source: @jvs_btc on X

The short-term holders (STHs) here refer to the investors who bought within the past 155 days. This group’s Realized Price has been at an important level historically during bull runs, as the asset has often found support at it.

Breaks under it have, in fact, usually led to bearish transitions in the past. “If we drop below this, I will concede to a bear market similar to May 2021,” says Straten.

BTC Price

Bitcoin has registered a decline of almost 7% over the past 24 hours and in the process, has lost any recovery it had made earlier. Now, BTC is trading around $62,100.

The price of the asset appears to have been going down recently | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, Glassnode.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Arbitrum’s Massive $107 Million Token Unlock Threatens To Send Price Below $1

Arbitrum (ARB) runs the risk of a significant price decline due to its upcoming token unlock on April 16. These token unlock events are known to be a recipe for high volatility because of what could happen in the aftermath of their occurrence.

$107 Million Arbitrum Tokens Set To Be Unlocked

Data from TokenUnlock shows that 92.65 million Arbitrum tokens (3.49% of its circulating supply) are set to be unlocked on April 16. 56.13 million ($65.10 million) of these tokens will be distributed to the team, future team, and advisors, while the remaining 36.52 million ($42.36 million) will be distributed to investors.

Related Reading: Dogecoin Whales Send 800 Million DOGE To Exchanges, Dump Incoming?

Token unlocks are usually followed by a wave of massive sell-offs from the beneficiaries, which causes the token’s price to drop. As such, Arbitrum’s price could also suffer the same fate once these tokens are distributed. However, this won’t be the first time, considering Arbitrum suffered a significant price decline during its last token unlock on March 16.

Data from CoinMarketCap shows that Arbitrum’s price, which closed the previous day at above $2, dropped to $1.8 on March 16. However, it is worth noting that the magnitude of this month’s token unlock is nothing compared to last month’s, when 1.11 billion Arbitrum tokens (41.89% of its circulating supply) were unlocked.

Therefore, the impact of any potential sell-off on the market might not be as severe as the last time. Despite that, Arbitrum still risks dropping below the $1 support level for the first time in a long while, as it is currently hovering around that price range.

Other Token Unlocks To Watch Out For

$76.96 million worth of Axie Infinity (AXS) tokens (7.6% of circulating supply) will also be unlocked this week on April 17. 3.10 million of these tokens will be distributed as staking rewards, while 6.08 million and 1.69 million tokens will be distributed to the team and ecosystem fund, respectively.

Related Reading: Bitcoin Miners To Lose A Whopping $10 Billion Following The Halving – Here’s Why

Meanwhile, like Arbitrum, Apecoin (APE) is another token that risks dropping below $1 with its upcoming token unlock on April 17. $18.57 million worth of Apecoin tokens (2.48% of circulating supply) will be unlocked, with most of these tokens going to the Yuga Labs founder. A significant drop in Apecoin’s price could further compound the bearish outlook of the Yuga Labs ecosystem, as the Bored Ape NFT is already down 90% from its peak.

ARB price drops to $1.11 | Source: ARBUSDT on Tradingview.com

Featured image from CoinGape, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Top 5 Crypto Payment APIs for Developers

As cryptocurrency continues to permeate mainstream markets, the demand for crypto payments is stronger than ever. Businesses that integrate cryptocurrency exchange APIs stand to attract a wealthier customer base and significantly increase their revenue. This is not just a trend, but a shift in the financial landscape. In 2023 alone, the global cryptocurrency market size was valued at USD 1.49 billion, and it’s expected to expand at a compound annual growth rate (CAGR) of 11.2% from 2024 to 2030.

The integration of cryptocurrency exchange APIs is not just about staying current. It’s about capitalizing on a growing market of tech-savvy consumers who value the flexibility and security that cryptocurrencies offer. According to a survey by HSB, 36% of small-medium businesses in the U.S. accept Bitcoin. These businesses report that offering a crypto payment option has attracted new customers and boosted sales.

In this rapidly evolving landscape, developers need reliable APIs to seamlessly integrate crypto exchange solutions into their applications. This article unveils the top cryptocurrency exchange APIs, ranked meticulously based on features, reliability, developer support, and overall performance.

1. ChangeNOW API

ChangeNOW.io API supports over 900 cryptocurrencies and enables cross-chain swaps, along with fiat onramp and offramp capabilities. Developers can utilize fixed-rate options for 150+ assets, enabling users to exchange large sums within a 20-minute window. The average exchange speed is approximately 5 minutes.

ChangeNOW.io offers a personal account manager, 24/7 support, and charges a competitive 0.5% fee per transaction. Developers can set custom commission rates and earn from each swap processed through their integrated application.

The platform’s NOWPayments.io crypto payment gateway supports over 300 cryptocurrencies and allows businesses to withdraw funds directly to their bank accounts in euros. As Bitcoin continues its resurgence, ChangeNOW.io API is well-positioned to help businesses capitalize on the growing demand for cryptocurrency payment solutions.

2. 1Inch API

The 1Inch API focuses exclusively on decentralized exchanges (DEXs) and specializes in decentralized finance (DeFi) functionalities. By integrating with the 1Inch API, developers gain access to a wide range of DEXs and can tap into deeper liquidity pools. The API utilizes smart routing algorithms to minimize slippage and ensure optimal trade execution prices across multiple DEXs. It also incorporates gas optimization strategies to reduce transaction costs. While the 1Inch API offers powerful tools and insights for creating innovative trading strategies, developers should be aware of the learning curve associated with DeFi protocols and the potential regulatory uncertainties surrounding decentralized finance.

3. Binance

Binance API is a widely used and reliable choice within the cryptocurrency community. It provides extensive documentation and supports both spot and futures trading. The API offers WebSocket and RESTful endpoints for efficient communication. Binance is known for its high liquidity and deep liquidity pools, facilitating seamless order execution even for large trades. The platform implements robust security measures and follows stringent protocols to protect against unauthorized access and potential breaches. However, developers should be prepared to invest time in understanding the complex trading concepts and functionalities offered by the Binance API.

4. Coinbase Pro

Coinbase Pro API offers developers a secure and straightforward way to access Coinbase’s trading platform. It provides real-time market data and a sandbox environment for testing purposes. Coinbase is recognized for its strong emphasis on security, which can instill confidence in both developers and users. The platform offers institutional-grade custody solutions for the secure storage of digital assets. Coinbase Pro API ensures regulatory compliance and provides seamless integration with fiat currencies. However, compared to other exchanges, Coinbase Pro API may have limitations in terms of supported cryptocurrencies and advanced trading functionalities.

5. Bitfinex API

Bitfinex API boasts a feature-rich platform that supports various trading activities, including spot and derivatives trading, margin trading, and lending. The API provides WebSocket and RESTful endpoints, along with real-time market data and advanced order types. Bitfinex offers a wide range of trading pairs and substantial liquidity. However, it’s important to acknowledge that Bitfinex has experienced security breaches in the past, which may raise concerns among some developers and users. Additionally, the complexity of Bitfinex’s interface and documentation might present challenges for novice users.

Conclusion

When selecting a cryptocurrency exchange API, developers should carefully evaluate their specific requirements, considering factors such as the range of supported cryptocurrencies, trading functionalities, liquidity, security measures, and ease of integration. While each API has its strengths and weaknesses, the choice ultimately depends on the unique needs of the project and the developer’s technical expertise. It’s crucial to thoroughly review the documentation, assess the learning curve, and consider the potential risks and limitations associated with each API before making a decision.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.