MarginFi: points, strategies, & everyday degen use cases

MarginFi: The most simple defi in Solana. Sort of.

MarginFi is a protocol on Solana which specialises in lending and borrowing.

dApp: https://app.marginfi.com/

Docs: https://docs.marginfi.com/

The docs link above explains everything you need to know about MarginFi and includes all the links for their socials etc.. I won't go into detail rehashing their story or mechanisms as it's really well laid out in the docs and in their blogs so head there to get all that.

Suffice to say MarginFi is one of the most simple to use defi protocols in Solana. That doesn't mean you can't enact complex strategies on it, you definitely can, but it means at a basic level it's very easy for anyone to understand.

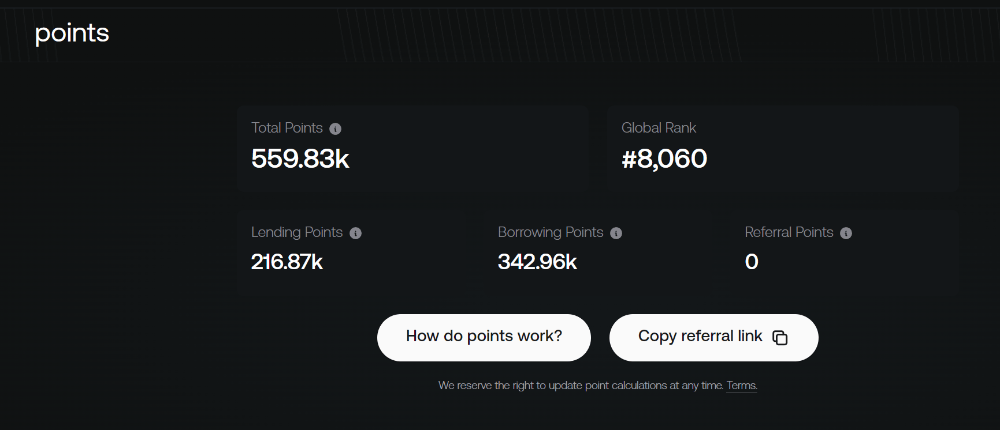

Points Points Points

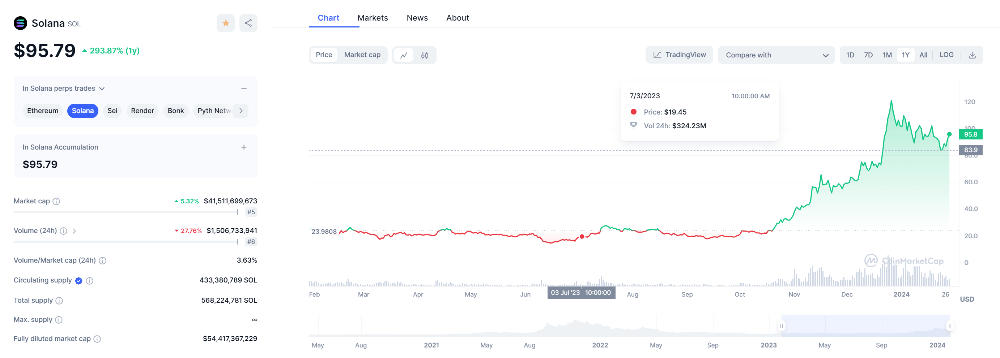

MarginFi kicked off their points program mid 2023, in the middle of a deep bear market in Solana.

Pretty much at the bottom to be honest. $SOL had just hit 15 USD not a few days earlier, whilst that wasn't Dec 2022 levels, it was still very low.

There wasn't a heap of broader confidence in the ecosystem (even though there was a lot of building).

Into this market MarginFi launched their points system. See this blog post for more details on that https://medium.com/marginfi/introducing-mrgn-points-949e18f31a8c

And it was a hit. And pretty much from the word go.

It showed the whole ecosystem that people were still hungry for new stuff and would back someone prepared to ignore the bear market and just keep on building and releasing stuff.

It's led to a number of imitators and is the reason we have so many points systems now.

At the most basic the points work as such

- 1 point per dollar lent

- 4 points per dollar borrowed

- points for referrals

... and that's it.

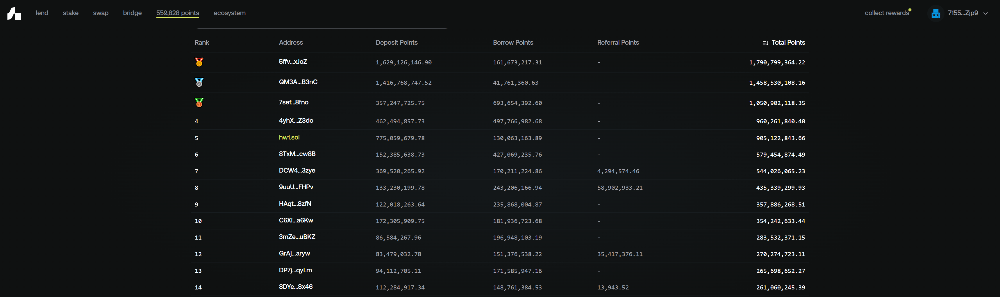

At this stage the leader board is pretty static, least at the top, as there's a bunch of large users who have been active since points started.

A lot of the lend and borrow positions on MarginFi are close to their limits as well meaning that even if you had a lot of capital, you'd struggle to compete at the higher levels.

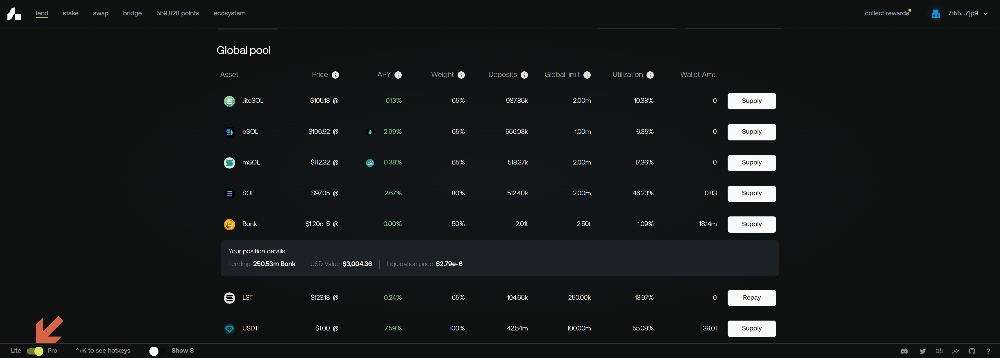

When you first log onto MarginFI I recommend turning on Pro mode as it gives you way more detail.

MarginFi isn't exactly heavy on the data side (it's just lending and borrowing) so the Lite Mode, I find, whilst visually very clean, is too simplistic.

My Strategies

What you are trying to do is maximise your risk ratio (Lend to Borrow) whilst not letting yourself get liquidated.

If you get liquidated you'll lose it all (make sure you read the docs about account health https://docs.marginfi.com/concepts/the-basics/account-health)

Borrows are a lot more points (4x) but they carry a lot more risk.

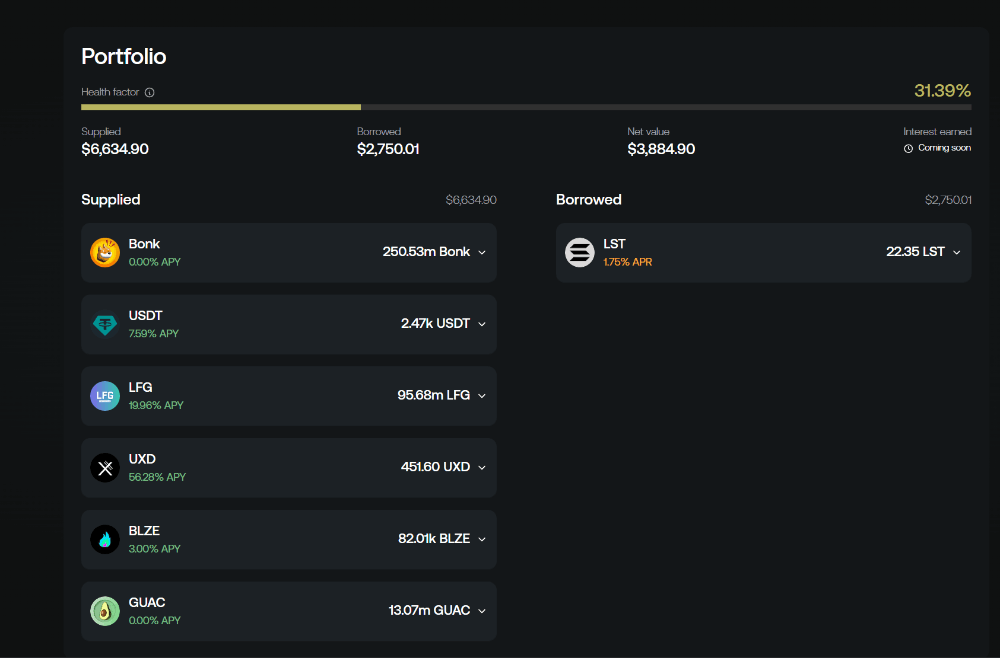

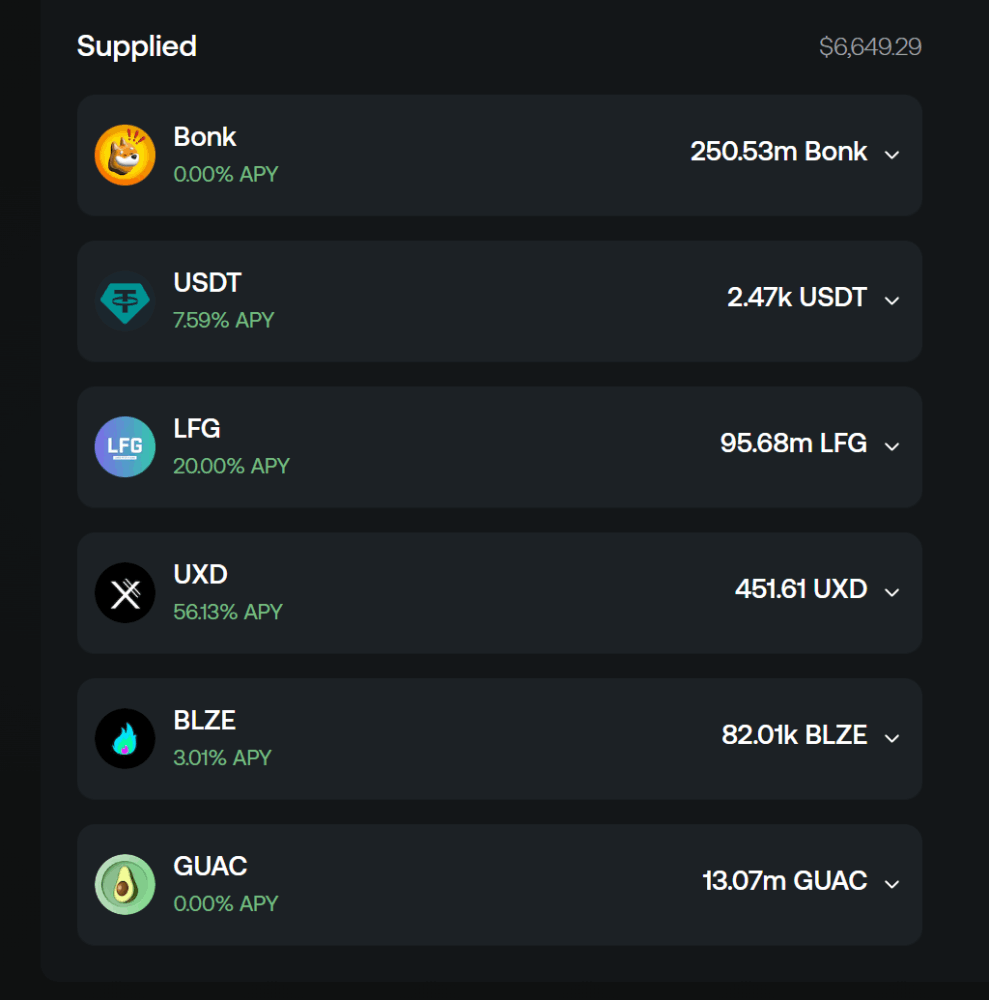

Below is my current position.

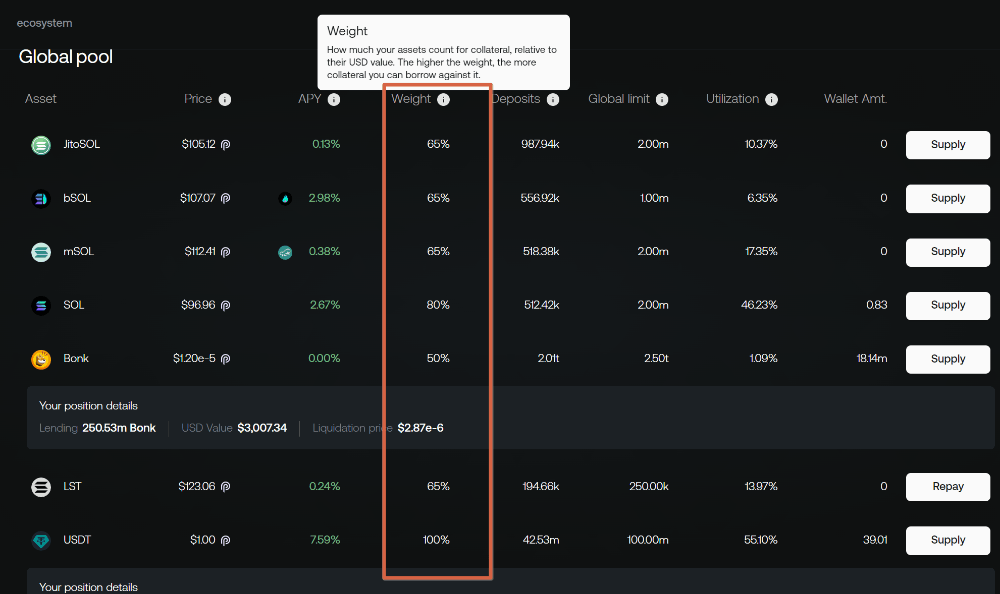

The next thing you want to consider is the interest rates. What are you earning vs what you are paying.

If we go back to my positions again we can see I'm borrowing at 1.75% and lending at a combination of interest rates.

You'll also see I'm lending some assets at 0% interest, more on that further down.

The next thing to consider is the weights each assets supplies in the Lend side. The weight determines how much of the asset's value is counted towards your Borrow.

For instance, USDT carries 100% weight meaning 100% of it's value is counted toward borrowing.

Bonk, on the other hand, only contributes 50% of it's value towards your Borrow position.

Questions, Questions, Questions

So all this begs the question: Why Lend anything under 100% weight?

The first answer is: Interest rates.

UXD is a stablecoin, same as USDT, yet has a 56% interest rate compared with USDT's 8%. Yet UXD only contributes 90% of it's value to the Borrow side.

The second answer is: Price volatility and Holding ..with a side of Extras!

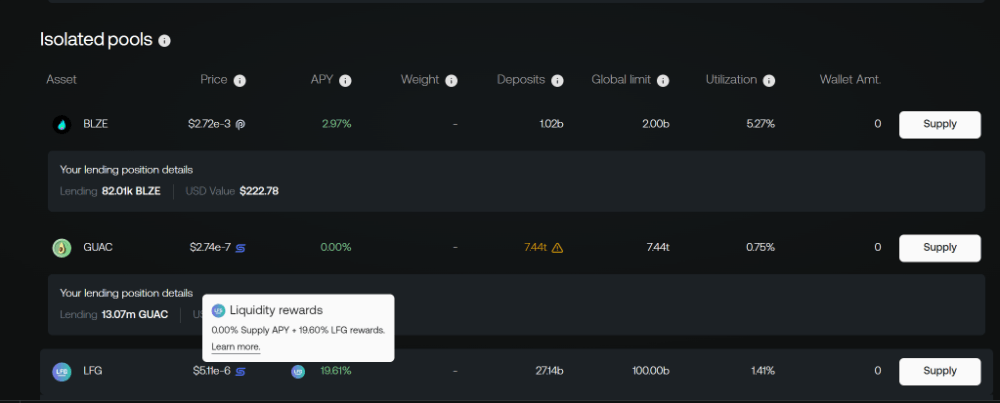

Firstly let's look at LFG. In one sense it's pretty useless: It holds no weight so I can't get any of those tasty 4x Borrow points.

But I can get Lend points AND LFG has incentives currently which means I can earn nearly 20% by lending as well.

The price of LFG has been pretty volatile so the IL (impermanent loss) has been high. Lending on MarginFi is essentially like holding it in your wallet only with some extra protocol risk (i.e., MarginFi could be hacked) and liquidation risk.

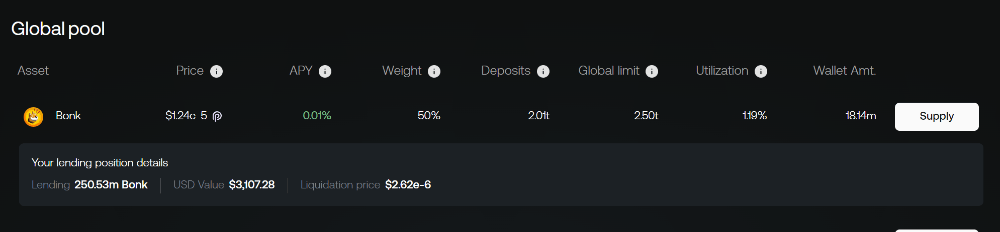

The second example is Bonk. Bonk only gives us a 50% weight and a very low interest rate. So why the hell am I lending it instead of something else??

Currently I'm in a few Bonk LPs but I want to protect part of my Bonk against IL.

The price of Bonk is volatile in a way that something like a UXD or USDT (both stablecoins) is not. As the price of Bonk increases, so too does my ability to borrow (and earn those 4x points). If I were to be in an LP as the price of Bonk increased I'd have less Bonk and more of whatever it was paired with (usually USDC or SOL).

Of course the opposite is true so that's why you should monitor your positions and manage your account health responsibly.

What if I don't have much capital?

As you can see I don't have insignificant amounts of capital but I started late in the game and I have far less money than most users.

So I've been looking for ways to give myself an edge.

MarginFi haven't said there will be points allocated for other tasks but... I suspect that engaging in a few other activities may end up being rewarded.

I don't know though, so take everything that follows as pure speculation.

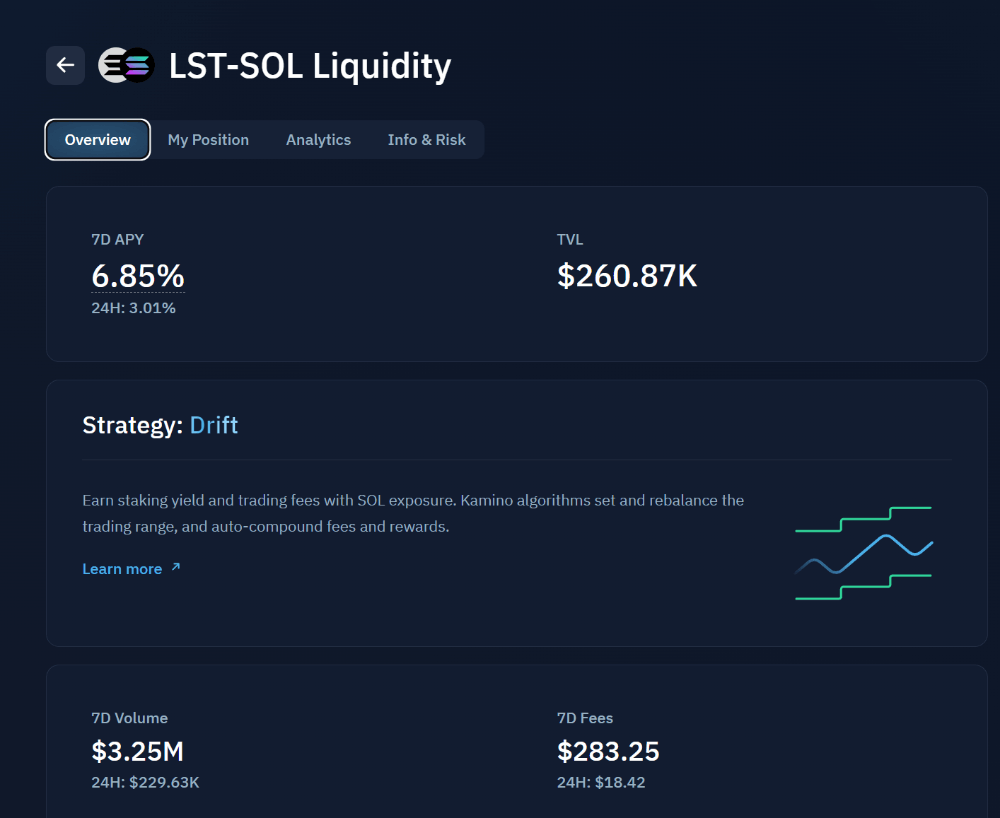

LST: MarginFi's liquid staked SOL

MarginFi are pretty proud of their LST token (hilariously named LST).

It is currently the highest yield of any SOL LST out there.

It is all one validator though so, unlike jitoSOL or mSOL, the risk is pooled all in one place.

I think holding some of it will give you a boost. I would mint on MarginFi to be sure. It's one of the lowest borrow rates so that's why I'm borrowing it. I'm also in the LST/SOL on Kamino.

https://app.kamino.finance/liquidity/76hmUZqSGZEBToDeGDr2pYYHap63K67HJuo3pehJc6UA

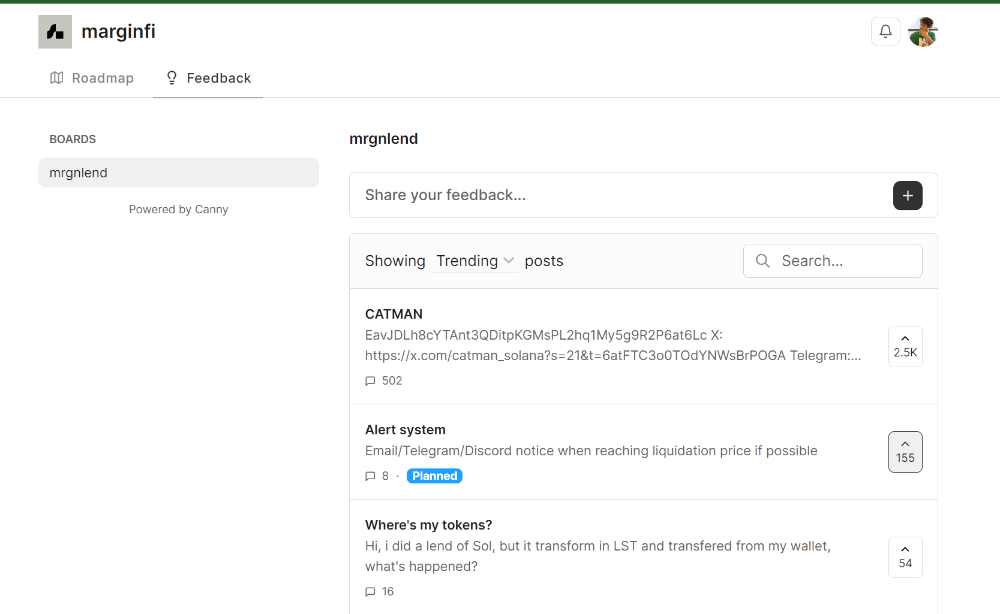

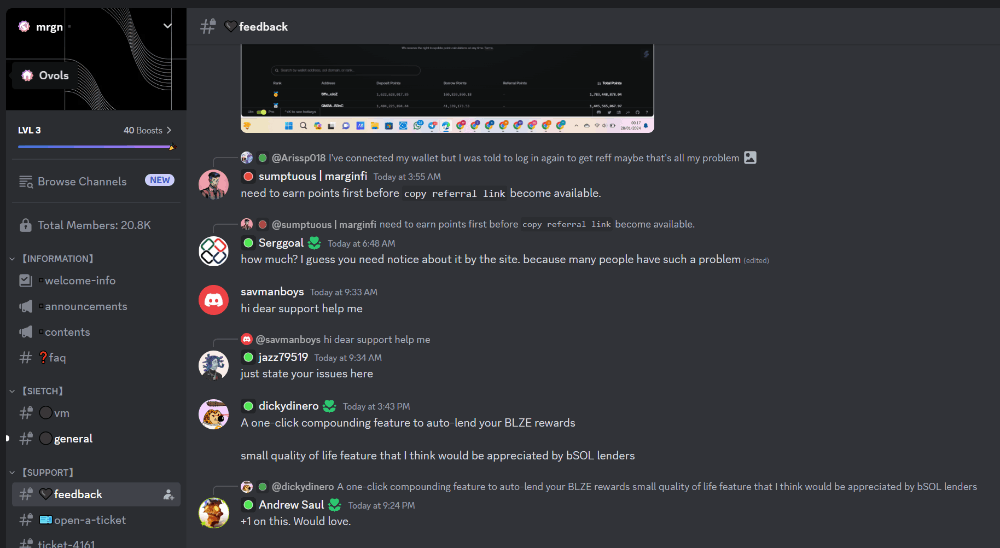

Give feedback in the help forum and on the Discord

There just doesn't seem to be a lot of people who have taken the time to give feedback. Having built tech products for decades now in my professional career I know this isn't unusual. It's hard to get anyone to take the time to give some feedback.

So you can stand out by giving some. ESPECIALLY if you're a newbie.

I'm guessing MarginFi are super keen to hear about newbies as that's where all their growth is going to come from. So don't stress about being confused or unsure: Your hesitation will be gold to the team if you can explain why you're finding something difficult.

After points...

When points finally end and the MarginFi token has it's first distribution, some of the reasons for using it will go away. That's IF we don't see points extended into multiple seasons and multiple airdrops (which I think would be a good idea).

But that doesn't mean you should take all your tokens and head home!

The point of these airdrops is to get you to use and learn tools so that you'll find uses for them that aren't simply farming tokens.

Here's some ways in which you might find MarginFi useful even after the points have finished:

- you don't want to LP a token as you're worried about IL, but you still want to earn some yield on it instead of it sitting in your wallet: Lend it on MarginFi

- you want to use some of your capital for a short term purpose (maybe buying and flipping an NFT) but you don't want to sell your positions down as you're worried you'll lose out on price gains: Lend on and then Borrow on MarginFi for what you need.

- you want to hold a token because of an upcoming airdrop (think: jitoSOL for JTO) but you don't want to sell your existing positions because you're worried you'll miss potential gains: Lend on and then Borrow on MarginFi for what you need.

Have you got any MarginFi use case that aren't farming tokens that aren't listed above? Drop them in the comments, would love to see them!

Referral link for MarginFi

If you found this post valuable and are going to try MarginFi out please consider using my referral link.

Sharing is caring (and clicking referral links)

https://www.mfi.gg/refer/47568b9e-efaa-4d73-9b4d-52c2b72f182c