Why I Don’t Invest in Real Estate

Why I Don’t Invest in Real Estate

Real estate has been a great investment for so long that people think it always will be. This is a mistake. I don’t think it will.

Powerful forces have been raising housing prices for decades. But they are now petering out, even reversing. As time passes, housing prices might shrink.

To understand this, we need a very simple rule: the law of supply and demand.

This article refers mainly to developed economies.

Have Housing Prices Always Gone Up?

No.

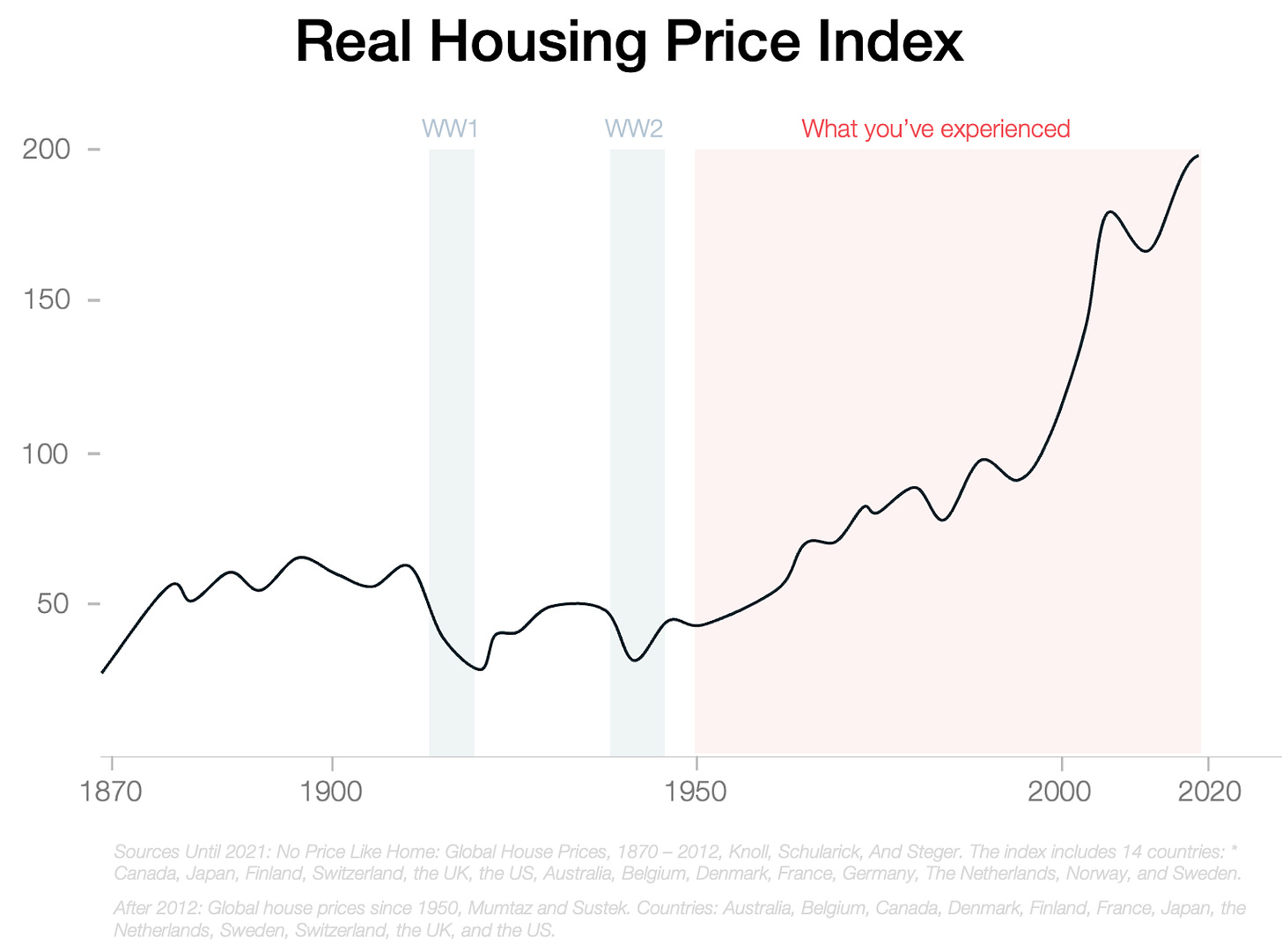

But you wouldn’t know that, because all your life, housing prices have grown:

Our living memory of housing prices only goes back to the 1950s.1 In that time, real housing prices2 have quadrupled.

But what happens if we look a bit farther back in time?

Prices only started growing after 1950!

Data from even farther back gets a bit spottier because few countries have good records, but the finding generally stands. This is Amsterdam:

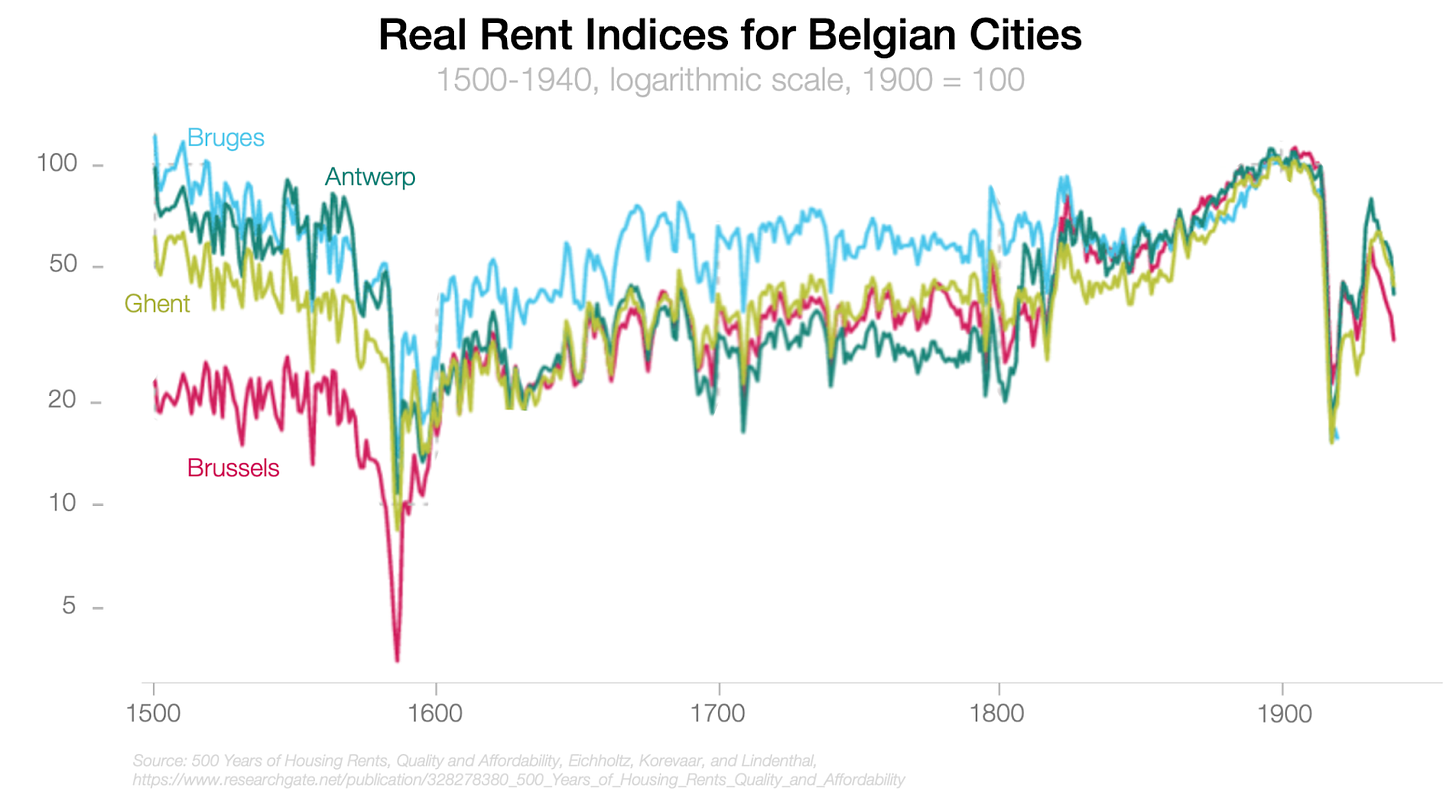

This is for Belgian cities:

Unfortunately the same paper doesn’t show the same data after 1940, and looking at other indicators is apples to oranges.

Housing prices used to be very stable. So why did they grow so dramatically in recent times?

Simply because demand has outstripped supply.

A. Demand

What drives the demand for housing?

- More people

- Who want to live in the same place: cities

- Who generally want bigger houses

- And who also might want fewer people living in the same household

Each one of these four trends has been growing incredibly in the past few decades, but is unlikely to keep growing and may even reverse.

1. Population Growth

The more people there are, the more housing we need to shelter them.

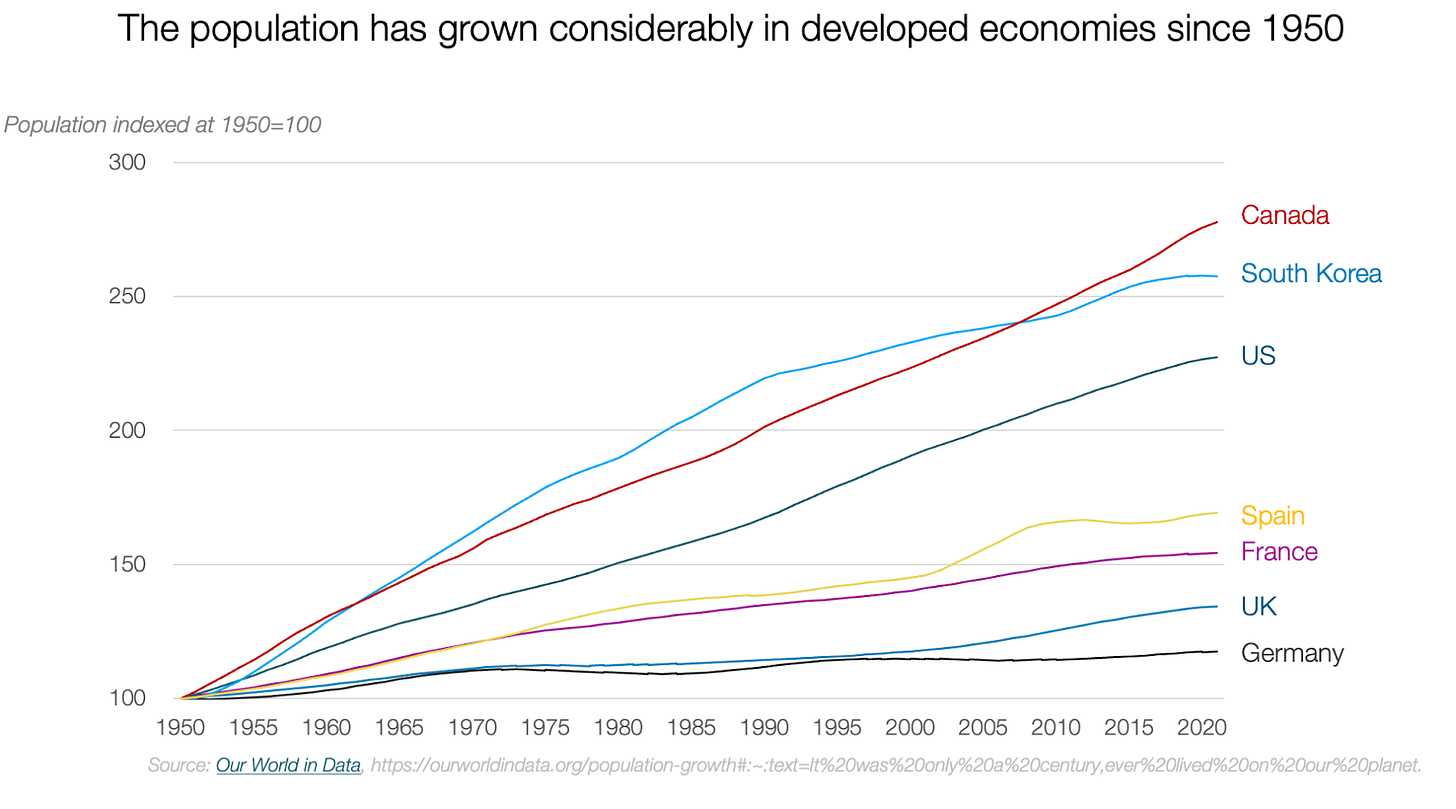

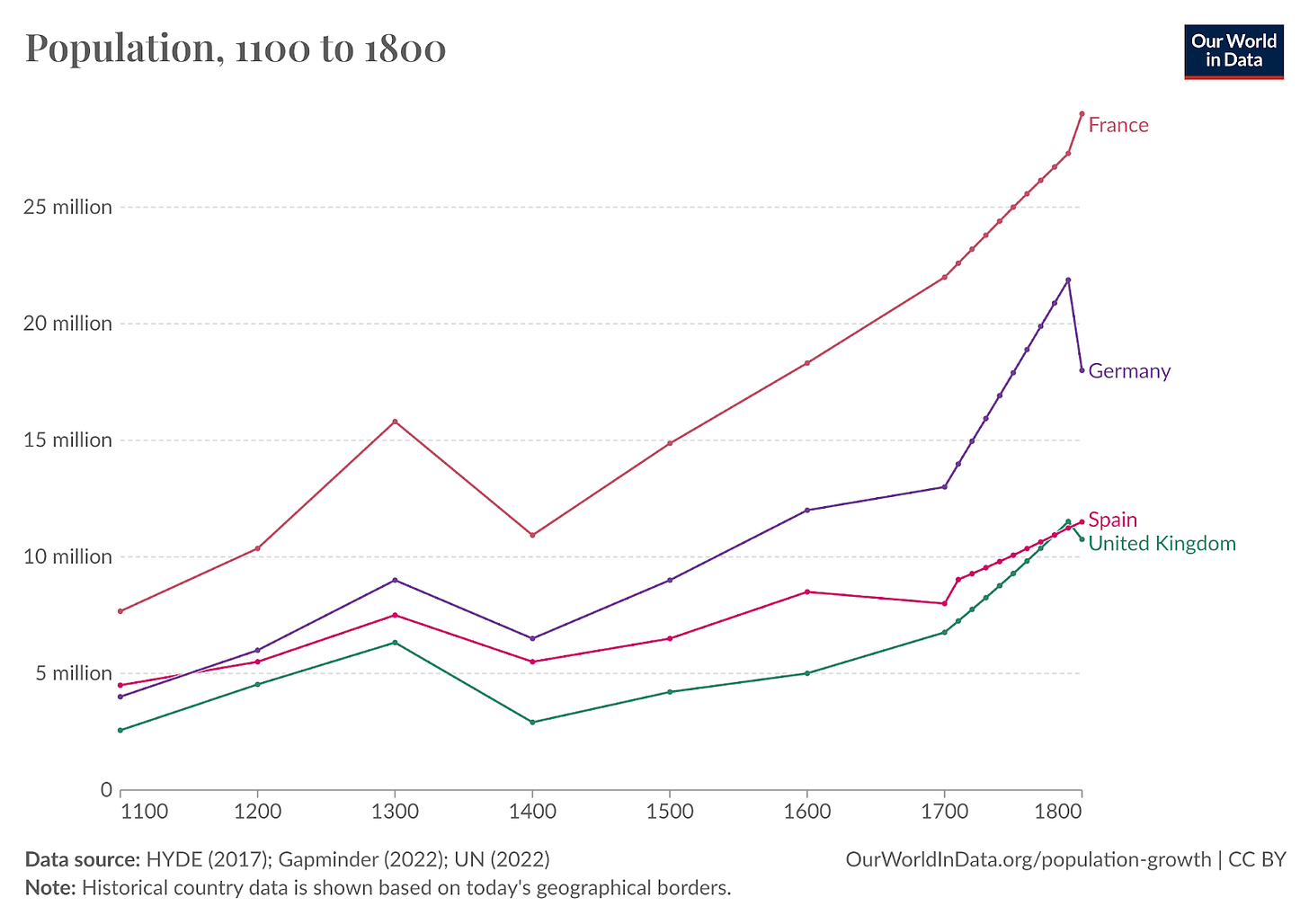

It’s true that population has grown since we were hunter-gatherers, but it has exploded in recent times in ways we have a hard time fathoming:

More people meant more demand for housing. But will this trend continue? As you can probably surmise, it won’t.

The populations of Japan, China, and Europe are already shrinking.

The US is mainly growing because of immigration (which we’ll discuss later), but even there, the growth rate is going to be lower in the future than in the past. That is true for the entire world.

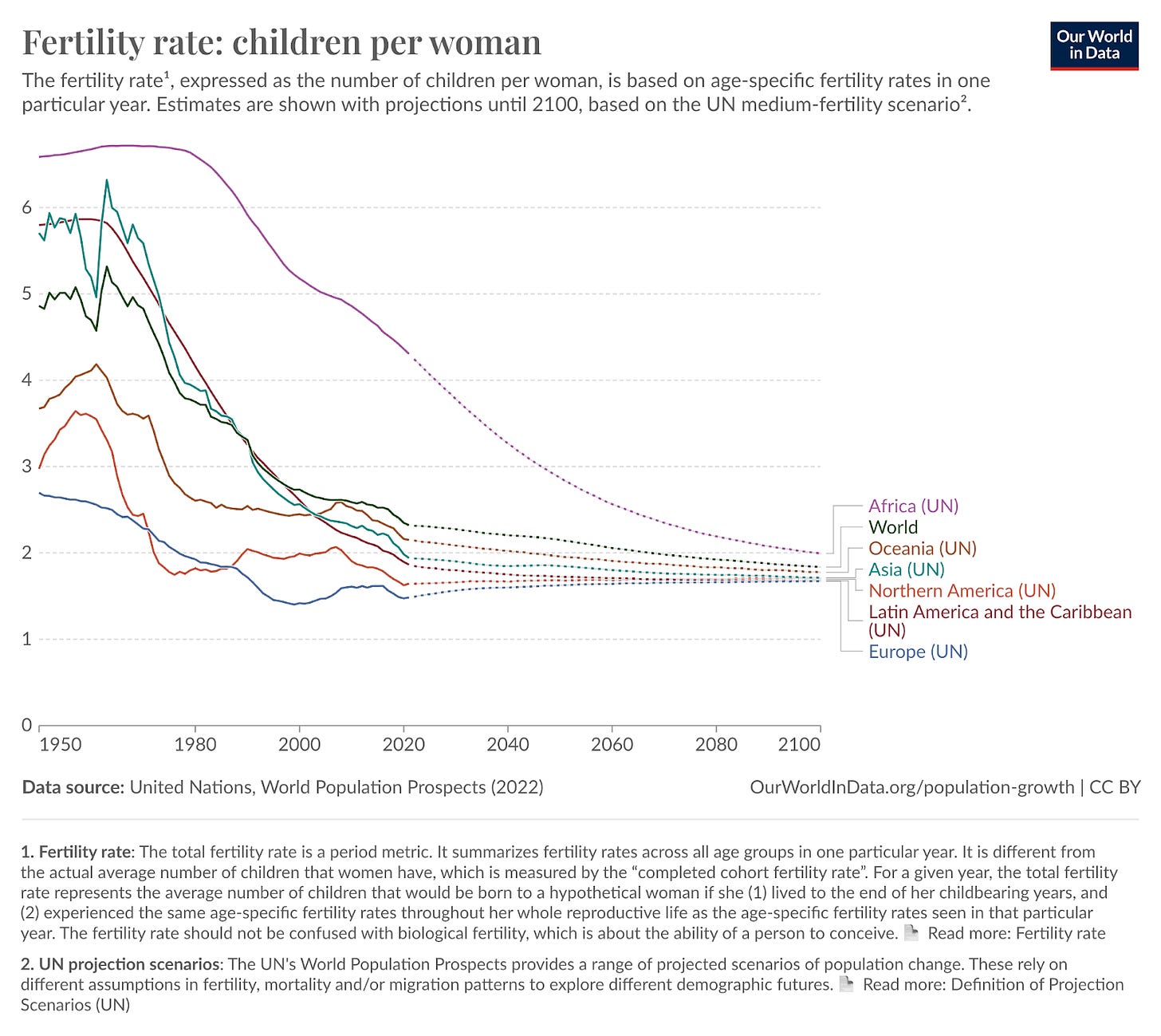

Of course, all of this is driven by the fertility rate, which is shrinking all over the world, is already below replacement rate in most countries, and will likely become the case in all of them.

To be explicit: More people means higher housing prices.

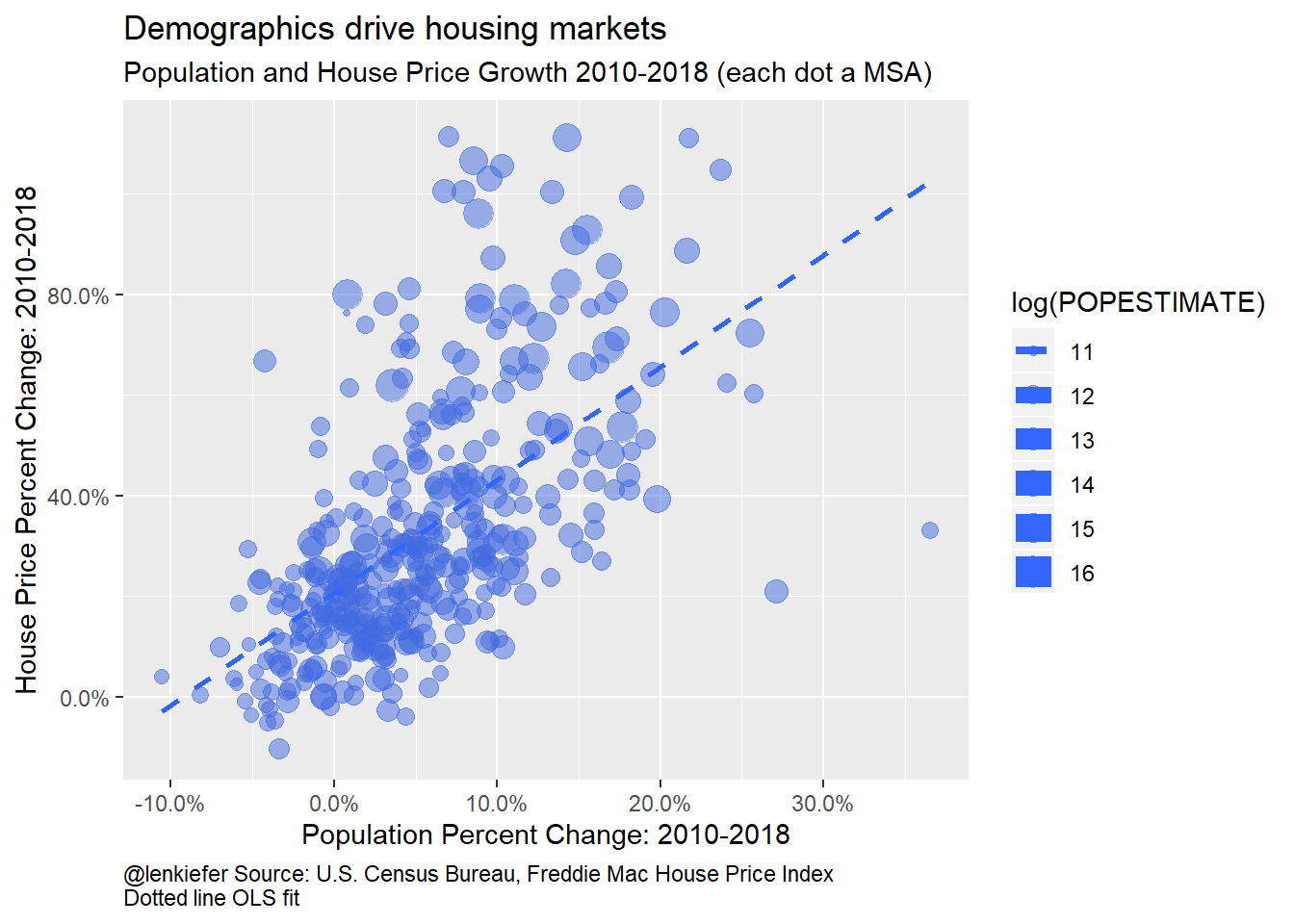

This is for the US. MSA means Metropolitan Statistical Area. I found a few more graphs like this and then stopped looking for something more perfect, which would include many more countries for many more years. Feel free to share if you find it. Source via this.

OK so one of the biggest drivers of real estate price increases was simply more people. But it’s not just that. They also all wanted to live in the same places!

2. Urbanization

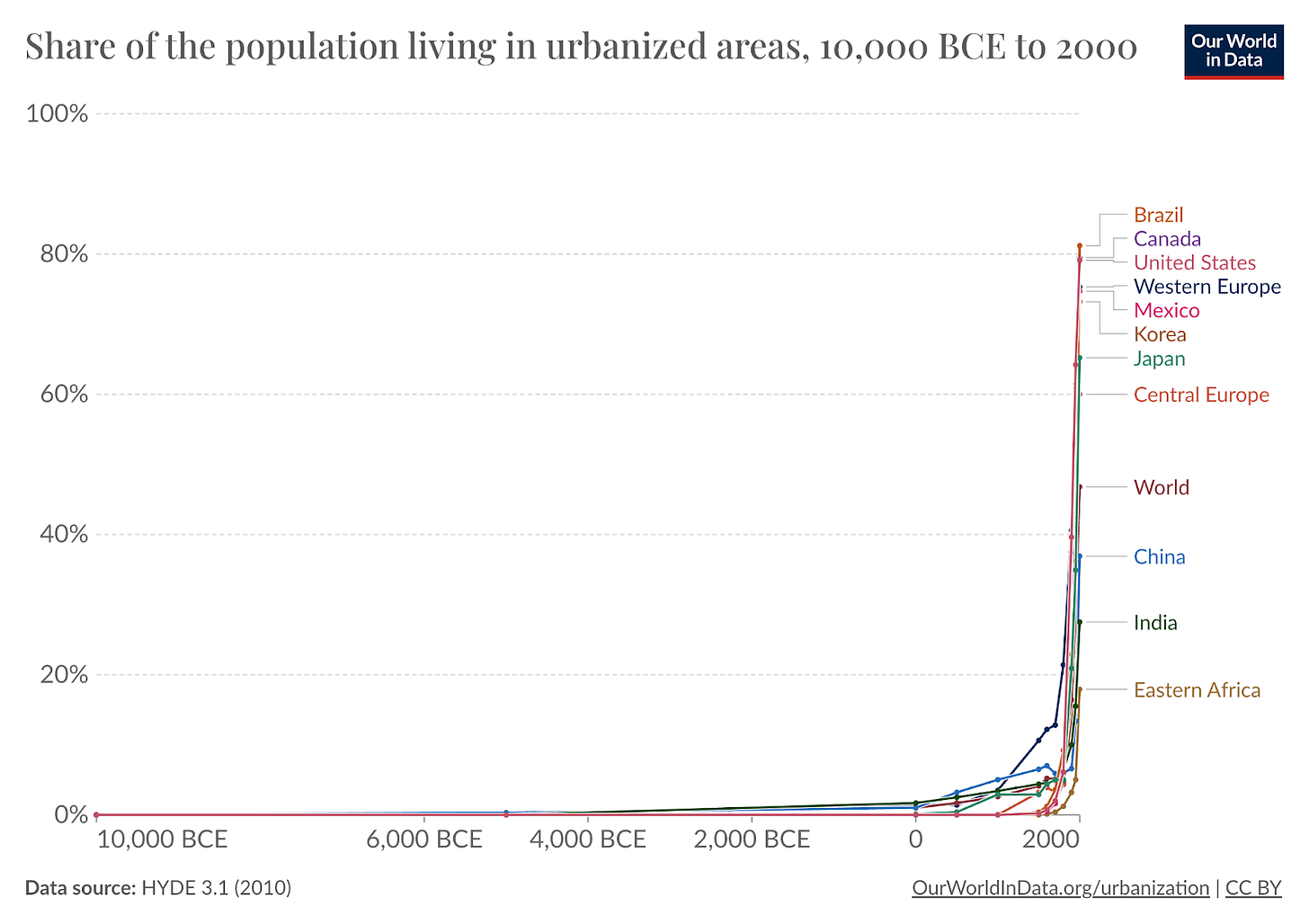

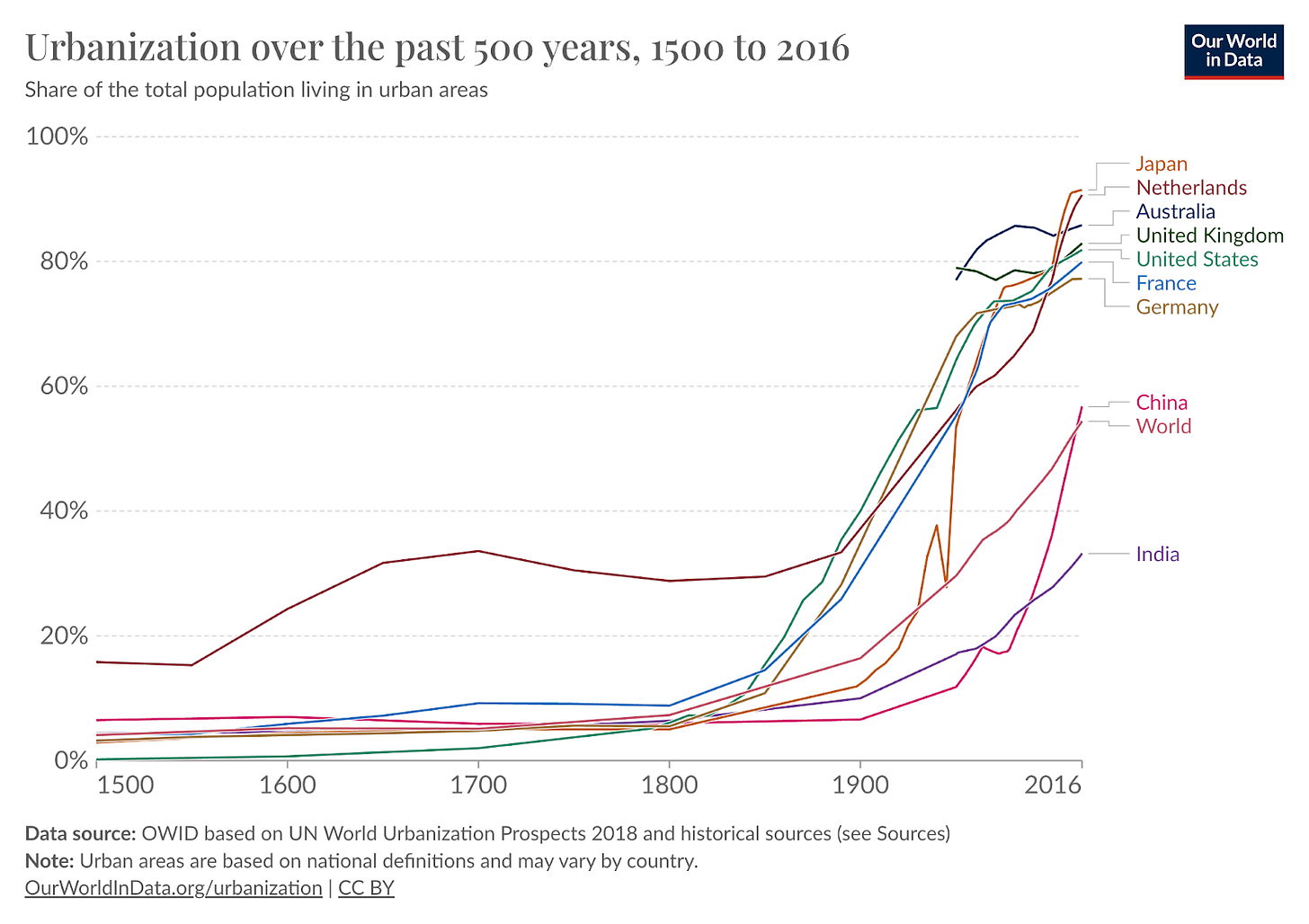

Source

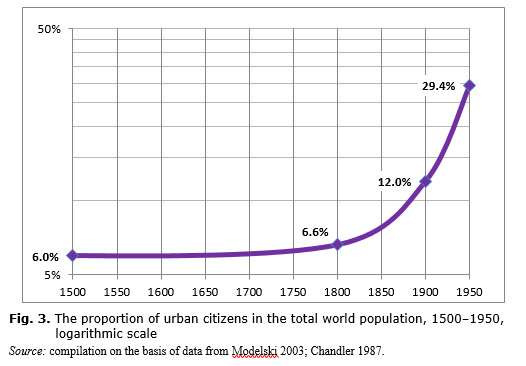

More and more people want to live in cities, but that’s quite a recent phenomenon! In nearly all countries, by the middle of the 1800s, less than 20% of the population was urban!

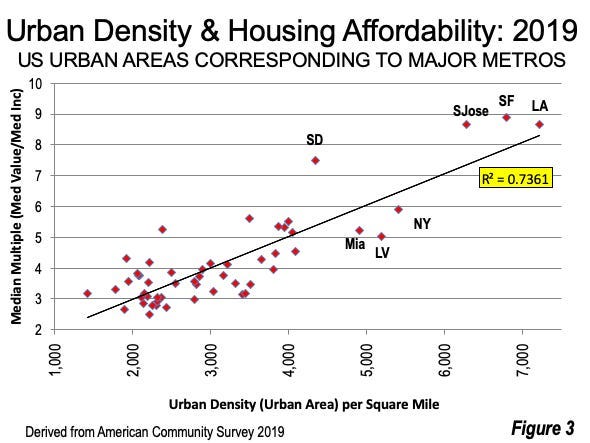

When everyone began moving to cities, demand on urban housing increased, and prices with them: the denser the area, the higher the prices.

Via this

The urbanization rate can’t keep increasing forever. When it went from ~10% in 1800 to ~90% in 2020, that was a 9x increase. From there, at most it can reach 100%, which is only a 10% increase. Therefore, this huge driver of demand for urban land that has existed for 200 years is now dead in developed countries, and might even revert given remote work.

OK, so we used to have more people who wanted to live in the same place in the last 200 years, and especially in the last 75.

But they also wanted to be less crowded!

3. Household Size

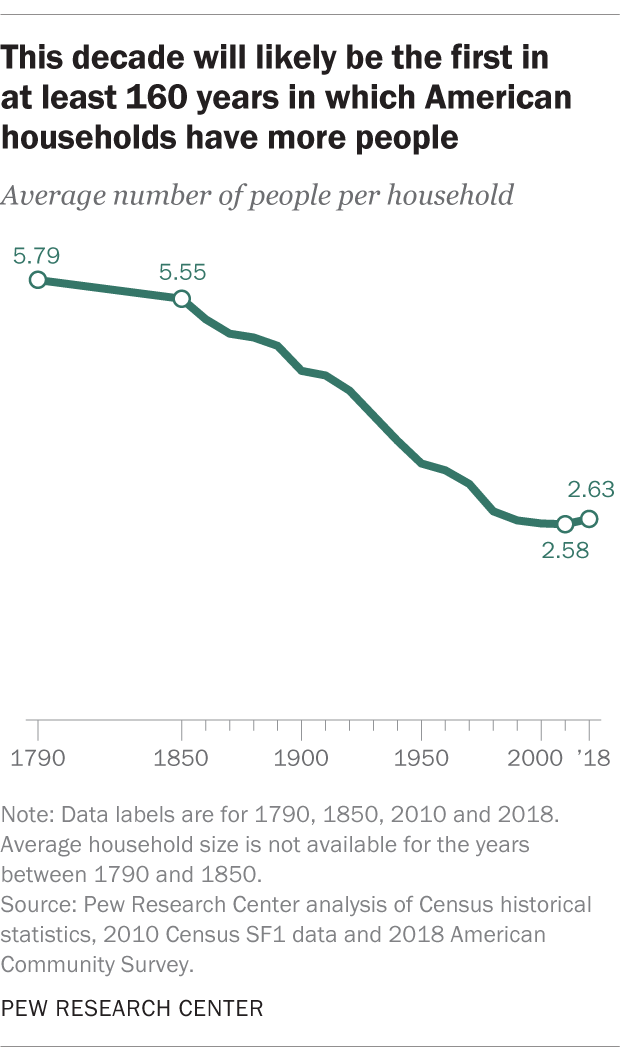

The number of people per household has shrunk dramatically over the last couple of centuries:

Source

If you zoom in on the most recent years, you’ll see that this trend has stopped too, or even reverted. The drive to live in homes with fewer family members grew housing demand until the 1990s, but has barely contributed since.

The same is true in Europe, where household size (as in people per household) is even lower:

Will we get to a world with one person per household? 0.5, if each person owns more than one home? Maybe. But based on the trend of the last few decades, it looks like this trend is now dead. Why? Because its main driver is family size:

And families can’t get much smaller than a couple and half a child.3

They do want bigger houses though.

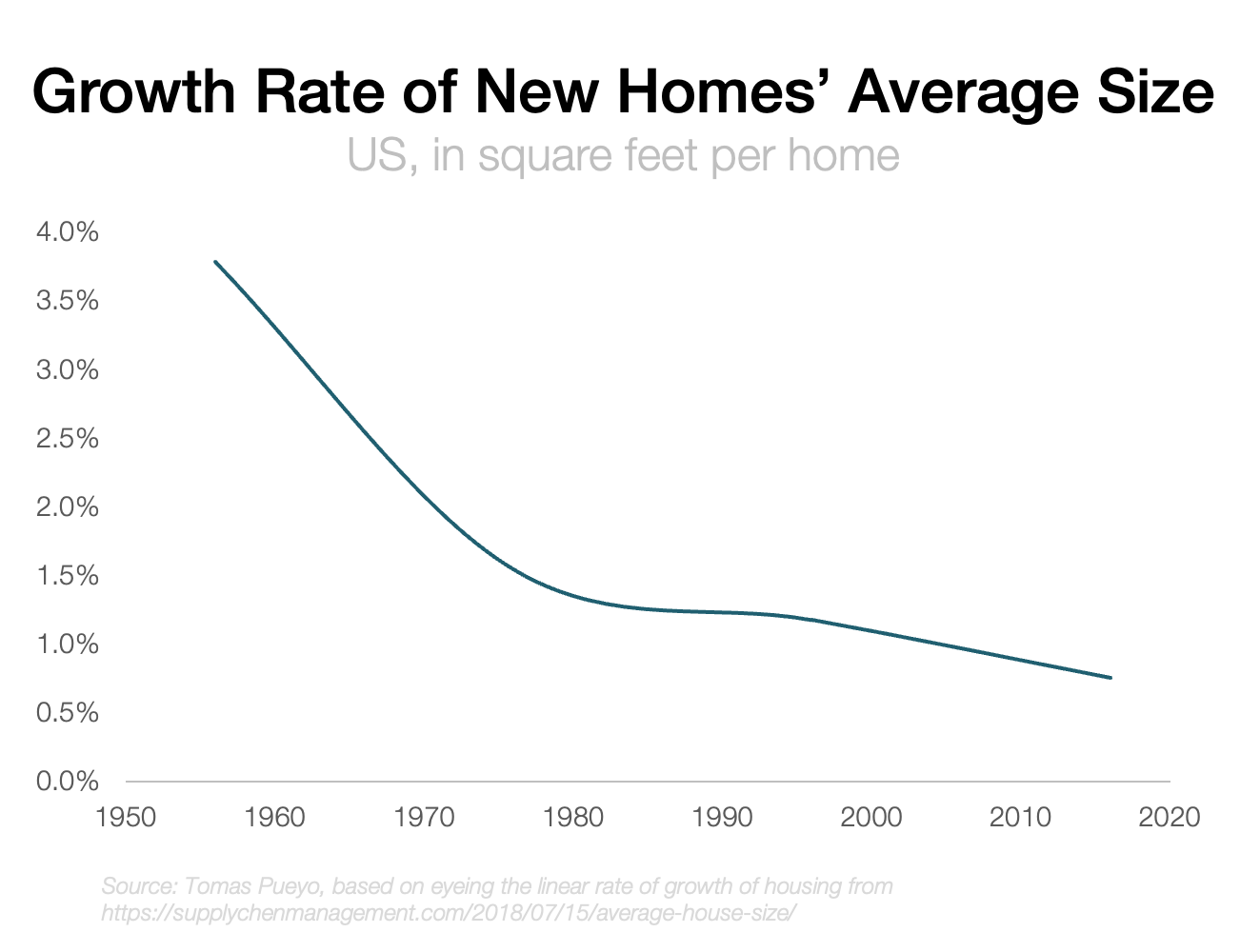

4. Bigger houses

As family sizes shrunk, house size grew.

This is how we arrived at houses with one room per child, coming from a world where we packed many people in one room.

This trend seems to be true in other rich countries.

Since Europe and Japan have much smaller homes than the US, it is possible that this trend still has room for growth in those places. Source.

But the more they grow, the less valuable each new square foot is. Yes, each person can have a room and an office, but at some point they have enough empty rooms and don’t want more. This trend will stop. And until then, it will decelerate.

In other words: Over the last few decades, there have been:

- More people

- Moving to cities

- Who increasingly want to live alone

- In bigger houses

These trends meant there has been a huge increase in demand for housing land since 1950. But now all these trends are stopping or reversing.4

While demand grew, supply didn’t keep up.

B. Supply

One inconvenient thing about houses is that they occupy volume. As a result, you can only grow your supply of housing by growing horizontally or vertically.

1. Horizontal Supply and the Marchetti Constant

In How Transportation Technologies Shape Cities, I explained how the main driver of city size is transportation technologies. It’s easy to understand why: People don’t like commuting more than 30 minutes—the Marchetti Constant. When new transportation technologies speed up the commute, city footprints can increase.

As such, city size was limited for thousands of years. Until the train arrived, and then streetcars, bikes, and eventually cars.

When your average commute speed goes from 5 km/h walking to 50 km/h by car, you can travel 10x farther in 30 minutes, and the edge of a city is pushed 10x farther.

But the land available increases by the square of that, making the city 100x bigger!

The result is that the car increased the supply of land for housing by 10-100x compared to walking!

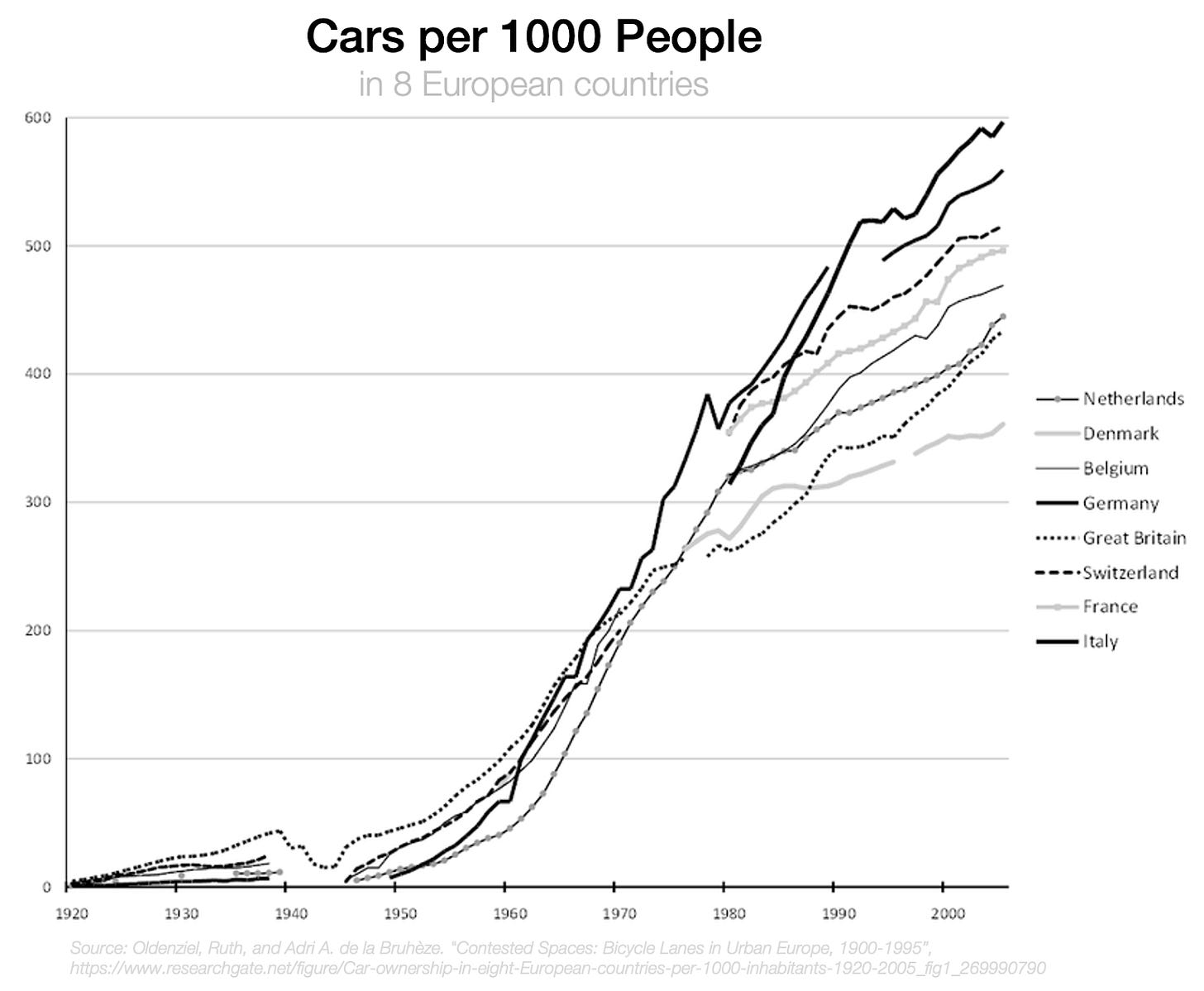

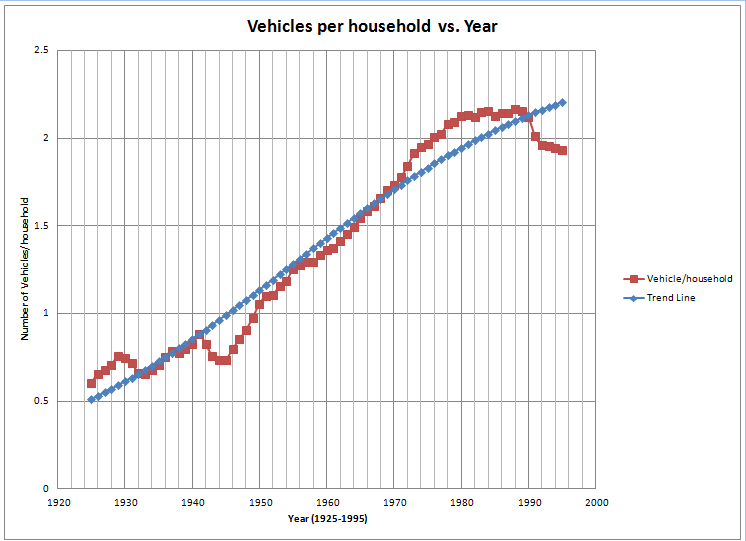

But that is only useful if you own a car. Car ownership has increased dramatically in the last 70 years:

In the US, we’ve reached saturation: There are about two cars per household, and that number hasn’t grown since the late 1980s.

Source

This means nearly every household can have a car, nearly everybody can drive to work, and car ownership doesn’t limit city size.

Consequently, over the last few decades, cities stopped growing horizontally: They had grown dramatically in the 1950s-2000s along with car ownership, until it wasn’t a limiting factor anymore. The edges of cities was the limiting factor.

You can probably get a sense of that in your daily life. When did your city suburbs grow the most? Probably in the 1950s-2000s. After that, new suburbs were ever farther from the city center, less compelling. This limited housing supply, which drove prices up.

But this trend is now ending, because remote work has reduced commute time to zero, so cities’ potential size is infinite.

Remote Work

If the car can allow people to live dozens of kilometers away from downtown because they can travel at 30-50 km per hour, what happens when they can travel at 300,000 km per second? That’s the speed of light, which is basically the speed of your video call. When you work remotely, you are no longer limited by the Marchetti constant. At most, you’re limited by the timezone.

Whereas Marchetti limited sizes to a few tens of kms around a city center to get to work, now the limit is continental: You don’t need to move to Mountain View to work for Google. You can work from Patagonia.

People couldn’t work remotely until very recently. Now, they can get electricity and Internet from virtually anywhere:

With Starlink, you can now get inexpensive Internet from virtually anywhere in the world, and solar panels are becoming cheaper and cheaper.

Many people will go to live in rural and semi-urban areas, where prices are lower, and safety and quality of life are higher. The entire world is now potential housing supply. What do you think that will do to housing prices in the long run?

2. Vertical Supply and Sky Highways

At the very same time that transportation technology was increasing supply horizontally, another type of technology was increasing the supply vertically: construction and elevators.

Until the 1800s, buildings were at most six floors tall because taller ones would crumble under their own weight. But steel framing and reinforced concrete changed that, technically allowing buildings to grow taller.

Chicago’s Home Insurance Building is considered the first skyscraper in the world, completed in 1885, with elevators to reach its 12 floors. It was not the first building to use elevators, however. That had been introduced 30 years earlier in New York, by the inventor of the modern safety elevator, Elisha Otis, using a steam engine.

It’s one thing to make them possible, another thing to make them enjoyable. In the past, higher floors were for poor people because nobody wanted to climb six flights of stairs.

The elevator, invented at the end of the 1900s, changed that. It allowed people to reach any floor easily. Coupled with the advent of electricity and things like water pumps for water access in high floors, elevators didn’t just make higher floors possible; they made them better. Now you’d rather have the penthouse than the ground floor. This is only 100 years old.

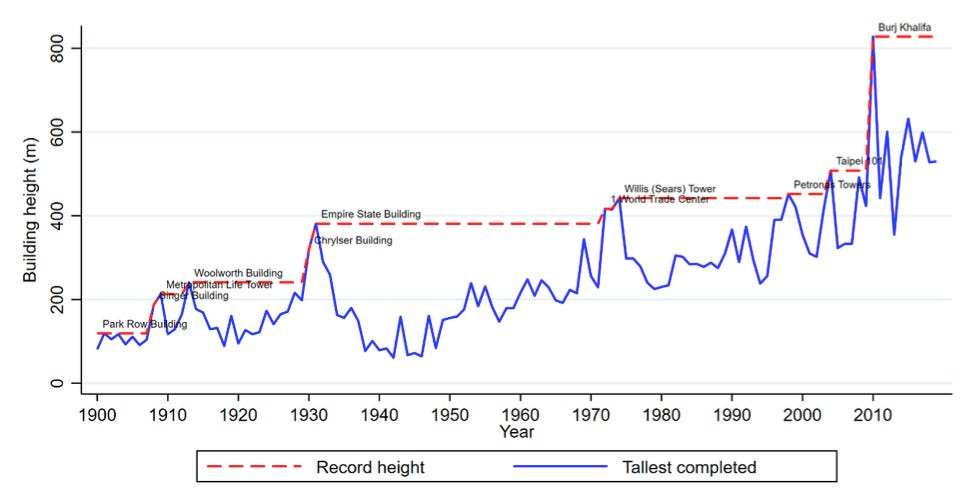

Size of the tallest building built every year between 1900 and 2018. Source.

As skyscrapers filled the skyline, people’s dwellings ascended into the heights, and this new supply kept prices controlled in the first half of the 20th century.

Then, we stopped building up.

NIMBYism

Paris built the Tour Eiffel. Then every Parisian thought it was ugly, and they decided to stop building tall buildings. Later, in the skyscrapers craze, they decided to build the Tour Montparnasse. They then thought it was ugly, and banned all new skyscrapers—they pushed them outside of the city, to La Défense. A few decades later, construction started again, and stopped again. If you live in a Western country, this might sound familiar to you.

Ticky-Flatty, AR

There are height restriction laws for buildings in most cities in Europe and North America. These have prevented buildings from growing up, limiting the supply of housing, and driving prices up.5

This is the only data I could easily find. If you find more data, please share. Spain has some of the densest cities in the Western world, I believe due to high-density buildings built during the Franco dictatorship until 1975. Source: Long-term changes in 3D urban form in four Spanish cities, Domingo, Van Vliet, Hersperger

This trend might not change, in which case supply will remain restricted. But if it changes, will it be for more restriction, or more freedom?

It’s hard to be more restrictive than today, where many cities can’t build anything, especially upwards. What is more likely is that building restrictions will be reduced, pushed by the YIMBY movement (Yes In My BackYard). Tired of NIMBY, they started fighting back. Across the US, building restrictions have been falling.

ADUs are Accessory Dwelling Units. Source.

Building restrictions are also likely to be relaxed for another reason: As demand shrinks, prices will drop, cities will compete to attract more people, and building restrictions are likely going to be relaxed.

If you have to bet whether restrictions are going to tighten or release, I’d say it’s more likely they’ll either stay the same or release, which means more supply for housing, and lower prices.

Bringing It Home

Until the Industrial Revolution, the population of most Western countries grew very slowly.

Cities were small, most people lived in rural areas, and there was no such thing as “housing prices” that really mattered.

Via this

Starting in the 1800s, all these trends blew up. Populations exploded, urbanization exploded, people started getting crammed in urban homes…

In some places, prices exploded. But in many others, they didn’t because as demand went up, people simply settled around the tiny centers of existing cities. Soon, these cities could be built up and out thanks to technologies like elevators, reinforced concrete, trains, and cars, adding floods of supply to the incessant demand for more housing.

Over the last 75 years, demand for urban housing was driven by:

- Higher population growth

- More urbanization

- More homes per person

- Bigger homes

But supply ground to a halt horizontally and vertically:

- Cities grew as much as they could horizontally and the edge of our car suburbs hit the Marchetti constant.

- NIMBYs restricted building up, limiting supply

Now, we’re entering a world where all these trends are slowing down or reversing:

- In demand:

- The population is shrinking or soon will

- Urbanization has reached its limits

- We have all the homes we need per person. That growth is stopping.6

- Homes keep getting bigger, but that trend is slowing every year

- In supply:

- Remote work eliminates the need to live close to work, which means the entire world becomes potential housing land supply

- Building restrictions can’t get any tighter, and will likely be relaxed

We’re moving from a world where people have only experienced growing housing prices, to one where they are likely to shrink.

Does that sound like a world where real estate will be as good an investment as it used to be?

Not to me. That’s why I don’t invest in real estate.