The Implication of cybersecurity Levy on Nigerians:

The Implication of cybersecurity Levy on Nigerians: A Manifestation of Inept Leadership and the Reemergence of Complete Bourgeoisie

Introduction: A Nation in Discontent

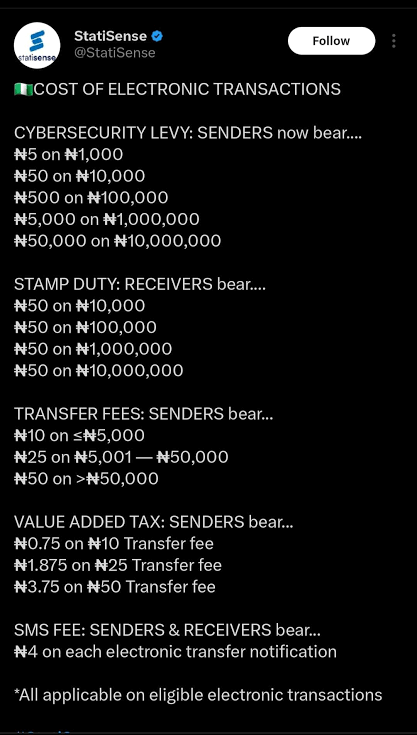

The recent announcement by the Central Bank of Nigeria (CBN) regarding the implementation of a 0.5% cybersecurity levy on all banking transactions has ignited a firestorm of criticism and debate across the nation. This levy, set to be applied at the point of electronic transfer origination, has sparked widespread dissatisfaction among Nigerians, who are grappling with the prospect of additional financial burdens.

The CBN Directive: Unveiling the Levy

In a circular issued to various financial institutions, including commercial, merchant, non-interest, and payment service banks, the CBN outlined the mechanics of the cybersecurity levy. The directive mandates financial institutions to deduct and remit the levy on behalf of customers, with the deducted amount to be reflected in the customer's account under the narration 'Cybersecurity Levy.'

Reactions and Dissatisfaction: Voices of the People

Nigerians from all walks of life have taken to social media platforms like Twitter to express their discontent with the levy. Many are questioning the rationale behind imposing additional charges on banking transactions, especially in a country plagued by economic hardship and widespread unemployment. Critics argue that the levy represents yet another burden on already-strained household budgets, further eroding the purchasing power of ordinary citizens.

Rising Tides of Financial Hardship: Sinking the Middle Class

For many Nigerians, already navigating turbulent economic waters, the levy represents yet another wave of financial hardship. As the cost of living continues to soar and incomes remain stagnant, the levy threatens to erode the financial stability of middle-class families, pushing them further into the abyss of poverty.

Economic Tsunami: Crushing Small Businesses

Small businesses, the lifeblood of Nigeria's economy, face the brunt of the levy's impact. Already grappling with operational costs and stiff competition, small enterprises now find themselves burdened with additional financial obligations. For some, the levy may spell the difference between survival and bankruptcy, as they struggle to stay afloat in an unforgiving economic climate.

The Ripple Effect: Widening Inequality

The levy's reverberations extend far beyond individual bank accounts, amplifying existing inequalities within Nigerian society. As the wealthy weather the storm with relative ease, the levy disproportionately affects marginalized communities and vulnerable groups, deepening the fault lines of socio-economic disparity. In this scenario, the levy becomes not just a financial burden but a symbol of systemic injustice and inequality.

Allegations of Complicity and Inaction

- Accusations of Enabling Fraud: The suspicion that customer funds are being collected to pay off hackers, notoriously known as "yahoo boys" in Nigeria, raises serious concerns.

- Lack of Innovative Solutions: The inability to think outside the box and find alternative solutions burdens Nigerians and hinders progress.

- Regulatory Failure: The Central Bank of Nigeria (CBN) has failed to hold commercial banks accountable for addressing this critical issue, neglecting their primary responsibility to protect customers and prevent fraud.

Calls for Repeal: Advocacy and Resistance

Organizations such as the Socio-Economic Rights and Accountability Project (SERAP) and the Nigeria Labour Congress (NLC) have vehemently opposed the cybersecurity levy, labeling it arbitrary and illegal. SERAP, in a statement, urged the government to retract the directive and amend oppressive clauses of the Cybercrimes Act, citing violations of constitutional and international human rights obligations. Similarly, the NLC raised concerns about the levy's disproportionate impact on workers and vulnerable groups, advocating for a more equitable approach to cybersecurity financing.

Government Response and Accountability: A Way Forward

As the outcry against the cybersecurity levy grows louder, the government faces mounting pressure to address the grievances of its citizens. Calls for transparency, accountability, and meaningful engagement with stakeholders underscore the urgent need for a reevaluation of the levy's implementation. Nigerians are demanding concrete measures to safeguard their financial interests and promote inclusive economic development, free from excessive taxation and undue financial burdens.

Conclusion: Charting a Path Forward

In the face of widespread discontent and resistance, the government must heed the voices of its citizens and rethink its approach to cybersecurity financing. A collaborative and consultative process, guided by principles of transparency and accountability, is essential to address the underlying concerns raised by the levy. As Nigeria navigates the complexities of economic governance and financial inclusion, the well-being of its citizens must remain paramount, ensuring that policies uphold the principles of equity, justice, and shared prosperity.