What’s Ahead For Bitcoin? Expert Forecasts Pre-Halving Rally As Early As Next Week

Bitcoin (BTC), the largest cryptocurrency in the market, has seen its price hover between $42,000 and $43,000, halting its recovery from the dip below $38,500.

With the upcoming halving event scheduled for April, market experts and crypto analysts such as Rekt Capital are observing historical patterns that suggest an interesting price action scenario, potentially igniting another significant price surge for Bitcoin.

Pre-Halving Rally For Bitcoin Imminent?

Rekt Capital, known for its expertise in analyzing market trends, highlights the significance of historical patterns about previous halving events. These patterns reveal a consistent trend of substantial rallies leading up to the halving, followed by a short period of correction and consolidation before a major bull run and peak.

No KYC Casino and Sportsbook with up to 300% match bonus + 175 Free Spins, and Wager Free Cashback. Play now at ROLR.IO!

Related Reading: Crypto Analyst Says ADA Price Will Rise To $8, Here’s When

According to Rekt Capital, Bitcoin should commence its Pre-Halving Rally as early as next week if history indicates.

This rally, driven by investors “buying the hype” in anticipation of the halving, aims to capitalize on the price surge and realize profits by “selling the news.” Short-term traders and speculators often exploit this hype-driven rally and sell their positions. Historical patterns suggest an imminent pre-halving rally for BTC. Source: Rekt Capital on X

Historical patterns suggest an imminent pre-halving rally for BTC. Source: Rekt Capital on X

The subsequent selling pressure contributes to a phenomenon known as the pre-halving retrace. This retrace typically occurs a couple of weeks before the actual halving event.

570% up to 12 BTC + 300 Free Spins for new players & 1 BTC in bonuses every day, only at Wild.io. Play Now!

In previous halving cycles, the pre-halving retrace reached depths of -38% in 2016 and -20% in 2020. It is worth noting that this phase can last for several weeks, introducing uncertainty among investors regarding whether the halving will act as a bullish catalyst for Bitcoin’s price.

Overall, the historical patterns observed by Rekt Capital point to the possibility of a pre-halving rally in the coming weeks, followed by a correction period known as the pre-halving retrace.

While past performance is no guarantee of future results, these historical trends provide valuable guidance on how the price of Bitcoin may perform in the coming weeks and days before the halving.

Long-Term Holder Support And ETF Buying Pressure

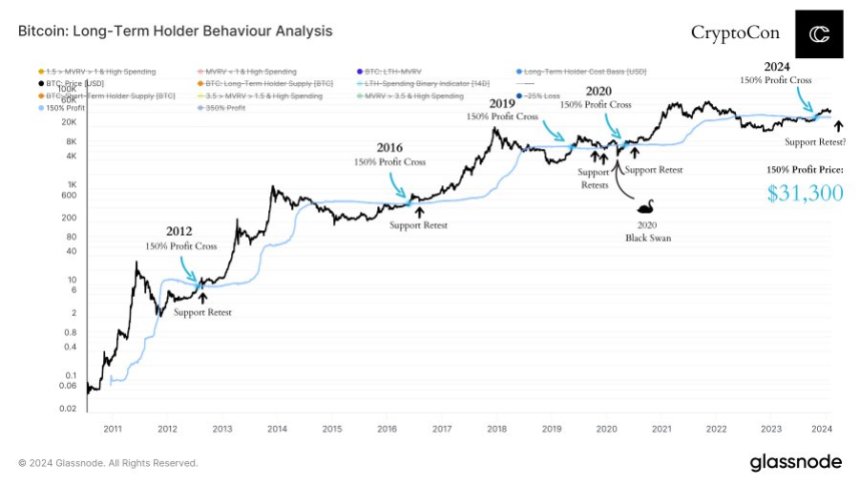

Despite expected short-term gains for BTC, Crypto Con has recently drawn attention to a historical trend in the Bitcoin market. According to Crypto Con, no Bitcoin cycle has ever escaped a retest of the 150% long-term holder support line.

According to the analyst, this line has acted as a crucial level of support during various market cycles. Even during the unprecedented black swan event and subsequent recovery in 2020, the price retested this line as support.

By analyzing this metric, Crypto Con suggests that based on historical patterns, Bitcoin’s price may need approximately $31,300 to retest the long-term holder support line.  BTC’s long-term holder support retests based on historical patterns. Source: Crypto Con on X

BTC’s long-term holder support retests based on historical patterns. Source: Crypto Con on X

The anticipated impact of ETF buying pressure on Bitcoin’s price is counterbalancing the argument for further corrections. Introducing ETFs (Exchange-Traded Funds) into the cryptocurrency market is a relatively new development. As such, the effects of ETF inflows on Bitcoin’s price remain to be seen and are a subject of ongoing observation.

Related Reading: Institutions Go All In: Chainlink 30% Rally Makes It The Hot Investment Trend

While the potential retest of the long-term holder support line may create temporary price fluctuations, proponents of Bitcoin as an investment opportunity view such a scenario as a buying opportunity.

Ultimately, Crypto Con believes that those who believe in the long-term prospects of Bitcoin may choose to take advantage of any price dips resulting from a retest of support.BTC’s sideways price action on the daily chart. Source: BTCUSDT on TradingView.com

BTC trades at $42,800, up a slight 0.4% in the past 24 hours as of this writing.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Tags: bitcoinBitcoin chartBitcoin ETFBitcoin ETF newsBitcoin ETF RallyBitcoin ETFsBitcoin HalvingBitcoin Halving CycleBitcoin Halving CyclesBitcoin newsbitcoin pricebitcoin signalsbitcoin technical analysisbitcoin tradingbtcbtcusdbtcusd priceBTCUSDTcryptocryptocurrency

Will $100,000 Per Bitcoin Become Reality? Top Crypto Visionary Thinks So

A notable figure in the crypto sphere, Blockstream CEO Adam Back, recently highlighted the potential for Bitcoin to rise to $100,000 with a compelling visual metaphor.

Halving To Drive Bitcoin To $100,000

Back, whose work was acknowledged by Satoshi Nakamoto in the Bitcoin whitepaper, posted an image of a car’s side mirror with a text reading “$100k BTC.”

Related Reading: Will Bitcoin Hit $1 Million By 2028? Experts Clash Over Bold Price Prediction

Accompanied by the caption “laser ray ’til halving day Bitcoin,” this post has sparked a wave of optimism within the community. The mirror warning image suggests that Bitcoin reaching $100,000 might be closer than it appears, a sentiment echoed by many anticipating the next halving event.

No KYC Casino and Sportsbook with up to 300% match bonus + 175 Free Spins, and Wager Free Cashback. Play now at ROLR.IO!

laser ray ’til halving day #bitcoin @CedYoungelman pic.twitter.com/wj1QbNrPQH

— Adam Back (@adam3us) February 5, 2024

Bitcoin halving, a fundamental aspect of its design, is an event that occurs approximately every four years, halving the reward for mining new blocks. This mechanism reduces the rate at which new BTCs are created, effectively limiting the supply and often leading to bullish market sentiment.

Historically, halving events have been precursors to substantial price increases in Bitcoin’s value, as the reduced supply heightens investor demand. The anticipation of these market movements often creates a flurry of activity and speculation, contributing to price volatility in the months leading up to and following a halving.

Crypto analysts and enthusiasts closely watch these cycles, speculating on the potential impacts each halving might have. The consensus is that these events create a scarcity effect, potentially driving up Bitcoin’s value as the supply of new coins diminishes.

570% up to 12 BTC + 300 Free Spins for new players & 1 BTC in bonuses every day, only at Wild.io. Play Now!

Analysts Weigh In On Bitcoin’s Future Trajectory

Amid this backdrop of halving anticipation, several analysts have offered insights into Bitcoin’s future price trajectory. Crypto analyst Michaël van de Poppe has shared his perspective, suggesting that Bitcoin might experience range-bound trading in the coming months.

Related Reading: Bitcoin’s Big Breakout: This Bullish Pattern Signals An Imminent Price Surge

Van de Poppe predicts a possible climb towards $48,000 pre-halving, followed by a consolidation period before a breakout towards a new all-time high in the latter half of 2024.

#Bitcoin stuck in a range, markets are in an equilibrium.

I’d be looking at the range-bound construction for the coming months.

Pre-halving a final run towards $48K, after that consolidation, before the breakout towards an ATH in Q3/Q4 of 2024. pic.twitter.com/jZznulSiwJ

— Michaël van de Poppe (@CryptoMichNL) February 5, 2024

Similarly, renowned crypto hedge fund manager Charles Edwards of Capriole Investments has put forth an even more ambitious forecast. Edwards anticipates Bitcoin reaching $280,000 in the upcoming year, a prediction aligning with the bullish sentiment prevalent in parts of the crypto community.

If Bitcoin’s post Halving returns are the same as 2020, we are looking at $280K Bitcoin next year.

You might reasonably argue this cycle’s returns are less than 2020.

However, I believe the 2020 cycle performance was mediocre and an outlier. pic.twitter.com/pzOkAd0ORm

— Charles Edwards (@caprioleio) February 5, 2024

However, the current market paints a more tempered picture. Bitcoin has been between $43,000 and $42,000 over the past week, exhibiting a modest 5.4% increase over the last two weeks. Despite this, the asset’s current price has shown a slight downturn, with a market price hovering around $42,657, down by nearly 1% in the past day.BTC price is moving sideways on the 4-hour chart. Source: BTC/USDT on TradingView.com

Featured image from Unsplash, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Tags: $100K BTCbitcoinbitcoin predictionblockstream