Will Avalanche’s ecosystem growth aid AVAX’s price?

- Avalanche’s ecosystem has experienced massive growth of late.

- Despite ecosystem growth, AVAX’s price declined, exhibiting lower lows and highs.

Avalanche [AVAX] has seen massive growth over the last few months in terms of its ecosystem.

A sudden spike in activity

In Q4 2023, the network experienced notable spikes in on-chain activity, reaching 6.4 million transactions on the 22nd of November and 6.3 million transactions on the 19th of December.

The first surge was initiated by ASC-20s, while the second was driven by increased activity related to meme coins. These spikes led to sustained growth, with new users surpassing active users by 17.7% at press time.

In terms of on-chain activity, January’s total daily transaction volume grew by 36.4% relative to October (19.2 million transactions vs. 14.1 million).

This growth was increasingly distributed across new subnets and projects, with over 249.4k new contracts deployed between Q4 2023 and the 2nd of February, hosting 75.3 million total subnet transactions.

Taking a look at the state of DeFi

Avalanche’s Total Value Locked (TVL) began rising in early Q4 2023, peaking at $1.53 billion on the 21st of December and consistently remaining above $1 billion since then.

This TVL increase was propelled by prominent protocols such as Benqi, Aave, Struct, and Delta Prime. Notably, Benqi Finance accounted for over 40% of the network’s TVL on the 21st of December.

Trader Joe continued to dominate Avalanche’s DeFi scene, attracting more trading volume than all its competitors combined.

Although overall DeFi activity on Avalanche has seen a gradual decline since the end of 2023, the network’s daily Real World Asset (RWA) market cap increased by 44.7% between October 2023 and February 2024. Source: Artemis

Source: Artemis

How is AVAX holding up?

Despite these factors, the price of AVAX declined significantly over the last few days. During this period, lower lows and lower highs were exhibited by the price. However, there was no significant trend established.

Is your portfolio green? Check out the AVAX Profit Calculator

At press time, AVAX was trading at $37.98. If its price declines further, the token could reach the $27.29 support level soon.

On the contrary, if the price of AVAX grows, it could weaken the $43.52 resistance level and may even push past it. Source: Trading View

Source: Trading View

Next: Polygon unlock sends MATIC worth $263M into circulation

Read the Next Article

Polygon unlock sends MATIC worth $263M into circulation

2min Read

With the latest supply of MATIC injected into circulation, will we be seeing any major price reactions?

Adewale Olarinde

Adewale Olarinde

Journalist

Edited By: Saman Waris

Posted: February 23, 2024

Share this article

- 273 million MATIC has been released into circulation.

- MATIC’s price has recovered by almost 2%.

Polygon [MATIC] has recently achieved a significant milestone with its unlocking process, and this could mark the beginning of a new phase in its price trend.

Polygon sees the last unlock

Etherscan’s data showed that more than 273 million MATIC tokens were transferred from the Polygon vesting contract to the Foundation.

The value of the transferred MATIC amounted to about $263 million at the time of this writing.

A notable aspect of this recent transfer is that it signifies the final token unlock, indicating that MATIC has now entered full circulation.

Polygon volume drops

According to CoinMarketCap, the circulating supply of Polygon was 9.6 billion at the time of this writing, while the total and maximum supply stood at 10 billion. The trading volume had decreased by over 17%.

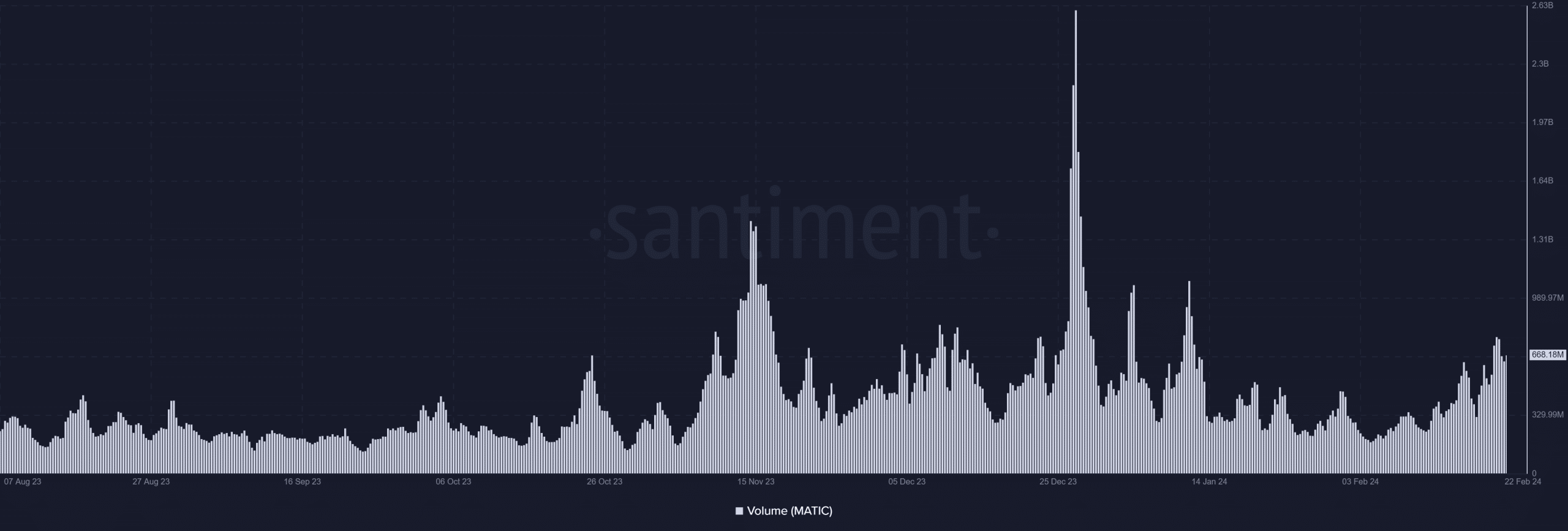

Santiment’s volume trend analysis further revealed that the volume had surged to nearly $760 million on the 21st of February. However, at the time of this writing, the volume had decreased to around $669 million. Source: Santiment

Source: Santiment

This suggested that there had been no immediate market reaction to the latest MATIC unlock. It also implied that the token had not fully entered into circulation by the time of this analysis.

MATC begins recovery

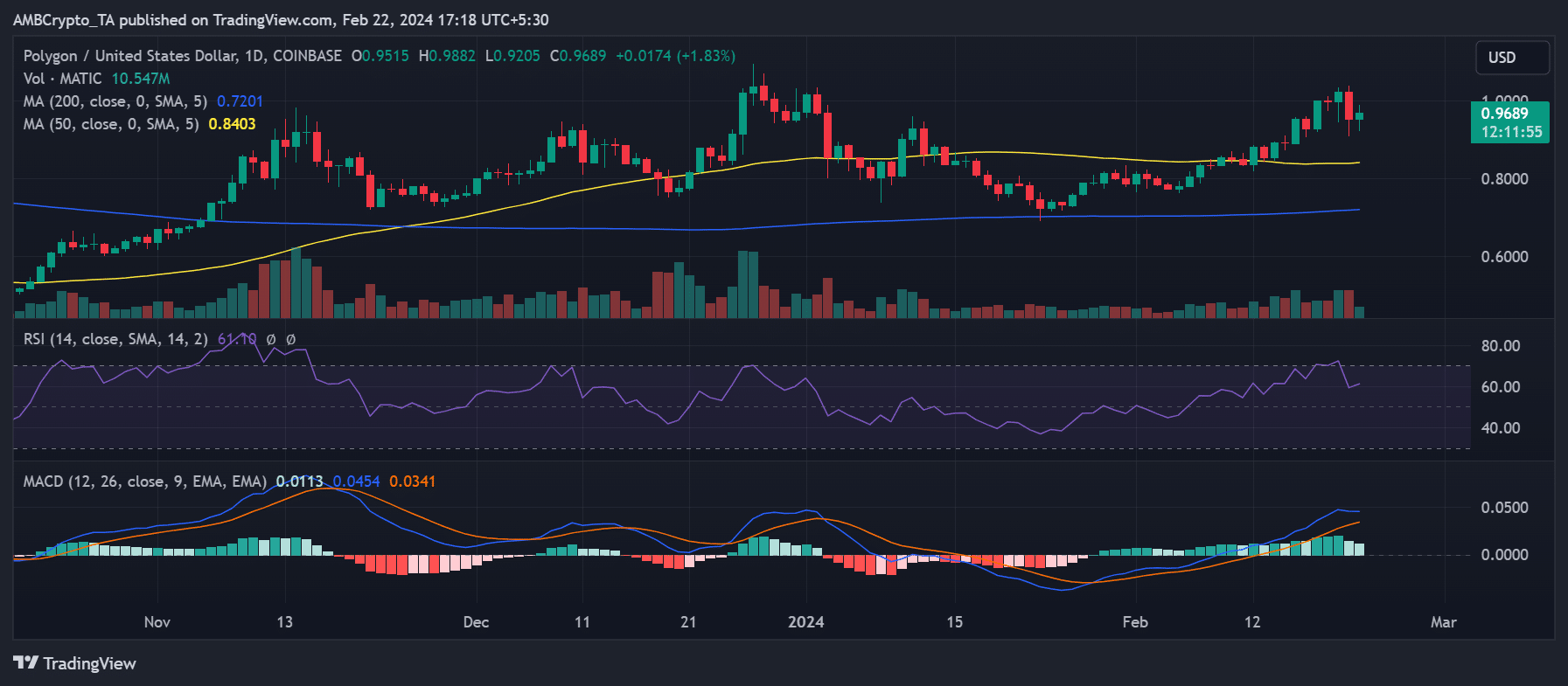

AMBCrypto’s look at Polygon’s daily timeframe chart showed that the newly unlocked token entered a market in decline.

As of the close of trading on the 21st of February, MATIC experienced an almost 7% drop, lowering its price from the $1 range to around $0.9.

However, at the time of this writing, the token had seen a slight recovery, trading with an almost 2% gain and reaching around $0.96. Source: Trading View

Source: Trading View

Before the decline on the 21st of February, MATIC’s Relative Strength Index (RSI) was oversold. However, the subsequent price drop brought its RSI to 60.

As of press time, the RSI had moved back above 60. Thus, despite the significant price decline, MATIC remained in a bull trend and continued to exhibit strength in that direction.

Is your portfolio green? Check out the MATIC Profit Calculator

Furthermore, AMBCrypto’s examination of the Polygon Open Interest on Coinglass revealed a surge in funds inflow, reaching one of its highest volumes.

The data showed an inflow of about $402 million, marking the most substantial influx in months. However, at the time of this writing, it has slightly decreased to around $333 million.

Previous: Will Avalanche’s ecosystem growth aid AVAX’s price?

Next: DOGE traders are increasing their holdings, should you do too?

Read the Next Article

DOGE traders are increasing their holdings, should you do too?

3min Read

Long-term holders are buying more coins, indicating some level of bullish conviction.

Victor Olanrewaju

Victor Olanrewaju

Journalist

Edited By: Ann Maria Shibu

Posted: February 23, 2024

Share this article

- The 0 to 100 coins and 1 million to 10 million cohort have increased their balances.

- DOGE might dump into the $0.80 before it bounces.

AMBCrypto’s analysis on the 21st of February showed that Dogecoin [DOGE] holders have been adding more coins to their portfolio. Using Santiment’s on-chain data, we observed that the balance of addresses of the 0 to 100 Dogecoin holding cohort has been increasing.

However, the retail segment was not the only one accumulating. A further assessment showed that the 1 million to 10 million whale cohort have also done the same. Actions like this suggest conviction that DOGE would perform well over the coming weeks. Source: Santiment

Source: Santiment

Rocky moves to come before the calm

When the new year began, DOGE started on a slow note. As a result, the Year-To-Date (YTD) performance of the coin stood at a 7.36% decrease.

But the last 30 days has brought some sort of relief as the cryptocurrency registered a 9.81% increase. If we were to go by the actions mentioned above, then DOGE could be set to surpass the highs it hit recently.

However, it is important to check out other indicators before concluding. From a technical perspective, it could take a while before DOGE hits a high value. This was because the price had dropped to $0.084. Looking at the 4-hour chart, it could face another hurdle around $0.087 if bulls attempt to push the price up.

A successful close above $0.087 might send Dogecoin to $0.095. But if the effort to break the resistance is futile, the price might drop to $0.080.

However, if bulls can defend the coin from going below $0.083, the Suprtrend indicate that it could be a buying opportunity.

Furthermore, the Chaikin Money Flow (CMF) showed a reading of 0.10. But the indicator has turned downwards, indicating that buying pressure had subsided.

In a highly bearish scenario, DOGE could slide as low as $0.077. But if demand for the coin increases, a rally close to $0.1 could be validated. Source: TradingView

Source: TradingView

Open Interest drops but what’s next?

In terms of the Open Interest, Coinglass data showed that the value had decreased. On the 20th of February, Dogecoin’s Open Interest was over $610 million. But as of this writing, it had decreased to $533.15 million. Open Interest is the sum of all open positions in a contract.

Unlike what you might have heard in some corners, longs and shorts are typically 50-50 in the market. However, an increase in the Open Interest might imply that more liquidity is coming into the market.

But if the Open Interest decreases, it implies as slump in net positioning. Source: Coinglass

Source: Coinglass

Dogecoin’s price decrease alongside the decrease in Open Interest suggests that buyers were no longer aggressive. This position offers DOGE’s sellers to take control on the price action.

Is your portfolio green? Check the Dogecoin Profit Calculator

From a trading perspective, the decreasing Open Interest could lead DOGE to dump into the support at $0.080. However, the potential price decrease could mean market participants could buy at a discount which is where you might want to watch.

Previous: Polygon unlock sends MATIC worth $263M into circulation

Next: Arbitrum falls below $2: How long till ARB regains its footing?

Read the Next Article

Arbitrum falls below $2: How long till ARB regains its footing?

2min Read

Arbitrum took an almost 9% hit in the last three days, with its price falling below $2.

Adewale Olarinde

Adewale Olarinde

Journalist

Edited By: Saman Waris

Posted: February 23, 2024

Share this article

- Close to one million ARB has been sold by a single entity in the last 24 hours.

- The fund inflow has reduced in the past few days.

Arbitrum [ARB] has recently experienced a decline in its price, following a period during which it attempted to establish a new price level.

The fall can be attributed in part to the heightened selling pressure it has encountered over the past few days.

Arbitrum drops below $2

AMBCrypto’s examination of the Arbitrum price on a daily timeframe chart showed a notable decline in the past few days. This was particularly significant, given the prior attempts to initiate an upward trend.

Specifically, between the 20th and the 21st of February, ARB’s price experienced an 8.78% decrease, causing it to drop from the $2 range.

At the time of this writing, there has been a marginal 0.2% increase, and ARB was trading at about $1.88. Source: Trading View

Source: Trading View

Furthermore, the chart’s volume analysis showed that during the two days of decline, selling volume dominated the overall volume trend.

Additionally, the short moving average (yellow line), previously acting as support, has now transitioned to resistance around $1.9 and $2.

The Relative Strength Index (RSI) also showed that ARB was in a bear trend. At the time of this writing, the RSI was below the neutral line, suggesting a bearish trend, albeit a relatively weak one.

Sell-offs contribute to price decline

Per Spot on Chain, the recent decline in Arbitrum’s price may be linked to a significant sell-off by Convex Finance.

Notably, Convex sold 901,392 ARB in the last 24 hours, worth $1.63 million, with a selling price of around $1.8 per ARB token.

For the uninitiated, when Convex received ARB in an airdrop back in April 2023, it was worth around $1.2 million. This implied that Convex garnered a profit of over $400,000 with the recent sales.

Interest in ARB drops

AMBCrypto’s look at the derivative aspect of Arbitrum showed relatively low interest in ARB at press time.

Realistic or not, here’s ARB market cap in BTC’s terms

The Open Interest on Coinglass showed a decrease in funds, with the number standing at about $254 million at the time of this writing.

At the time of this writing, the Funding Rate stood at around 0.014%, indicating that buyers still maintained control, albeit with less aggressiveness.

Previous: DOGE traders are increasing their holdings, should you do too?

Next: Bitcoin: Will GBTC outflows continue to hurt BTC?

Read the Next Article

Bitcoin: Will GBTC outflows continue to hurt BTC?

2min Read

Bitcoin outflows keep increasing, driven by the actions of GBTC.

Himalay Patel

Himalay Patel

Journalist

Edited By: Saman Waris

Posted: February 23, 2024

Share this article

- BTC outflows continued to rise due to GBTC’s behavior.

- MVRV ratios remained high, indicating a high number of profitable addresses.

Bitcoin [BTC] was observed to be stagnating at the $51,000 price level for quite some time. One of the reasons for the lack of movement from BTC’s price was due to Grayscale Bitcoin Trust (GBTC)’s outflows.

Rising outflows

GBTC outflows have acted as a hindrance to BTC’s growth for quite some time. A recent report revealed a $199 million outflow from GBTC and a $111 million inflow from The Nine.

This resulted in a total daily net outflow of $88 million.

Additionally, there was speculation that GBTC may be selling a portion of the Genesis/Gemini shares.

The diminished institutional interest, particularly highlighted by the significant outflow of $199 million from GBTC, has the potential to cast a shadow on Bitcoin prices.

Institutions, often considered influential market participants, play a vital role in shaping overall market sentiment.

When a major investment vehicle like GBTC experiences a substantial outflow, it suggests that institutional investors might be reconsidering their exposure to Bitcoin.

Institutional interest is typically associated with confidence in the market, and a notable reduction can be interpreted as a signal of caution or even a shift towards a more bearish outlook.

Institutions typically conduct thorough analyses and risk assessments before making investment decisions.

If their reduced interest is driven by concerns about the future performance or inherent risks associated with Bitcoin, it could trigger a broader sentiment shift among market participants. Source: X

Source: X

Not all large investors

However, not all hope is lost, as some whales did show interest in BTC.

Notably, the largest whale cohort, holding between 1,000 and 100,000 BTC, has been accumulating. This accumulation pattern, a characteristic of bull markets, signaled a positive outlook among major holders.

Their buying activity commenced at around $29,000 and intensified as the price exceeded $46,000.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

At press time, BTC was trading at $51,847.69 and its price had fallen by 0.26% in the last 24 hours. The MVRV ratio of BTC had remained high during this period.

This meant that despite recent price fluctuations, most holders were profitable at the time of writing. Source: Santiment

Source: Santiment

Previous: Arbitrum falls below $2: How long till ARB regains its footing?

Next: Ethereum’s circulating supply craters to 120M – A post-Merge low

Read the Next Article

Ethereum’s circulating supply craters to 120M - A post-Merge low

2min Read

Ethereum's circulating supply falls to a new post-merge low as burn rate spikes.

Abiodun Oladokun

Abiodun Oladokun

Journalist

Edited By: Saman Waris

Posted: February 23, 2024

Share this article

- Ethereum’s burn rate spiked in January.

- This has resulted in a decline in the coin’s circulating supply.

18,109 Ether [ETH], worth around $53.17 million at press time, have been removed from circulation in the last 30 days, pushing its circulating supply to a new post-Merge low, per Ultrasound.money. Source: Ultrasoundmoney.com

Source: Ultrasoundmoney.com

Information from the data provider showed that the leading alt’s circulating supply was 120.16 million ETH at press time.

This was the lowest in 524 days, when the coin’s network transitioned to a Proof-of-Stake (PoS) consensus mechanism in an event popularly referred to as “The Merge.”

When the Ethereum network sees growth in demand and utilization, its burn rate increases, and more ETH coins are permanently removed from circulation.

This spike in network activity is often accompanied by a jump in transaction fees.

According to data from Messari, average transaction fees on the Ethereum network have increased by a whopping 100% since the 17th of February.

An uptick in activity on the Ethereum network

An assessment of Ethereum’s non-fungible tokens (NFTs) and decentralized finance (DeFi) verticals confirmed the rally in network demand.

According to data from CryptoSlam, NFT sales volume on the Ethereum network has totaled $395 million so far this month.

With a few days left till the close of the month, this figure already represented Ethereum’s highest monthly NFT sales volume since April 2023.

Data from CryptoSlam showed that 619,000 NFT sales transactions have been completed by 91,000 unique sellers and 108,000 unique buyers in the last 21 days.

Regarding its DeFi sector, a major indicator of growth on the Ethereum network is the rally recorded in total value locked (TVL) in the last 30 days.

According to data from DefiLlama, Ethereum’s TVL was $46 billion at press time, climbing by 45% in the last month.

During that period, the liquid staking platform Lido Finance, the foremost protocol on the chain, registered a 39% TVL uptick.

Is your portfolio green? Check out the ETH Profit Calculator

Further, Ethereum has witnessed a spike in its decentralized exchange (DEX) trade volumes amid the current rally in the values of crypto assets.

Per data from Artemis, the total volume of daily transactions executed on DEXes housed on Ethereum has skyrocketed by 118% since the 17th of February.

Previous: Bitcoin: Will GBTC outflows continue to hurt BTC?

Next: How Solana stands to benefit from NVIDIA and the AI hype

Read the Next Article

How Solana stands to benefit from NVIDIA and the AI hype

2min Read

Meme token NVDA on the Solana network experienced a massive growth after NVIDIA earnings.

Himalay Patel

Himalay Patel

Journalist

Edited By: Ann Maria Shibu

Posted: February 22, 2024

Share this article

- Solana meme token NVDA witnessed an extraordinary surge fueled by speculative enthusiasm.

- SOL prices were up nearly 2% in the last 24 hours.

Due to the AI hype and the recent NVIDIA earnings, semiconductor stocks have rallied on the American stock market. A meme token with the same ticker as NVIDIA on the Solana [SOL] network also witnessed a massive surge due to this hype.

Looking into the hype

In the last 11 hours, the price of the meme token NVDA grew by an alarming 56,000%. Coupled with that, other tokens such as GPU and NVIDIA also grew massively in terms of price over the last 24 hours.

However, it should be noted that this surge in price was primarily driven by hype and may not be sustainable in the long term. Source: Dex screener

Source: Dex screener

The temporary nature of the surge in the prices of these tokens may not benefit many investors, and some may even get rug pulled after buying these tokens.

Despite this, Solana could be a beneficiary of the surge in interest in these tokens.

The fact that people are using the Solana network to develop and trade these tokens may improve the overall activity on the network and may also help in providing liquidity in the ecosystem.

How is SOL doing

After testing the $79.20 support level on the 23rd of January, the price of SOL surged by 31.22%. During this period, SOL’s price exhibited multiple higher highs and higher lows, showcasing a bullish trend.

The $117 resistance level was weakened multiple times during the last few months. If SOL re-tests the level yet again, there is a chance that the token may push past it and reach new heights.

The RSI for SOL also declined and reached 42 at the time of writing, implying that SOL had moved into the oversold territory.

Is your portfolio green? Check out the SOL Profit Calculator

This may be interpreted by some traders and analysts as a signal that the asset is undervalued or that selling pressure has been excessive, potentially indicating a point of reversal. Source: Trading View

Source: Trading View

However, in terms of volume, there was a significant dip observed. In the last few days, the volume at which SOL was trading at fell from 3.42 billion to 1.92 billion. Source: Santiment

Source: Santiment

Previous: Ethereum’s circulating supply craters to 120M – A post-Merge low

Next: BDAG and Meme Moguls presales shine amid SOL-ETH speculations for 2024

Read the Next Article

- Home > Press Release > BDAG and Meme Moguls presales shine amid SOL-ETH speculations for 2024

![RichBeak News [EN]:How options expiration will affect BTC and ETHA large number of bitcoin (BTC)](https://cdn.bulbapp.io/frontend/images/e128f363-f0c0-413d-a2da-4e9ba9c1e258/1)