Ethereum Analysis: Mechanisms, Risks and Opportunities with USDe

Ethena's growth

Ethena is a stablecoin project with remarkable growth in the short time since its launch. Currently, the capitalization of stablecoin USDe has reached 2.36 billion USD, quickly surpassing new stablecoins such as GHO, PYUSD, or some other decentralized stablecoins such as crvUSD, FRAX.

Essentially a stablecoin project, users can optimize interest rates without being affected by price fluctuations. To optimize interest rates, USDe holders can deposit assets to Pendle, give up principal interest and shards (points) to receive 59.29% fixed APY from PT.USDe.

The result of the growth is an outstanding revenue level compared to all other stablecoin issuance projects on the market, directly competing with giant MakerDAO.

Ethena's revenue of 47 million USD since mainnet is higher than large projects such as zkSync, Base, GMX PancakeSwap...

Ethena's success to date is a combination of a trend-appropriate Shard strategy, outstandingly high yield, partnership strategy with asset management protocols, and The successful TGE token batch was immediately listed on Binance. In particular, the operating mechanism is the most unique point of the project.

Ethena's mechanism of action

Ethena implements a delta neutral trading strategy* with ETH and tokenizes this strategy through stablecoin USDe. USDe represents the value of a delta neutral position, while directly receiving yield from the assets held. The project defines this stablecoin as a type of synthetic dollar that synthesizes yield from the internet.

*Delta neutral is a strategy that keeps the portfolio position with a total profit and loss always equal to 0.

Steps to implement Ethena's delta neutral trading strategy:

· Users deposit ETH liquid staking assets such as stETH, cbETH, rETH to mint the corresponding USDe value. During the minting process, users may incur price escalation fees.

· Liquid ETH staking is then sent to asset managers (Copper, Ceffu) for custody.

· The project receives data about the number of stETH, opens a short ETH perpetual futures contract with 1x leverage on CEX exchanges.

· This delta neutral position is the collateral behind USDe.

· Thus, USDe will receive the following yield sources:

Types of ETH staking liquids that the project holds.

· Short hedge ETH, in case the funding rate is positive, the long side pays the short side (basis yield).

· The strategy is profitable when Liquid Staking ETH yield + Basis yield > 0.

· Yield will be returned to users via sUSDe.

Compare Ethena USDe and Terra Luna UST

ETH is used as the main asset due to its strong network effect and the ability to generate yield in both directions of the strategy. Ethena's yield level may remind many people of Luna's UST, however these two projects have fundamental differences:

UST is a stablecoin that operates purely on a balance algorithm between UST and LUNA, without using collateral. USDe is backed by a delta neutral position.

UST's fixed profit mainly comes from the project's reserve fund. The large difference in borrowing and lending activities leads to UST not actually generating yield. USDe generates yield from liquid ETH staking and ETH short positions.

The yield level of UST is usually fixed, while the yield of USDe fluctuates according to market conditions.

The role of the ENA token

ENA is used as a governance token and can be locked to increase the reward (shard) users receive in Airdrop Season 2. Accordingly, users hold ENA equivalent to at least 50% of the USDe value they hold. holding will receive additional rewards on the entire amount of USDe.

Suppose a user holds 10,000 USDe and divides it into positions:

· 2000 USDe locked for 7 days on Ethena

· 2000 USDe on Gearbox or Morpho

· 2000 USDe LP position on Curve

· 2000 USDe staked into sUSDe

· 2000 USDe bridged to qualified L2 (Mantle, Arbitrum…)

At this point, you will need to lock up at least 5000 USD of ENA value to get a 50% increase in shard rewards on the entire 10,000 USDe position. This mechanism aims to add value to ENA beyond governance, linking ENA with the development of USDe. The increased demand for rewards from USDe positions will increase demand for ENA.

Risks with Ethena

Ethena's operating mechanism requires the participation of many parties and there are many factors that can directly affect success or failure. This leads to many risks that Ethena may encounter. Some key risks include:

1. Liquidation risk

Ethena uses liquid staking ETH such as stETH as collateral for ETH/USD perpetual short orders, the price difference between the two assets can expose short positions to liquidation risk.

According to past data, stETH has at times had a maximum price drop of 8% compared to ETH, which can cause the position to be liquidated. However, after the Shapella update, users can unstake stETH to ETH, the stETH/ETH discount has never exceeded 0.3%.

Exchanges will have a maintenance margin requirement (MM) for each opened position; if the value of the collateral falls below this level, the position will be gradually liquidated. The larger the position, the higher the MM rate will be. According to calculations from the project, ETH increased in price by 65% compared to the new stETH, leading to liquidation risk for Ethena's position.

2. Asset custody risk

Ethena operates on an Off-Exchange Settlement solution to hold assets. These custodians will help Ethena deposit, withdraw, send and receive and open short positions on exchanges. If these custodians encounter problems such as default, Ethena may be at risk of operational problems.

3. Risks related to the trading platform

Ethena opens short positions on centralized exchanges. If these exchanges encounter problems leading to collapse, Ethena's position will not be fully hedged.

4. Risks related to collateral

Ethena initially used stETH released by Lido. In case Lido is attacked or has problems related to smart contracts, the project will be directly affected. In the future with more ETH liquid staking assets, these assets may diverge in price from each other, making hedging more difficult.

5. Funding rate risk

Ethena's strategy can benefit from funding rates, however the project may also have to pay funding fees in case funding rates change direction.

Bad scenarios can happen

Case 1: Funding rate reverses

Currently the APY from USDe is 17.2%, the formula to determine this APY can be determined as follows:

USDe APY = NativeYield stETH + (FundingRate-8hour x 3 x 365)

With Lido's current 3.5% yield, assuming the funding rate is at -0.0035% (shorts pay longs), the yield from USDe will reverse to negative:

USDe APY = 3.5% + (-0.0035% x 3 x 365) = -0.3325%

If this yield level is maintained for a long time, users may suffer losses when holding USDe. At that time, users will no longer have the incentive to hold USDe and withdraw assets from Ethena and withdraw USDe liquidity from liquidity pools.

In some cases, users will not want to redeem because the yield is negative, users receive less stETH in return, and will tend to sell via DEX. According to calculation assumptions, if whale wallet addresses withdraw 50% of the current liquidity from the USDC-USDe pool, then the slippage for users will reach more than 70%.

However, looking at the funding rate in the past, in the last 3 years the funding rate of ETH on exchanges is often positive, negative days only account for ~20.5% of days. If we include the APY from stETH, the number of days only accounts for ~10.8% in 3 years. The longest time the total ETH funding rate was negative was in Q3/2022.

Case 2: When USDe expands

In a positive case, USDe is widely accepted on a very large scale, then USDe will create great demand for both sides:

Increasing the amount of stETH staked will gradually reduce the yield received.

The increased volume of ETH shorts will cause the shorts to overwhelm the longs, causing the funding rate to decrease or even reverse direction.

Assuming Ethena expands large enough, both of the above will affect the yield generated by USDe itself. When the yield level drops to only 5-10%, users will consider choosing the 5% risk-free profit rate instead of taking a series of risks from Ethena where the yield level is not too different.

In the worse case, when USDe expands really large scale, USDe APY can be negative, leading to the consequences of case 1. In general, USDe is not a Ponzinomics project when the yield obtained from USDe can be considered is real yield from the market, but in return users have to bear many risks.

From Ethena

Ethena is also aware of the risks that may occur with USDe and also implements risk assessment and prevention measures such as using multiple asset managers, opening orders on many different exchanges, monitoring USDe liquidity situation…

According to the conclusion from Ethena's risk assessment, a retention level of 10-20% and an initial reserve level of 20 million USD are appropriate for the initial capitalization stage of 1 billion USD. If the project retains 50%, the initial capital of 20 million USD, the Insurance Fund will be enough in most levels of development.

If the project develops too strongly in the initial stages, when the Insurance Fund is not large enough, even a black swan event can adversely affect the project.

In the near future, Ethena is also researching and expanding Bitcoin and related strategies as collateral for USDe.

From related projects

USDe in fact still has many risks, so projects cannot be completely trusted, a typical example is Aave. After MakerDAO accepted the use of Ethena's USDe as collateral to borrow DAI on Morpho, Aave immediately moved to reduce the Loan-to-value value of DAI by 12%, to 63%.

This means that 100 DAI can currently only borrow a maximum of 63 USD in assets. There have even been proposals discussing reducing the LTV of DAI on Aave to 0%. The appearance of USDe could create a “political war” between major DeFi protocols in the market.

Opportunities with Ethena

Protocol

In addition to profit from USDe, accumulating points to receive ENA in the Ethena Season 2 program as described above, users can also participate in arbitrage trading when USDe deviates from the peg by buying USDe from the market. secondary then redeem to get back the collateral. The steps are as follows:

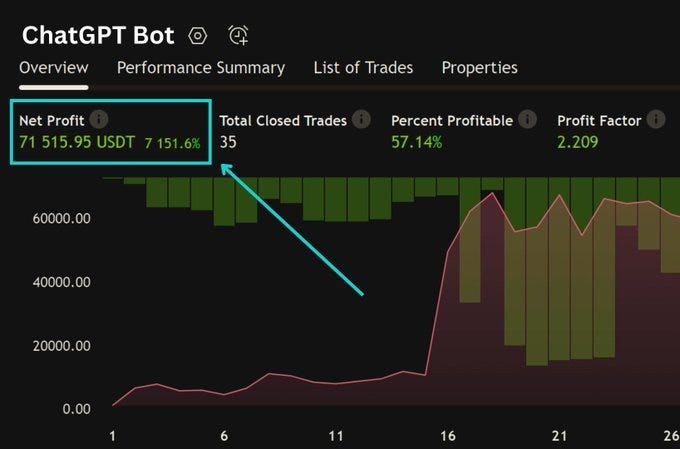

Arbitrage trading with USDe

Arbitrage trading volume is happening on Ethena as a way of maintaining USDe's peg. These transactions have profits ranging from a few USD to a maximum of 117k USD.

As described above, users can use Pendle to optimize yields:

· Buy PT: In case you want to fix the yield received within a fixed period of time. In return, you will not receive shard points to receive airdrops.

· Buy YT: Increase the points received to 170x, but will not receive native yield of USDe.

· Note: Both PT and YT USDe tokens can fluctuate in two directions.

Strategic choices with USDe and Ethena Finance on Pendle.

summary

Ethena is not really a ponzinomics project as USDe, although it brings high yields, is real-yield earned from the market. In return for this yield, users will have to bear more risks than regular stablecoins. Currently, Ethena and surrounding projects also have many opportunities for users to seek profits.