Solana (SOL) 2024: The Biggest Resurgence in the Bull Market

Solana, one of the prima donnas of the 2021 bull market era, has unfortunately received a lot of negative sentiment especially after the FTX and Alameda Research incident, which made its network transaction volume drop drastically.

The good news is that after experiencing this bad season, Solana was able to bounce back with many developments in terms of new products and adoption as seen from the many new players in its ecosystem.

As a result, Solana has now increased significantly in terms of the number of users to the price of its coin, SOL, which has successfully passed the price of $100.

Before FOMO to buy, it is better for investors to see the condition of Solana through this article to determine whether SOL is one of the good coins to buy to improve the quality of their respective investment portfolios.

What is Solana?

Solana is a layer one (L1) blockchain that was created to process crypto transactions as well as a place for developers to build decentralized applications or DApps on it.

The capabilities of Solana make it classified as a third-generation blockchain, which is a generation of blockchain with the ability to process transactions and become a place for building applications without the need for assistance from other networks due to its efficiency.

Solana itself operates using a consensus mechanism called Tower BFT which is a development of the Byzantine Fault Tolerance mechanism, a mechanism that keeps blockchain networks alive.

This mechanism is combined with the Proof of History or PoH consensus mechanism which is a development of the Proof of Stake (PoS) consensus mechanism but with some changes.

As a result, this mechanism makes Solana validators only need to provide time records on each block and transaction without the need for excessive validation, making the network faster and reducing electricity consumption.

All of these mechanisms were created by the CEO of Solana named Anatoly Yakovenko in 2017, with the aim of creating a blockchain that is efficient, cheap in terms of transaction costs, and solving other problems that Bitcoin and Ethereum have.

Anatoly Yakovenko himself has more than 20 years of experience in the technology industry which makes him suitable to lead Solana to date. He and his team officially launched Solana in 2020 after conducting trials since 2017.

Along with the launch, Solana also launched its own coin called SOL which acts as a validator coin for staking, for transaction tools in the Solana ecosystem, and other uses related to investment and buying and selling.

How does it Work?

Just like any other third-generation blockchain, Solana uses validators to process its transactions. But because of the PoH mechanism, Solana validators have less work than other networks.

To become a validator in Solana, the number of SOL that must be locked for staking is at a minimum of 0.03 SOL according to official documentation from the Solana Team.

However, the amount of SOL to be locked is only the initial capital to rent a place to become a validator, because the validator must pay an additional fee of 1.1 SOL per day to participate in the consensus on the Solana Blockchain. Please note that this is the cheapest capital to become a validator in Solana.

Validators in Solana have several positions, where there is a mechanism called leaders and followers. Leaders are validators whose job is to gather other validators and ensure that all validators get the opportunity to get rewards and the blockchain never stops.

The leader selection mechanism is to alternate automatically through random selection based on the number of SOL locked in staking, where the more SOL locked in staking, the greater the chance to become a validator or leader, and the more rewards.

The validation process in Solana is faster than other blockchains due to the PoH mechanism, where each validator does not need to check all transactions but only needs to mark the time on the transaction so that all transactions are neatly arranged in the block and records are not messy.

Validators do not need to check and verify transactions again because of the assumption in the Solana Blockchain that all transactions are valid because they reflect previous transactions.

But to ensure the absence of malicious transactions, Solana implements a mechanism called Verifiable Delay Function which is tasked with removing transactions that are harmful to the network.

These mechanisms have led Solana to achieve transaction speeds of up to 65,000 transactions per second with a maximum speed of up to 710,000 transactions per second.

Network Update

Unfortunately, despite implementing the Tower BFT mechanism, Solana still experienced several "blackouts" as evidenced by the events between 2021 and 2022.

This "blackout" is a condition where the Solana Blockchain temporarily shuts down because it cannot process too many transactions, which happened when the blockchain was just starting to gain popularity even though it only launched in 2020.

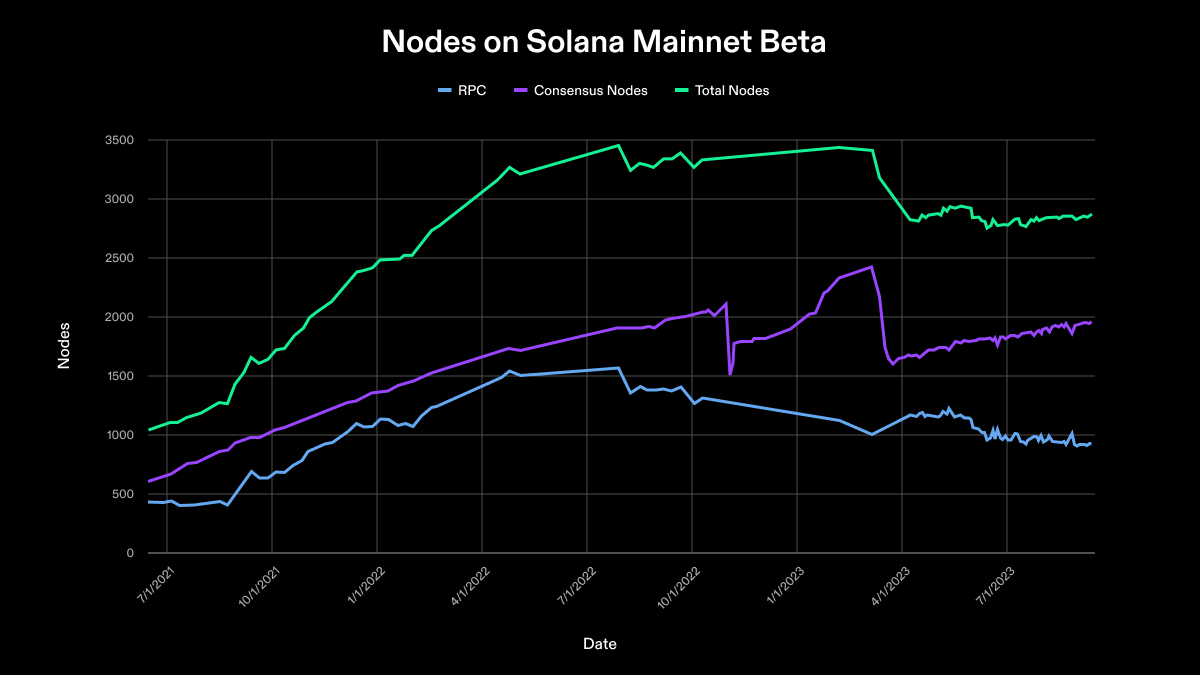

But the good news is that since then, Solana has never experienced a temporary shutdown again, especially in 2023 where the performance of the blockchain has improved drastically.

The three updates that led to the stability in 2023 were the QUIC update mechanism, Stake-Weighted QoS, and Fee Markets.

QUIC is an update to ensure that Solana can process more transactions from a standing start so that, when the network is crowded, there are no more temporary outages, making the network more resilient to sudden increases in transaction volume in the long run.

This mechanism was inspired by Google, so given the amount of data transactions Google processes per day, this update was a natural fit for Solana.

The next update is Stake-Weighted QoS which is an update to ensure that all validators can run smoothly through their respective leaders.

The result is a network that has high efficiency without the need for the help of other networks such as second layer networks.

Finally, the Fee Market update is a mechanism where par users can choose transaction fees according to the urgency of the transaction whether they want to be completed in a fast, medium, or slow time, so that different fees are charged.

This mechanism is implemented to ensure that more important transactions will be completed first so that the transaction queue occurs neatly and according to user needs.

These updates have successfully improved the quality of the Solana Blockchain in 2023 with a 100% increase in performance and average transactions at 5,000 transactions per second, faster than the majority of well-known blockchains in the crypto world, such as Ethereum and Bitcoin.

In addition, Solana has also gained several new members in its ecosystem as a result of developer interest in the network.

Future Plans

One of these new members is a company called Jito Labs that offers client applications as well as easy staking for validators in the Solana ecosystem.

Before Solana introduced Jito Labs, the application that clients or validators used on the Solana Blockchain to maintain the entire validation process was an application from Solana Labs.

After the launch of Jito Labs, validators now have two choices of applications to maintain the validation process on the Solana Blockchain, so that when one application breaks, they have another choice, minimizing the possibility of Solana temporarily shutting down again.

Besides Solana, the other blockchain that has more than one validator or client manager application is Ethereum, so this is a big achievement.

After Jito Labs, Solana announced that there are several other companies that want to build client applications on Solana, for example Jump Crypto with the Firedancer application and Syndica with the Sig application.

Currently more than 30% of validators have used applications from Jito Labs which makes the Solana network more diversified and less likely to go down temporarily.

Solana has also launched an application called Solang which focuses on building applications based on EVM or Ethereum Virtual Machine so that developers who are more familiar with the Ethereum mechanism can build applications on the Solana Blockchain.

This application was built as a tool to provide a bridge between Solana and Ethereum developers due to language differences. Solana developers use the main language Rust while Ethereum uses Solidity.

The existence of Solang can drive adoption because it means more developers can build on the Solana ecosystem, especially considering Solidity is the most used language in the crypto world today.

Solana has also integrated with Amazon Web Service for companies that want to build applications or want to adopt Solana Blockchain for their company products.

This is a significant achievement considering there is only one other blockchain that Amazon allows for integration into Amazon Web Service which is Ethereum.

Another new product from Solana is Saga, Solana's new smartphone that simplifies the integration of blockchain applications and improves the quality of investor and trader convenience in the Solana ecosystem.

All these updates have reinvigorated Solana after it was left behind by Alameda and FTX, which were previously the biggest supporters of transaction volume in the Solana ecosystem but have suffered a collapse due to fund manipulation scandals.

Several other updates will soon be released by Solana, mainly related to improving transaction processing capabilities for users so that more transactions can be validated in one process, as well as updates to the efficiency of consensus agreements on validators.

Both of these updates are still in the testing and development stage so there is still no news regarding when they will be launched.

Both updates will provide higher efficiency to the data storage mechanism on the Solana network and increase Solana's transaction speed to near its maximum capabilities.

Airdrop Potential

In addition to the updates that have been implemented, Solana also has several airdrops to increase investor interest in its ecosystem.

Some that have been implemented are airdrops from Pyth Network (PYTH), Jupiter Exchange (JUP), Jito Labs (JTO). These three airdrops succeeded in luring back airdrop activists who like to hunt, thus indirectly increasing the volume of transactions in the Solana ecosystem.

The increased transaction volume is due to the fact that there are several things or tasks that airdrop recipients need to do to get the right to take their airdrop. So indirectly some of these airdrops succeeded in increasing transaction volume.

After these three airdrops, there seems to be no more official information about potential airdrops. This absence of information is also likely due to the turn of the year where the majority of projects in the Solana ecosystem are seen to reduce the publication of updates ahead of the new year.

But there is some speculation regarding further airdrops that will occur in the Solana ecosystem that could potentially benefit as much as the three projects previously mentioned.

First up is Firedance from Jump Crypto. For now, there is still no clear and official information regarding whether Jump Crypto will hold an airdrop after the launch of Firedancer.

But speculation is starting to be strong in the Solana community because Firedance is similar in nature to the application from Jito Labs where both function as client management applications or validators in the Solana ecosystem.

The difference is the predicted wider use of Firedancer where there are many narratives that Firedancer can make it easier for validators on other blockchains to understand and adopt it, thus increasing the interest of validators in the Solana ecosystem.

Seeing this, speculation began to spin so that at this time it is possible that Jump Crypto will hold an airdrop.

Second is MarginFi, one of the Decentralized Finance or DeFi ecosystems in the Solana ecosystem that continues to rise in fame.

Speculation related to airdrops around Margin arises because of the points mechanism where there will be points every time users use the application.

There is speculation that these points will later be exchanged for airdrops but until now there is still no official information from MarginFi regarding whether there is really an airdrop or not.

In addition, currently at MarginFi there is a lending option where if users lend bSOL, users will get an airdrop reward in the form of BLZE tokens, one of Solana's ecosystem projects called Blaze which plays a role in improving the quality of network infrastructure.

There are still several other speculations regarding the potential for airdrops in the Solana ecosystem, but for now these two projects are still the main attention of airdrop hunters.

SOL Token Economics

Keep in mind that Solana has its own coin called SOL which is the main center for investors if they want to support this project.

Its uses are still diverse regarding all transaction tools in the Solana ecosystem except for DAO Governance or voting rights to reject or approve network updates.

SOL itself has a total inventory of 564 million without any maximum inventory. This means that the number will continue to grow, where it is predicted that by 2030 there will be 700 Million SOL rotating at the current inflation rate.

SOL has inflationary properties but adopts a burn mechanism, which makes its inflation rate fluctuate annually within a limit of 1.5% to 3% per year.

According to data from CoinGecko, the allocation of SOL is relatively fair with the team, founders, and early investors owning 43% of SOL circulating in the market and the rest circulating to general investors equally.

For now, almost 70% of SOL is still locked in staking which makes the potential for a significant correction very difficult as selling pressure continues to diminish once SOL is locked in staking.

This could be an indicator that SOL will not be easily manipulated as the more SOL locked in staking, the less selling pressure.

But keep in mind that this condition does not mean SOL is free from volatility, because considering its market capitalization is still relatively small compared to large cryptos like Bitcoin, its volatility is still relatively higher.

SOL Price Prediction

There are currently around 500 decentralized applications operating in the Solana ecosystem which makes it one of the most crowded blockchains in the crypto world.

This could be a positive sign for Solana in the long run as the more projects in the ecosystem, the higher the potential for increased transaction volume.

In terms of price, it currently looks like SOL is still moving positively but has the potential for a correction given its already high appreciation. This correction is not a bad thing because it can provide normalization of price appreciation in the long run.

According to data from Messari, currently SOL market capitalization dominance has reached 3% which means 3% of all funds in the crypto market are moving on SOL. This makes SOL ranked fourth in terms of crypto market capitalization.

This shows that SOL can grow even in a bull market, making it one of the projects that can survive both bear and bull markets.

In terms of social media, Solana's followers on Twitter (X) currently appear to be on the rise, signaling renewed interest in the ecosystem and its latest news.

This data could be a sign that more new investors are paying attention to Solana as an increase in followers means more new followers.

Unfortunately for Telegram, the number of community members seems to be going down. But this could be due to the move to discord or other decentralized community apps in the Solana ecosystem.

This could be due to the large number of NFTs or Non Fungible Tokens circulating in the Solana ecosystem. So, in general, NFT investors prefer to use Discord rather than Telegram.

SOL transaction volume was also seen to increase significantly in the second half of 2023, which could signal that SOL buying impulse is on the rise and could be a sign of renewed interest in the next bull market.

According to data from Coinglass, an increase in transaction volume is also seen in the futures market where currently the transaction volume reflected in the open interest of SOL futures contracts, shows a higher volume than the 2021 bull market conditions.

This could be a reflection of increased interest in SOL that could continue to persist in the long term.

But it could also be a warning of a potential correction in the short term to normalize transaction volumes and excessive leverage usage from futures traders who are mostly retail.

So for now, despite its long-term positive potential, SOL has a small potential correction to normalize its price appreciation.

Conclusion

Judging from this article, Solana has excellent fundamentals as updates and adoption have increased.

However, if looking to adopt SOL in a long-term portfolio, there are a few things to consider before making a purchase.

The first is the impact of FTX and Alameda Research still having SOL in their bankruptcy portfolios that will be disbursed to reimburse customers.

Until the disbursement is complete, there is still a shadow risk that continues to haunt SOL in the long run. But this risk will be resolved once both entities no longer have SOLs in their portfolios and have finished disbursing funds to customers.

Another thing to consider is the leader mechanism within the Solana validator, where the risk arises if there is a dangerous leader that could potentially damage the Solana network.

For now, there are two mechanisms to deal with this risk, namely Tower BFT and validator leader rotation, which are still being implemented.

But according to publications, Solana is currently working on creating a new mechanism that will solve this problem.

Finally, focusing updates on scalability or speed over security, Solana's main focus currently seems to be on transaction processing speed over blockchain security.

This could be something to consider if investors feel safer investing in blockchain coins that prioritize security over speed.

Overall, Solana is one of the best blockchains in the crypto world, but it still needs some improvement and development.

Given the current state of the team and future plans, SOL could be a good asset for long-term investment if implemented with good risk management and financial management.