MVRV ratio and Realized Loss signal potential market bottom. BTC market euphoric with rapid growth.

Euphoric sentiments remain in the Bitcoin market despite the extended price consolidation.

- Despite recent price troubles, the BTC market remained euphoric.

- Readings from the coin’s MVRV ratio and Realized Loss metrics suggested that a local bottom may soon be discovered.

Bitcoin’s [BTC] Net Unrealized Profit & Loss (NUPL) metric has shown that the coin’s market remains within the euphoria phase with significant unrealized gains among investors, Glassnode found in a new report.

The BTC market is said to be euphoric when there is widespread optimism and belief that the coin’s price will continue to rise indefinitely.

During this period, the market witnesses rapid price growth and increased trading activity fueled by the excitement.

According to Glassnode, although this phase has cooled off since the market correction began, the value of the coin’s NUPL above 0.5 showed that euphoric elements remained within the BTC market.

Santiment said,

“By this metric, the Euphoria phase (NUPL>0.5) of this bull market has been in effect for (the) last seven months. Even the mightiest up-trends experience corrections, however, and these events offer valuable information about investor positioning and sentiment.”

Is the local bottom in?

According to Glassnode, the recent correction in BTC’s price has caused its short-term holders (STHs), particularly those who have held their coins for periods between one week and one month, to intensify distribution.

Their distribution activity during periods of market correction such as this becomes noteworthy as it can help identify potential buying opportunities (local lows).

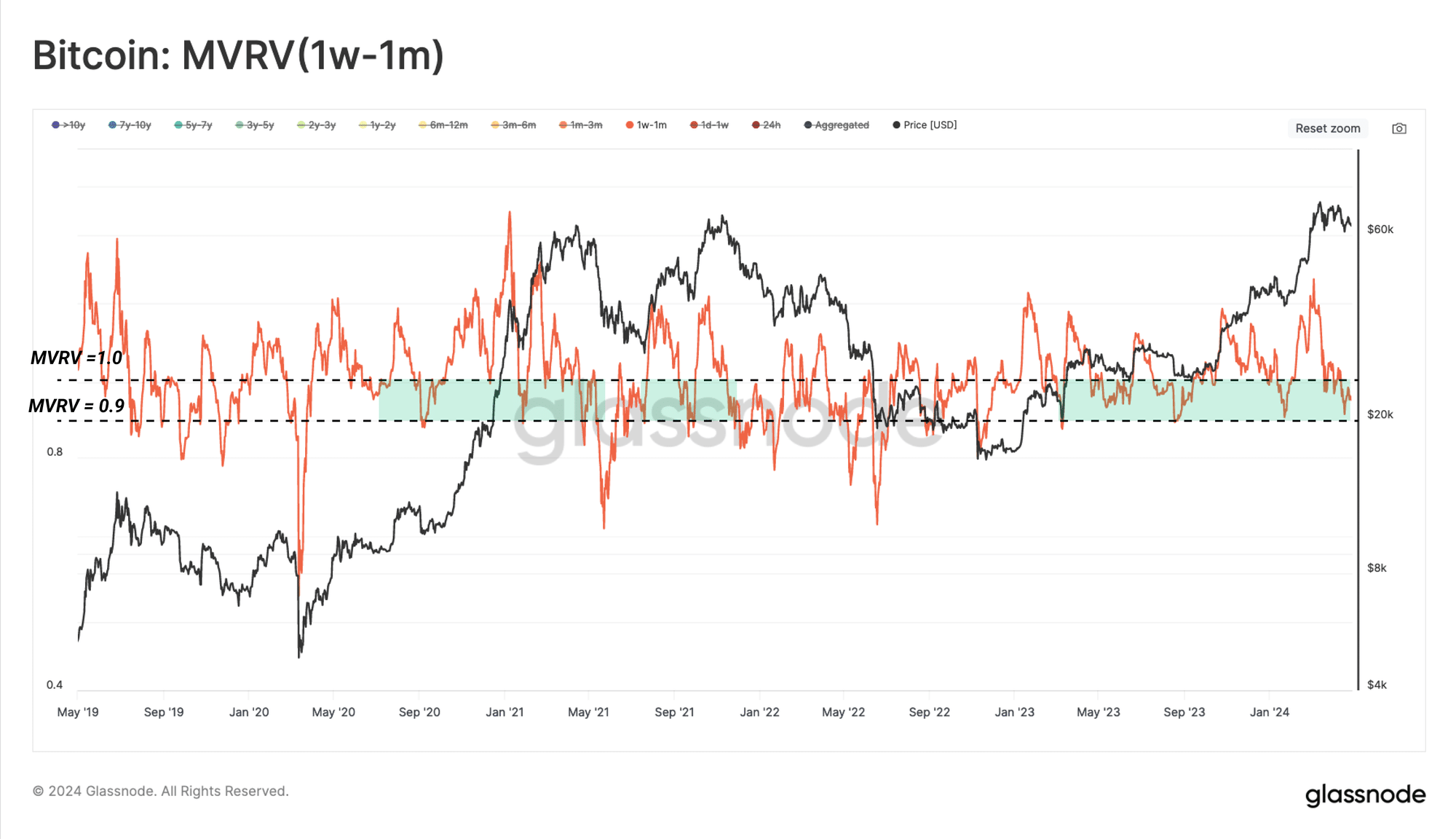

Glassnode assessed the historical pattern of the MVRV ratio of coins held between one week and one month and found that during bull market corrections like this, the value of the ratio “drops into the 0.9-1 range.”

This means that investors who have held their coins for periods between one week and one month would usually witness around 0% to 10% decline in their assets, causing them to sell.  Source: Glassnode

Source: Glassnode

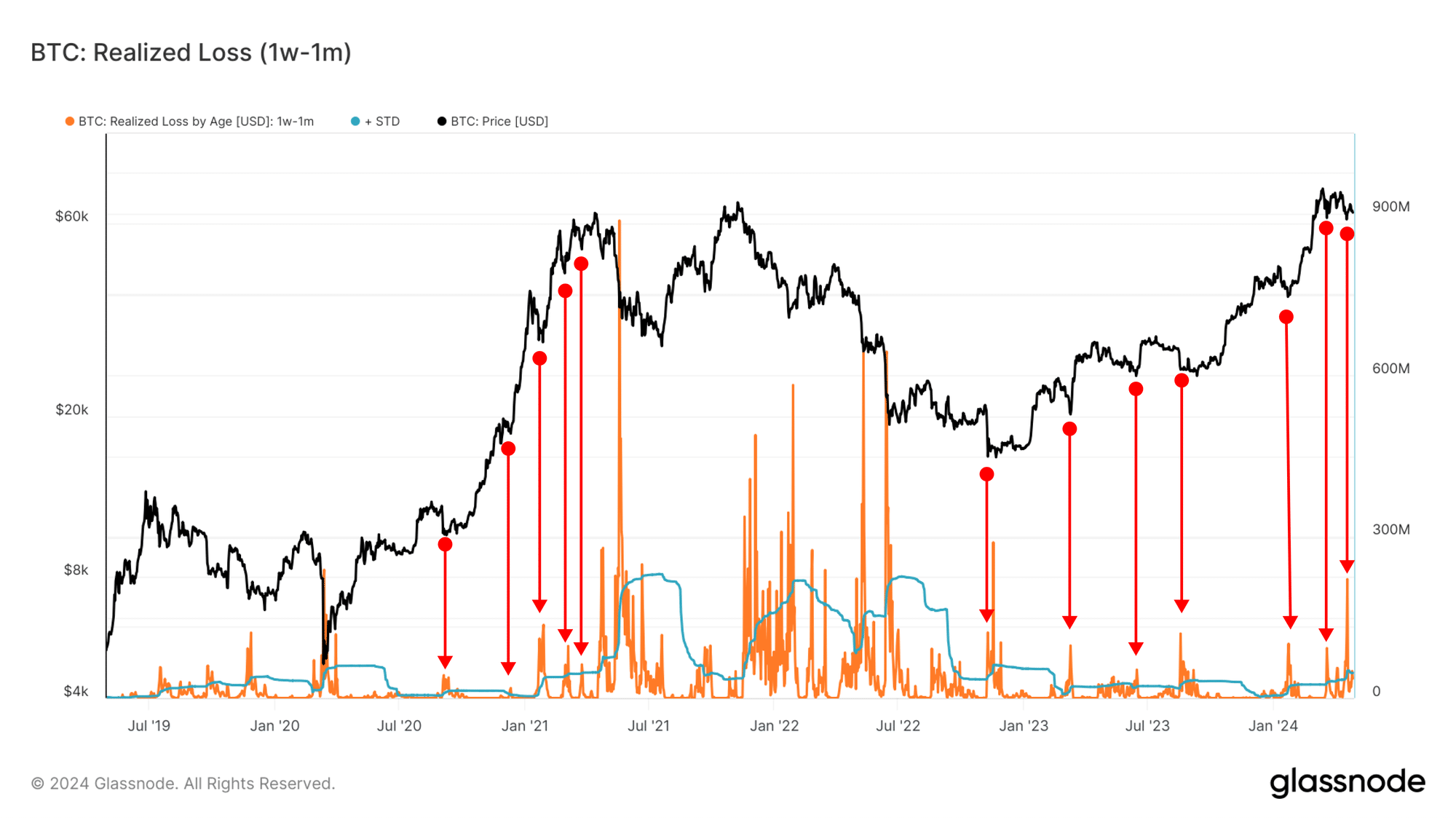

The on-chain data provider also considered the Realized Loss by one-week to one-month-old entities.

Historical precedents show that when this metric goes above 1, it suggests that STHs are panic selling at a loss.  Source: Glassnode

Source: Glassnode

Glassnode combined its readings from both metrics and concluded:

“Since the price resides within the $60k to $66.7k range, the MVRV condition is met, and it could be argued that the market is hammering out a local bottom formation. That said, a sustained break below that MVRV level could create a cascade of panic and force a new equilibrium to be found and established.”

The Fed noted that rate cuts are not appropriate until there is greater confidence that inflation is heading to 2%.

- US Fed left interest rate unchanged again, citing “lack of further progress” on 2% inflation target.

- BTC remains under pressure despite a modest flip after the Fed meeting.

Bitcoin [BTC] eased its two-day bleeding streak after the Fed meeting. As expected, the US Federal Reserve left interest rates unchanged on 1st May.

This marks the sixth Fed meeting at which the agency kept the rate at 5.25% – 5.50%. However, the Fed noted that rate cuts are not appropriate until there is greater confidence that inflation is heading to 2%.

Part of the Fed’s policy statement read,

“In recent months, there has been a lack of further progress toward the Committee’s 2 percent inflation objective.”

In a later press conference, Fed chair Jerome Powell was asked whether there would be three rate cuts later in the year. To which Powell responded,

“We didn’t see progress in the first quarter; it appears then that it’s going to take longer to reach that level of confidence.”

In a nutshell, “the higher rates for longer” stance seems officially back.

Bitcoin saw a modest flip as memecoins led a short recovery

Within an hour after the Fed rate decision, memecoins led a slight recovery. Bonk [BONK], Floki Inu [FLOKI], and dogwifhat [WIF] recovered by 6%.

BTC and Ethereum [ETH] recorded a modest flip within the same period.

In the past two days, BTC has slumped hard, shedding over 12% from a high of $64.7K to a low of $56.5K. This extended BTC’s April losses into May and underscored a tough Q2.

After the Fed statement, BTC reclaimed $58K but dropped lower a few minutes later, denoting that it was still under immense sell pressure.

ETH also saw a modest uptick but faced rejection at the $3000 level at the time of writing.

With the Fed’s “higher for longer” stance and negative flows from US BTC ETFs, it will be interesting to see if BTC could reclaim the range-low around $60.8K.

The year 2024 is proving to be a golden age for cryptocurrencies, with the exponential growth of this asset class coinciding with a surge in crypto voters.

Notably, a significant portion of this surge in crypto adoption occurred after the 2020 presidential election. Following Biden’s election, there was an unprecedented wave of retail adoption within the cryptocurrency industry.

However, as the U.S. elections 2024 approaches, an unexpected development has emerged.

The United States Department of Justice has announced charges against Roger Ver, also known as “Bitcoin Jesus,” on allegations of tax evasion.

Diverging perspective

Various execs have weighed in on the matter, speculating that it is an anti-crypto stance within the Biden administration.

Highlighting consecutive arrests by the U.S. government, including Sam Bankman-Fried, Changpeng Zhao, and now Roger Ver, David Shares, a crypto expert noted,

“The U.S. is aggressively coming after crypto. Just look at the recent targets. If you think you’re not a target, think again. They will come after all of us at some point. We have to fight!”

Echoing similar sentiments, Jane Adams, a 2024 candidate for the U.S. House of Representatives and a supporter of Bitcoin, said,  Source: Jane Adams/Twitter

Source: Jane Adams/Twitter

However, some execs believed in the steps taken by the U.S. Voicing his apprehensions against Ver, Bitcoin educator, Dan Held said,

“Good. He’s been a net negative for Bitcoin.”

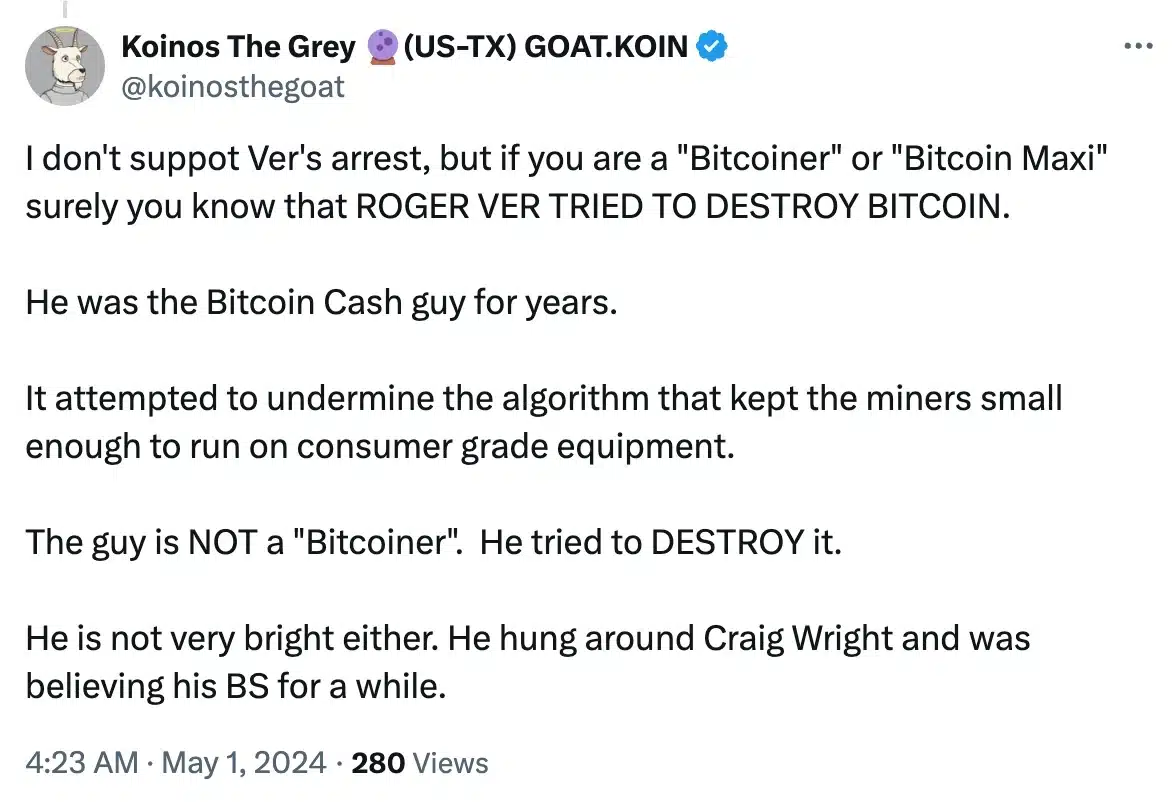

Adding to the fray, an X user, @koinosthegoat, claimed,  Source: @koinosthegoat/Twitter

Source: @koinosthegoat/Twitter

These contrasting perspectives underscore the complexities and divisions within the crypto space, suggesting potential implications for the upcoming U.S. elections.

What’s more to it?

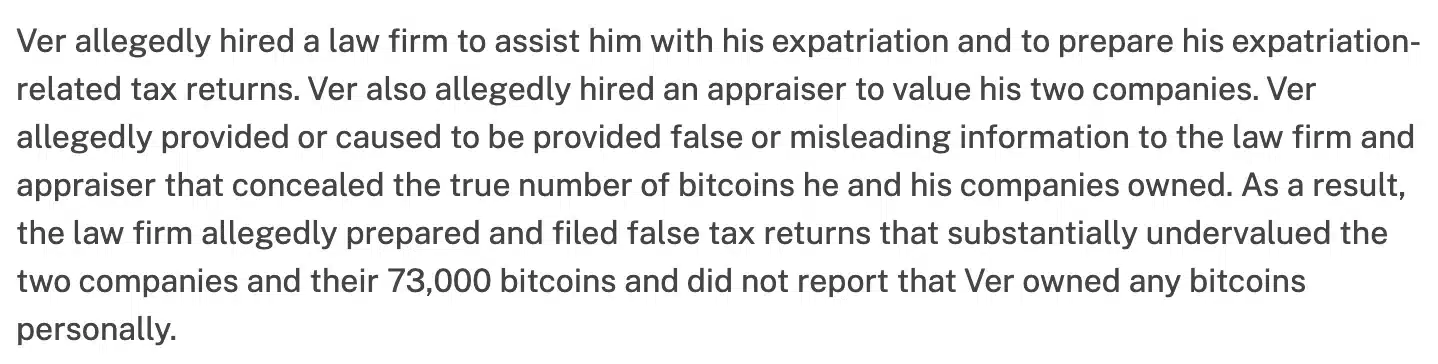

As a matter of fact, Ver was arrested in Spain on the 30th of April, following criminal charges in the U.S. for offenses including mail fraud, tax evasion, and filing false tax returns.

The DoJ alleges that Ver avoided taxes totaling $48 million on his Bitcoin and cryptocurrency sales in 2017. According to a press release by the DoJ, Source: U.S. Department of Justice

Source: U.S. Department of Justice

However, despite renouncing his US citizenship in 2014, Ver faces extradition to the United States, prompting criticism from crypto veterans and social media users.

Amidst this criticism, Kim Dotcom, a crypto veteran who himself was in the same shoes a few years ago, remarked,

“This indictment has nothing to do with tax evasion. This is a malicious attempt to vilify Roger and to punish him for exposing and opposing the crimes of the US empire.”

As things unfold, it will be interesting to watch how the upcoming U.S. elections will shape the future of cryptocurrency in the States.