The Bitcoin Crisis Paradox

How many times have you heard that Bitcoin is a hedge against a crisis? A safe haven asset in times of political instability?

Is it possible that if we ever reached the chaotic system that bitcoin is meant to thrive in, that actually bitcoin would be worthless?

This perception has led to what I term the “Bitcoin Crisis Paradox.” The paradox lies in the notion that while Bitcoin, like gold, serves as a hedge against instability, in the face of extreme crises, its utility quickly becomes irrelevant. First, we need to understand why Bitcoin is so valuable as a safe haven asset.

Bitcoin: The Digital Gold

Bitcoin is Digital Gold

Bitcoin is Digital Gold

Since its inception, Bitcoin has been likened to gold. Its appeal lies in its stability, scarcity, and its detachment from the conventional financial system. In times of political and economic uncertainty, investors and individuals alike have turned to Bitcoin, seeking a refuge from the volatility of local markets. Just look at Argentina where they had close to 100% year over year inflation and just elected a politician who wants to turn the system upside down. It’s no surprise then that Argentines have flocked to Bitcoin and other cross-borders assets to flee from the death spiral of their currency. So much so that Argentina is one of the fastest growing crypto markets in the world.¹

Argentina isn’t the only country with problems. If you watch the news, it seems like the whole world is moving towards instability and you’d be right. I explain this more in a previous article about the coming geopolitical crises and on inflation. Now to the paradox.

The Paradox

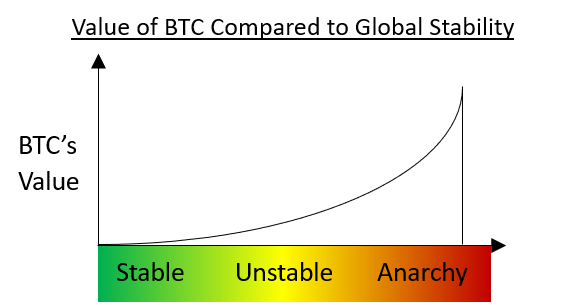

As political instability rises, the value of a hedging instrument increases. Think about it, would you want to invest in a country that is in a civil war? What about if the country just had a coup? No you wouldn’t. You’d want to wait until stability increases and the new government won’t confiscate your assets (happened wayyyyy too many times to count). This is true for foreign investors and for the local citizens. Therefore, the currency loses value as everyone moves their investments out of the local currency and out of the country. For example, China took significant steps to liberalize capital controls for their citizens around 2007. These changes allowed Chinese citizens to invest outside China and oh man did they… Within the same year, China had to cap the amount of foreign capital flows per citizen to $50,000² to stem the outflow. Turns out, when citizens don’t trust their governments to take their money, they look for alternative ways to hide it. Luck would have it that Bitcoin is an excellent alternative.

When times are good and governments are trusted, other forms of currency like gold or Bitcoin are not needed. Before everyone gets their pitchforks, I am only talking about the value of BTC in relation to a hedge against crisis. Obviously there is value to Bitcoin intrinsically through the technology and use cases behind it. The basic idea is that if you trust your government and it is stable, the national currency should also be stable. Resulting in little need for a hedge against the currency.

We can debate if any nation currently falls in this category so I will offer only one, Switzerland. You can always trust the Swiss — even the Allies and the Nazis trusted the Swiss during WWII and no one batted an eye. Now back to the paradox. As stability decreases, the value of Bitcoin increases. Again, this shouldn’t be a surprise. Bitcoin is easily accessible and able to be stored with ease. So it is obvious why countries ranging from Argentina to Russia to South Sudan have been buying Bitcoin to counter geopolitical instability. The Bitcoin Crisis Paradox

The Bitcoin Crisis Paradox

The core of the Bitcoin Crisis Paradox lies in its limitations during extreme crises. When society faces severe challenges like natural disasters, wars, or periods where basic resources become scarce, the practical utility of Bitcoin and even gold diminishes. Neither can directly offer food, shelter, or safety — the basic needs for survival. In such scenarios, the reliance on digital or intangible assets becomes not just impractical but also irrelevant.

Wow, thanks for stating the obvious… It is obvious but it isn’t talked about. There is a point in time where everything changes because you have to survive. Think about to the beginning of COVID where people were fighting over toilet paper. F-ing toilet paper! What happens when there is no food available? You think the storeowner cares about your Bitcoin? Let alone the local currency? No they don’t. As you approach anarchy, basic instincts and values change drastically.

Now there is a silver lining to this, if you can even call it that. The Paradox mainly happens in a continental or global crisis. In a localized crisis, there is no catastrophic cliff where Bitcoin is worthless because the rest of the world is stable. Stability ebbs and flows, so being able to hold onto assets that are not correlated to the local currency like Bitcoin, will leave those individuals better off after the crisis is over.

Conclusion: Embracing the Paradox

Now for the good news, the likelihood of this type of scenario is highly unlikely. Even if newly famous Youtubers are calling for the collapse of globalization — cough cough Peter Zeihan. Let alone if there is actually a cliff at the end of the road. The big point was that Bitcoin’s value was increasing exponentially as instability was rising.

Bitcoin will always be a hedge against political instability because of its decentralized nature. The libertarians were correct in this fact. Governments will come first for their currency (printing free money until the death spiral of inflation), then they come for the valuable assets (gold, silver, diamonds). Having the ability to hedge against government intervention in those dark times will protect you from losing everything. Bitcoin is not only the last line of defense but the only line.

-Just Another Crypto Analyst

Doing this for fun but if you want to leave a tip: 0xa33aE4207466cD866D13fA587067B1F824C06d4A

Sources

[1] Chainanalysis Team. 2022. “Latin America’s Key Crypto Adoption Drivers.” Chainanalysis. https://www.chainalysis.com/blog/latin-america-cryptocurrency-geography-report-2022-preview/

[2] People’s Bank of China. China: the evolution of foreign exchange controls and the consequences of capital flow. https://www.bis.org/publ/bppdf/bispap44h.pdf

Crypto

Cryptocurrency

Bitcoin

Ethereum

Blockchain

Follow

Follow

Written by Just Another Crypto Analyst

8 Followers

·

Writer for

Coinmonks

Crypto Analyst sharing what I've learned over the years

More from Just Another Crypto Analyst and Coinmonks

Just Another Crypto Analyst

Just Another Crypto Analyst

in

Coinmonks

Navigating Chaos: Why Cryptocurrency is Emerging as a Preferred Asset Class

Introduction

8 min read

·

Nov 13, 2023

Shantanu Gupta

Shantanu Gupta

in

Coinmonks

Which Crypto Will Explode in 2024? Here Are Some Of MyTop Picks.

As we approach the end of the year, investors worldwide are gearing up for the anticipated bull run in the crypto market, eyeing the next…

4 min read

·

Dec 19, 2023

668

2

Velvet.Capital

Velvet.Capital

in

Coinmonks

🚨Velvet.Capital Token Distribution (Airdrop)🚨

🚨 Airdrop Alert🚨: DeFi Asset Management Done right! Everything you need to know for Velvet.Capital’s Token Distribution & Airdrop!

4 min read

·

Dec 30, 2022

38K

1020

Just Another Crypto Analyst

Just Another Crypto Analyst

in

Coinmonks

How to Get the Highest Yield on Your Stablecoins (Oct 2023)

All over the news, we are hearing that money markets, U.S. treasuries, and high interest savings accounts are all offering +5% APYs. And…

8 min read

·

Oct 15, 2023

8

See all from Just Another Crypto Analyst

Recommended from Medium

Scott Galloway

Scott Galloway

2024 Predictions

Each year, we review/make predictions re the past/coming year. Most years, we hit more than we miss. But we do miss — if we made 10…

11 min read

·

Jan 6

8.7K

119

Mike Coldman

Mike Coldman

Top 4 Crypto Gems Set to Explode in 2024 !

Unlock the Secret Strategies of Elite Investors and Transform Your Portfolio Overnight !

·

5 min read

·

Jan 8

170

3

Lists

Modern Marketing52 stories

Modern Marketing52 stories

·

368

saves

data science and AI39 stories

·

43

saves

My Kind Of Medium (All-Time Faves)58 stories

My Kind Of Medium (All-Time Faves)58 stories

·

184

saves

Generative AI Recommended Reading52 stories

Generative AI Recommended Reading52 stories

·

623

saves

0xAnn

0xAnn

in

Crypto 24/7

What we know about Bitcoin ETFs so far

It’s finally here, so how is the first impression?

·

5 min read

·

5 days ago

94

3 Arthur Hayes

Arthur Hayes

Signposts

(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor…

12 min read

·

Jan 5

1K

4

Crypto Rookies

Crypto Rookies

Bitcoin versus Gold ETF

Abstract

8 min read

·

6 days ago

64

Shawn Forno

Shawn Forno

in

The Startup

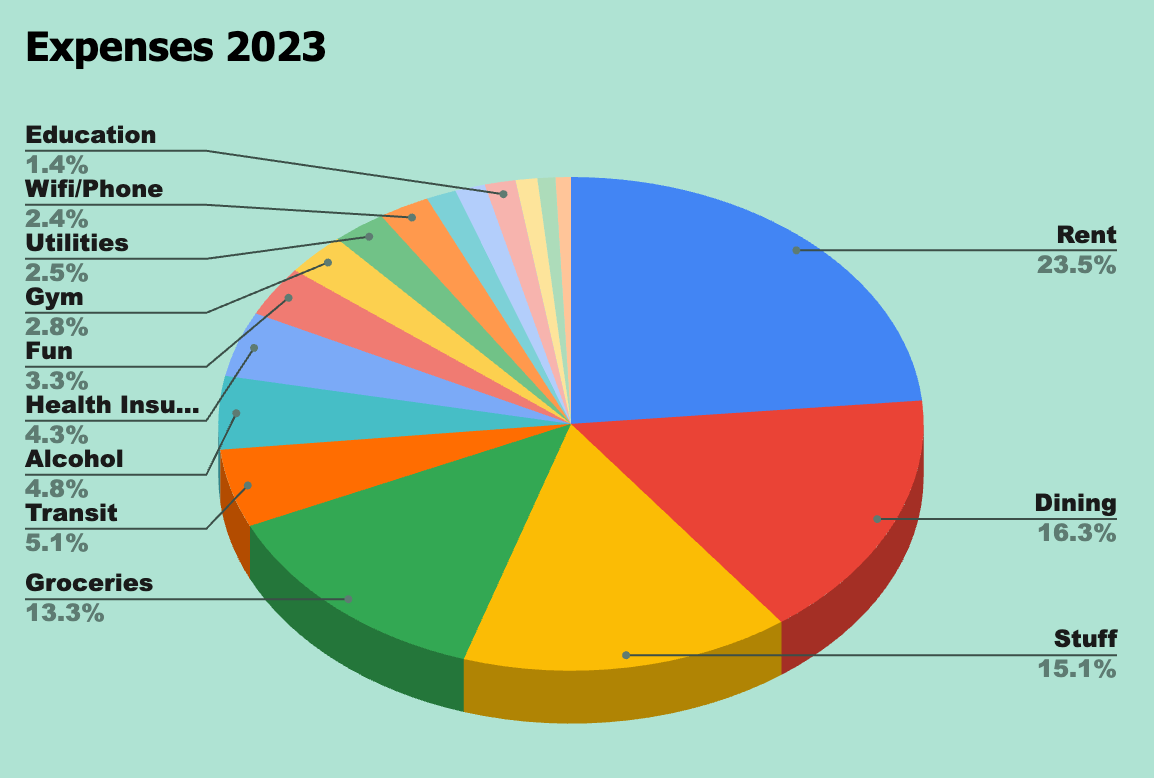

Here’s Exactly How Much it Costs to Live in Spain for One Year

An honest look at our average monthly expenses in Galicia, Spain

·

12 min read

·

Jan 6

2.6K

49

![RichBeak News [EN]:How options expiration will affect BTC and ETHA large number of bitcoin (BTC)](https://cdn.bulbapp.io/frontend/images/e128f363-f0c0-413d-a2da-4e9ba9c1e258/1)