Can Cryptocurrency Revolutionize Money Transfers?

Deep Dive: Can Cryptocurrency Revolutionize Money Transfers?

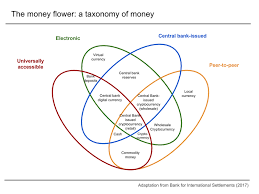

A cryptocurrency, crypto-currency, or crypto[a] is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it.[2]

Individual coin ownership records are stored in a digital ledger, which is a computerized database using strong cryptography to secure transaction records, control the creation of additional coins, and verify the transfer of coin ownership.[3][4][5] Despite the term that has come to describe many of the fungible blockchain tokens that have been created, cryptocurrencies are not considered to be currencies in the traditional sense, and varying legal treatments have been applied to them in various jurisdicitons, including classification as commodities, securities, and currencies, cryptocurrencies are generally viewed as a distinct asset class in practice.[6][7][8] Some crypto schemes use validators to maintain the cryptocurrency. In a proof-of-stake model, owners put up their tokens as collateral. In return, they get authority over the token in proportion to the amount they stake. Generally, these token stakers get additional ownership in the token over time via network fees, newly minted tokens, or other such reward mechanisms.[9]

Cryptocurrency does not exist in physical form (like paper money) and is typically not issued by a central authority. Cryptocurrencies typically use decentralized control as opposed to a central bank digital currency (CBDC).[10] When a cryptocurrency is minted, created prior to issuance, or issued by a single issuer, it is generally considered centralized. When implemented with decentralized control, each cryptocurrency works through distributed ledger technology, typically a blockchain, that serves as a public financial transaction database.[11]

The first cryptocurrency was Bitcoin, which was first released as open-source software in 2009. As of June 2023, there were more than 25,000 other cryptocurrencies in the marketplace, of which more than 40 had a market capitalization exceeding $1 billion.[12] Throughout their existence, cryptocurrencies have been involved in criminal activities and multi-billion-dollar fraud schemes. Some economists and investors, such as Warren Buffett, considered cryptocurrencies to be a speculative bubble.

Speed Demon: Traditional bank transfers can feel like watching paint dry. International transfers, with their reliance on multiple banks and currency conversions, can take days. Cryptocurrencies, on the other hand, are lightning-fast. Blockchain technology, the secure digital ledger that underpins crypto, verifies transactions almost instantly. This makes sending money across borders as quick as sending an email. Imagine sending funds to your family in another country and they have it within minutes, ready to use.

Financial Inclusion Revolution: There are millions of people around the world who lack access to traditional banking systems. Cryptocurrencies offer a lifeline. Anyone with a smartphone and internet connection can hold and transfer crypto, bypassing the need for a bank account. This opens doors for the unbanked and underbanked, promoting financial inclusion on a global scale. Imagine a small business owner in a developing country being able to receive payments from international clients instantly and securely.

Volatility's Shadow: While speed and cost savings are attractive, there's a catch: cryptocurrency volatility. The value of cryptocurrencies can fluctuate wildly, meaning the money you send might be worth less when it arrives. This uncertainty can be a major drawback, especially for large transactions. Imagine sending money for a critical medical procedure overseas and the value of the cryptocurrency dips before it reaches its destination.

Security Concerns: The cryptocurrency space is still young, and security breaches have happened. Hacking and scams can threaten your hard-earned crypto. Unlike traditional banks with robust security measures, cryptocurrency wallets might require a higher level of technical expertise to keep them safe.

The Road Ahead

Cryptocurrency holds immense potential to revolutionize money transfers. Faster speeds, lower fees, and financial inclusion are all within reach. However, volatility, regulations, and security concerns need to be addressed. As the technology matures, regulations become clearer, and security measures improve, crypto transfers could become a mainstream option.

The takeaway? Cryptocurrencies are shaking things up in the money transfer world. They offer exciting possibilities, but it's important to be aware of the challenges before diving in. Do your research, understand the risks, and only invest what you can afford to lose. The future of money transfers might just be cryptographic.

References

- ^ Pagliery, Jose (2014). Bitcoin: And the Future of Money. Triumph Books. ISBN 978-1629370361. Archived from the original on 21 January 2018. Retrieved 20 January 2018.

- ^ Milutinović, Monia (2018). "Cryptocurrency". Ekonomika. 64 (1): 105–122. doi:10.5937/ekonomika1801105M. ISSN 0350-137X. Archived from the original on 16 April 2022. Retrieved 18 April 2022.

- ^ Jump up to:

- a b Andy Greenberg (20 April 2011). "Crypto Currency". Forbes. Archived from the original on 31 August 2014. Retrieved 8 August 2014.

- ^ Polansek, Tom (2 May 2016). "CME, ICE prepare pricing data that could boost bitcoin". Reuters. Archived from the original on 23 April 2022. Retrieved 3 May 2016.

- ^ Pernice, Ingolf G. A.; Scott, Brett (20 May 2021). "Cryptocurrency". Internet Policy Review. 10 (2). doi:10.14763/2021.2.1561. ISSN 2197-6775. Archived from the original on 23 October 2021. Retrieved 23 October 2021.

- ^ "Bitcoin not a currency says Japan government". BBC News. 7 March 2014. Archived from the original on 25 January 2022. Retrieved 25 January 2022.

- ^ "Is it a currency? A commodity? Bitcoin has an identity crisis". Reuters. 3 March 2020. Archived from the original on 25 January 2022. Retrieved 25 January 2022.