Bitcoin climbs above $60k after US labor market report

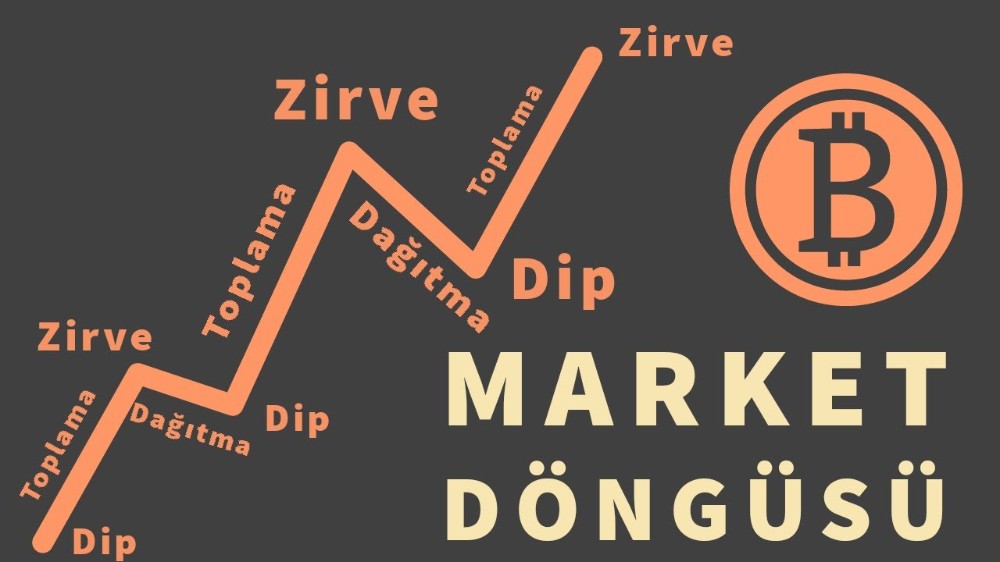

The cryptocurrency market, particularly Bitcoin (BTC), is known for its volatility, often reacting swiftly to major economic news. This article explores the recent rise in Bitcoin's price following the release of the U.S. jobs report and delves into the factors influencing this shift.

The cryptocurrency market, particularly Bitcoin (BTC), is known for its volatility, often reacting swiftly to major economic news. This article explores the recent rise in Bitcoin's price following the release of the U.S. jobs report and delves into the factors influencing this shift.

U.S. Jobs Report Triggers Shift in Fed Rate Cut Expectations

The turning point for Bitcoin's price surge appears to be the release of the U.S. jobs report. This report plays a crucial role in shaping investor expectations regarding the Federal Reserve's monetary policy, particularly its key interest rate.

Prior to the report, the market anticipated a single rate cut in November 2024. However, the data revealed a scenario that has led to a revision in these expectations.

The report seemingly suggests that a more aggressive approach from the Fed might be necessary. Analysts are now predicting two potential rate cuts of 0.25% each, with the first one happening in September instead of November.

Bitcoin Soars on Reduced Rate Hike Fears

The revised outlook on the Fed's key rate proved to be positive news for Bitcoin and the broader risk market. Bitcoin's price jumped by over 4% following the release of the jobs report and continued its upward climb towards the $62,000 mark, as per CoinMarketCap data.

This price increase can be attributed to a few key factors:

Reduced fears of aggressive interest rate hikes

When the Fed raises interest rates, it generally leads to a stronger dollar. This, in turn, can put downward pressure on riskier assets like cryptocurrency. With the prospect of a single rate cut in November replaced by two potential cuts starting in September, investors likely felt a sense of relief.

Increased risk appetite

The revised Fed rate cut expectations boosted overall risk appetite in global markets. This means investors became more comfortable investing in assets with higher potential returns but also higher risk, like Bitcoin.

Shifting investor sentiment

The release of the U.S. labor market report appears to have triggered a renewed wave of discussions surrounding Bitcoin. Santiment analysts point to a surge in the use of the hashtag #buythedip and mentions of BTC on social media. This indicates a potential polarization among traders, with some seeing a buying opportunity and others remaining cautious.

The rise in the cryptocurrency fear and greed index from the "fear" zone to the "neutral" zone further supports the idea of a shift in investor sentiment. However, it's important to note that "neutral" still represents a degree of uncertainty, highlighting the ongoing debate about the future trajectory of Bitcoin's price.

Looking Ahead: May 15th Consumer Price Index Report as the Next Key Hurdle

While the U.S. jobs report has caused a positive stir in the Bitcoin market, the road ahead remains paved with potential uncertainties. Bloomberg analysts highlight that the next major data point for investors will be the release of the consumer price dynamics report on May 15th.

This report will provide crucial information about inflation in the U.S. economy. Inflationary pressures are a major concern for the Fed, as they can erode the purchasing power of the dollar. If the May 15th report indicates higher-than-expected inflation, it could lead the Fed to reconsider its rate cut plans, potentially impacting Bitcoin's price negatively.

Conclusion

The recent rise in Bitcoin's price showcases the cryptocurrency's sensitivity to major economic news, particularly those related to the Fed's monetary policy. The revised U.S. jobs report sparked a wave of optimism in the market, leading to a surge in investor risk appetite and a subsequent rise in Bitcoin's value.

However, the outlook remains uncertain. The upcoming consumer price dynamics report and the Fed's eventual response will likely play a significant role in shaping the future trajectory of Bitcoin's price. Investors should closely monitor these developments and conduct thorough research before making any investment decisions.

In essence, the dance between Bitcoin and the broader market continues. While the recent U.S. jobs report offered a temporary reprieve, long-term price movements will depend on a complex interplay between macroeconomic factors and investor sentiment.