GBTC has a positive cash day for the first time, Bitcoin ETFs attract 380 million USD inflow

Bitcoin has recovered strongly in the past 12 hours to the $63,500 mark thanks to the return of buying power from Bitcoin spot ETFs.

Price fluctuations of leading cryptocurrencies on the market at 08:50 AM on May 4, 2024

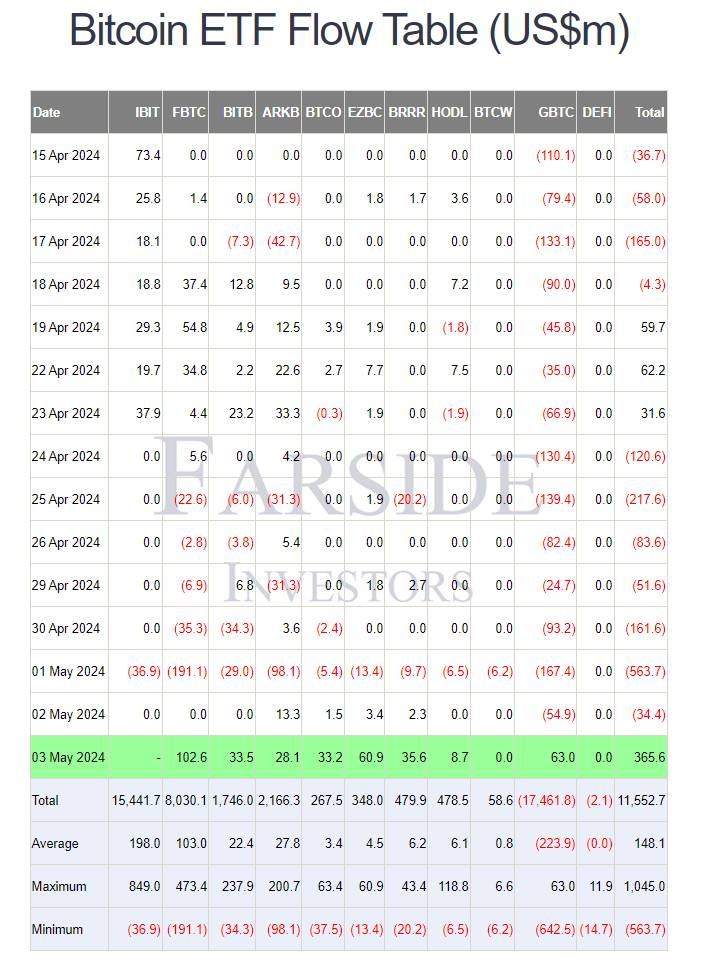

According to preliminary statistics, 11 Bitcoin spot ETFs on Wall Street had a prosperous trading day on May 3 (US time), breaking the previous 7-day consecutive outflow streak.

Specifically, the inflow of Bitcoin ETFs last day was up to nearly 380 million USD, led by Fidelity's FBTC fund with 102 million USD.

Inflow/outflow data of Bitcoin spot ETFs on May 4, 2024. Source: Farside Investors

Notably, this is also the first day after 78 trading sessions since the Bitcoin spot ETF was approved that Grayscale's GBTC fund had positive inflows. Previously, GBTC recorded a capital outflow of up to 17.4 billion USD, with an average of 224 million USD per day over the past 3 months.

The remaining ETF funds also "changed their clothes" to green after a long "red" week. Although BlackRock's IBIT is no longer the "leader" with an inflow of only 13 million USD, it is still the fund with the best performance with only one outflow day ever on May 1. Other funds also have inflows ranging from 8 to 60 million USD, making this possibly the first day that all 11 Bitcoin spot ETFs have no outflows.

Thanks to the above positive news, Bitcoin price in the past 12 hours has recovered from 58,500 USD to 63,600 USD, regaining all of what was lost in the dump from April 30 to May 1. Previously, because Bitcoin ETFs recorded more than half a billion USD outflow within 24 hours, the world's largest cryptocurrency dropped from 60,100 USD to 56,600 USD - the lowest price since the end of February.

1h chart of the BTC/USDT pair on Binance at 08:50 AM on May 4, 2024

Another important information that many people may overlook is the buying power coming from Hong Kong crypto ETFs. Although they have only been trading for a few days and with a volume of only a few tens of millions of USD per day, which is not too impressive, the issuers of these funds have already purchased a large amount of crypto to prepare for investor demand. East Asia region, with an estimated inflow value between 210 - 290 million USD in the form of BTC and ETH.

However, BTC's prospects have not improved as it has just lost a streak of 7 consecutive months of growth, and is expected to face many difficulties with the "Sell in May" mentality of investors.

Other altcoins on the market have increased from 3 to 10% in the past 24 hours. Ethereum (ETH) recovered slightly to the price range of 3,100 USD after previously falling to 2,817 USD.

1h chart of the ETH/USDT pair on Binance at 08:50 AM on May 4, 2024

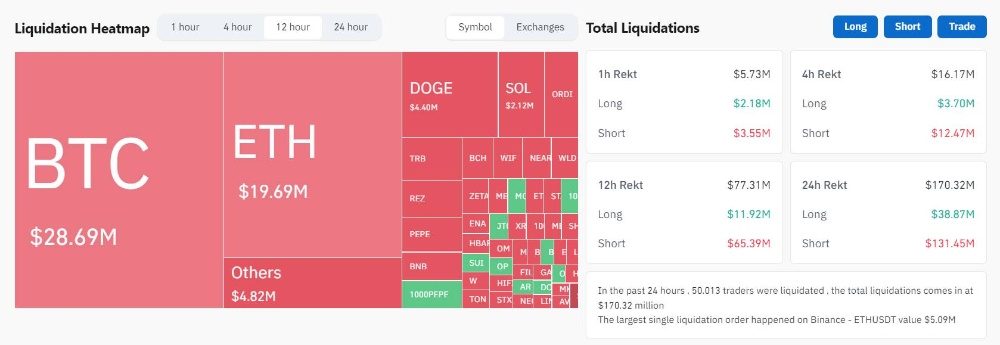

The total liquidation value in the derivatives market in the last 12 hours reached 77 million USD, with 86% being short. This number in the 24-hour frame is 170 million USD liquidated and 77.7% short, respectively.

The fact that the price recovered clearly but did not have massive liquidation value like previous increases and decreases shows that investors in the market are not overusing trading strategies that apply leverage.