Navigating the Crypto Market: Technical vs. Fundamental Analysis

In the ever-evolving landscape of cryptocurrency investment, understanding how to analyze the market is crucial for making informed decisions. Two primary methodologies dominate this space: technical analysis (TA) and fundamental analysis (FA). Each approach offers unique insights into the market dynamics and can be valuable tools for traders and investors alike.

Technical Analysis (TA)

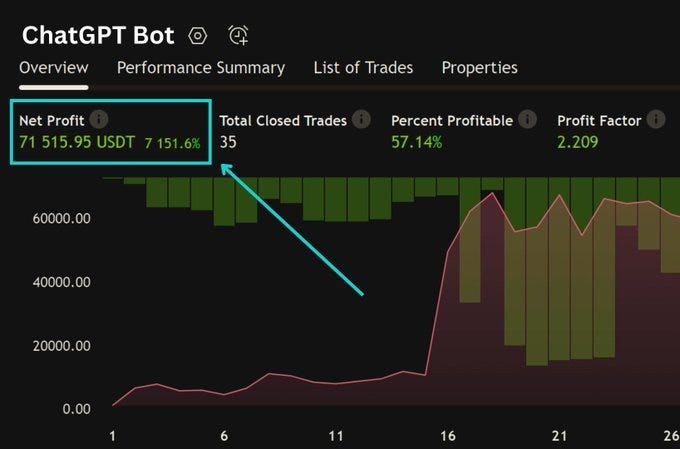

Technical analysis relies on historical price and volume data to predict future price movements. It revolves around the belief that market trends, patterns, and indicators repeat themselves over time. TA enthusiasts often utilize charts and statistical tools to identify patterns, such as support and resistance levels, trendlines, and chart formations.

Key components of technical analysis include:

1. Chart Patterns: These patterns, like head and shoulders, triangles, and flags, are used to predict future price movements based on past behavior.

3. Support and Resistance Levels: These are price levels where a cryptocurrency tends to find buying (support) or selling (resistance) pressure. Identifying these levels can help traders make decisions about entry and exit points.

Fundamental Analysis (FA)

Fundamental analysis, on the other hand, evaluates the intrinsic value of a cryptocurrency by examining factors external to price and volume data. This approach focuses on the underlying technology, project team, adoption rate, regulatory environment, and market demand.

Key components of fundamental analysis include:

1. Technology and Use Case: Evaluating the technology behind a cryptocurrency project and its real-world applications. Projects with innovative technology and strong use cases may have long-term viability.

2. Team and Community: Assessing the competency and experience of the project's development team, as well as the level of community support and engagement.

3. Market Adoption and Partnerships: Analyzing the adoption rate of the cryptocurrency, partnerships with other companies or organizations, and integration into existing systems.

The Debate: Technical vs. Fundamental Analysis

Proponents of technical analysis argue that price movements reflect all available information and that patterns and indicators can provide valuable insights into market sentiment and future price direction. They believe that by studying historical price data, they can anticipate future price movements and make profitable trades.

Conclusion:

In reality, both technical and fundamental analysis have their strengths and limitations, and many traders use a combination of both approaches to inform their decisions. Technical analysis can be useful for short-term trading and identifying entry and exit points, while fundamental analysis provides insights into the long-term viability of a cryptocurrency project.

Ultimately, successful cryptocurrency investment requires a deep understanding of market dynamics, risk management strategies, and a willingness to adapt to changing conditions. By incorporating both technical and fundamental analysis into their toolkit, investors can navigate the crypto market with greater confidence and agility.