Safeguarding Your Investments: Effective Strategies to Protect Yourself from Crypto Fraud

Introduction:

With the growing popularity of cryptocurrencies, the risk of falling victim to fraud and scams has also increased. From phishing attacks to Ponzi schemes, the crypto space is rife with opportunistic actors seeking to exploit unsuspecting investors. In this comprehensive guide, we'll explore various strategies and best practices to help you protect yourself from crypto fraud and safeguard your investments.

1. Educate Yourself:

2. Conduct Thorough Research:

Trading view: https://www.tradingview.com/pricing/?share_your_love=dyvvne

Coingecko: https://www.coingecko.com/account/candy

3. Choose Reputable Exchanges and Wallets:

Selecting reputable cryptocurrency exchanges and wallets is essential for protecting your funds from theft and fraud. Choose exchanges with a proven track record of security and regulatory compliance, and opt for wallets that offer robust security features, such as multi-factor authentication (MFA), cold storage, and encryption.

4. Use Hardware Wallets for Cold Storage:

Consider using hardware wallets for cold storage of your cryptocurrencies, especially if you plan to hold a significant amount of funds for the long term. Hardware wallets store your private keys offline, making them immune to online hacking attempts and malware attacks. Keep your hardware wallet in a secure location and ensure it's backed up properly.

5. Enable Two-Factor Authentication (2FA):

Enable two-factor authentication (2FA) on all your cryptocurrency exchange accounts and wallets to add an extra layer of security. 2FA requires you to provide a second form of verification, such as a one-time code sent to your mobile device or email, in addition to your password, when logging in or conducting transactions.

6. Beware of Phishing Attempts:

Be vigilant against phishing attempts, where fraudsters impersonate legitimate companies or individuals to steal your sensitive information. Never click on suspicious links or download attachments from unsolicited emails, and always verify the authenticity of websites and communication channels before providing any personal or financial information.

7. Keep Your Private Keys Secure:

Your private keys are the keys to your cryptocurrency holdings, and keeping them secure is paramount. Never share your private keys with anyone, and avoid storing them in online accounts or unencrypted files. Consider using a secure password manager or hardware wallet to manage and store your private keys securely.

8. Stay Updated on Security Best Practices:

Stay informed about the latest security best practices and developments in the cryptocurrency space. Follow reputable security blogs, forums, and social media channels to stay updated on emerging threats, security vulnerabilities, and recommended security measures.

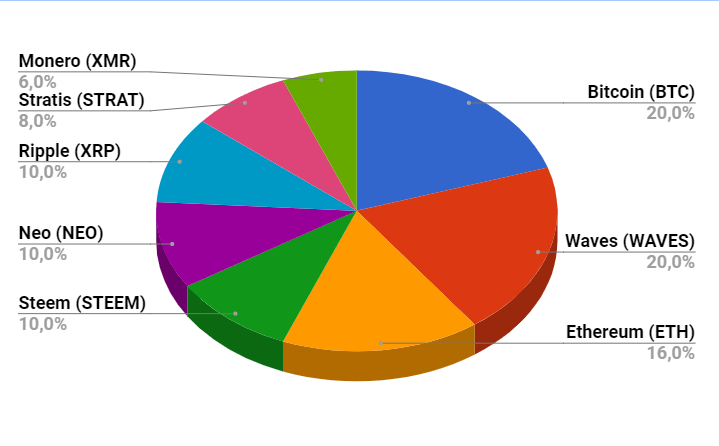

9. Diversify Your Investments:

10. Trust Your Instincts:

Above all, trust your instincts and exercise caution when dealing with unfamiliar or suspicious opportunities. If something sounds too good to be true or raises any doubts or concerns, err on the side of caution and refrain from investing until you've conducted thorough due diligence and verified the legitimacy of the opportunity.

Conclusion:

Protecting yourself from crypto fraud requires diligence, vigilance, and a proactive approach to security. By educating yourself about common scams, conducting thorough research, using reputable exchanges and wallets, and implementing robust security measures, you can significantly reduce the risk of falling victim to fraudulent schemes and safeguard your investments in the cryptocurrency space. Remember, your security and peace of mind are worth far more than any potential gains, so always prioritize safety and security in your crypto endeavors.