DWF Labs accused of market manipulation on Binance

DWF Labs denied that this was baseless information, however, Binance said that their investigation team worked with "integrity" and reported based on evidence.

According to sources from the Wall Street Journal (WSJ), from 2022 - 2023, the Binance exchange hired a team of leading investigators to search for evidence of market manipulation on the exchange.

Notably, the Binance monitoring team discovered that DWF Labs - one of the leading investment funds and market maker (MM) in Web3 projects - was manipulating the price of YGG tokens and at least 6 currencies. other encoding.

Not only that, DWF Labs also had the act of "wash trading" more than 300 million USD in trading volume and selling nearly 5 million tokens of all types during two market recoveries around the above mentioned time period.

To overcome market manipulation, the investigation team asked Binance to issue a trading ban for violating users from the exchange, including DWF Labs' accounts.

After receiving the information, Binance said that the transactions detected by the monitoring team were private and could not constitute price manipulation. In addition, the evidence presented by the monitoring team is not enough to confirm the wrongdoing of DWF Labs.

A week later, Binance announced the dismissal of the Head of the Supervisory Team on the grounds of having a close "off-the-record" relationship with Wintermute - DWF Labs' rival, which had a "war of words" in mid-2023. At the same time, refuse the request to remove the DWF Labs trading account.

Also according to WSJ, one of the biggest successes of the Binance monitoring team is detecting the price manipulation behavior of the TRON Foundation and removing the trading account of the blockchain company founded by Justin Sun - a character who is also in charge. involved in a lawsuit by the SEC on charges of illegal securities offering. The types of securities that the SEC specifically named are the two currencies TRON (TRX) and BitTorrent (BTT) of the TRON system.

In addition, the WSJ report also "revealed" that the monitoring team discovered that Binance had a trading account used to trade a number of cryptocurrencies. When they asked the question "who manages the Binance internal trading account", they did not receive an answer.

WSJ said that the total trading volume of the Binance platform is up to 2/3 of the volume from VIP customer accounts. In particular, DWF Labs is one of the highest-ranking VIP members of the exchange - meaning it owns a trading volume of at least 4 billion USD/month.

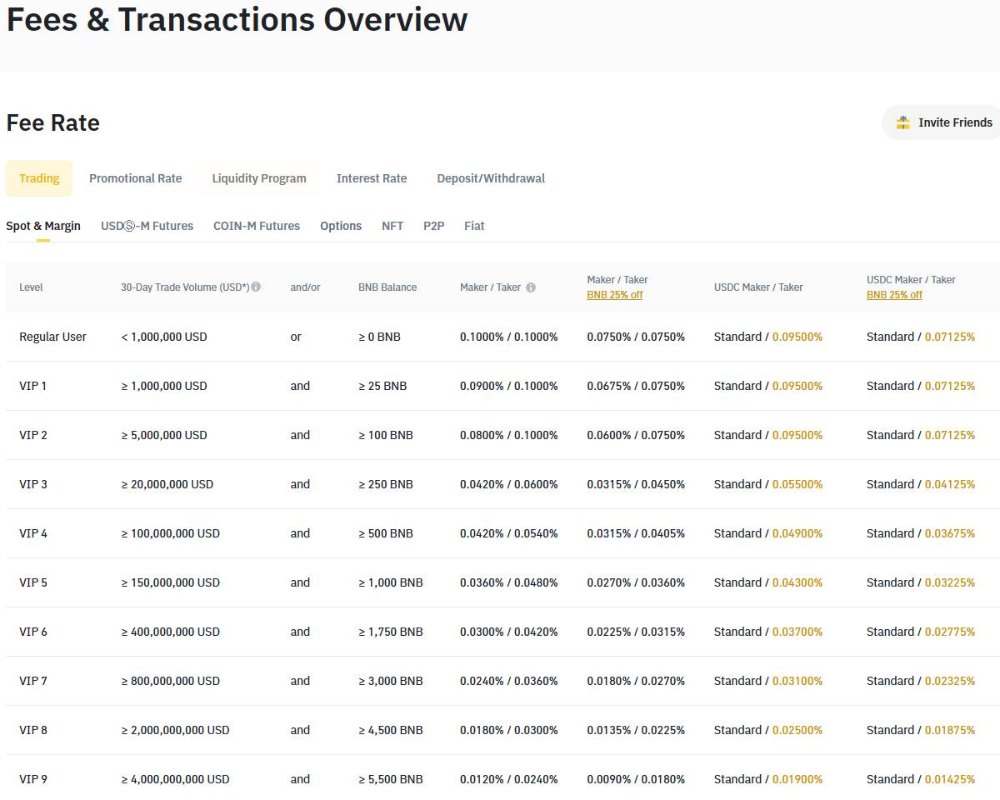

With level 9, Binance VIP accounts will enjoy preferential trading fees from only 0.009 - 0.019% for Spot. Futures transactions will be in the range of 0.0153 - 0.017%, even free of transaction fees.

Transaction fee table by each level for VIP customers on Binance.

Immediately after the news, Binance affirmed that its monitoring program is "integrated", neutral, only reports based on evidence with investigations, and does not tolerate manipulation of market value. with any individual or entity, including market makers.

The exchange wants to ensure there is healthy competition in the cryptocurrency space from MMs, and Binance will always be ready to fight to protect users from manipulation.

In the last 3 years, the exchange has removed nearly 355,000 user accounts with a total trading volume of more than 2,500 billion USD for violating Binance's manipulation terms.

Binance co-founder Yi He also spoke up about the incident, affirming that he strictly monitors the activities of MMs on the exchange and will report dishonest acts to the authorities. Ms. Yi He also implied that there is often fierce competition between market makers and there is no shortage of tricks to "smear" each other in front of the media.

In response to the accusations of "getting their noses" at them, DWF Labs declared that this news is baseless and distorts the truth.

The market maker affirms itself as always operating with the highest standards of transparency and ethics, and is committed to always supporting users and more than 700 partners across the cryptocurrency ecosystem based on this criterion.

However, many members of the cryptocurrency community "opened up" the past statements of DWF Labs fund manager Andrey Grachev, indirectly admitting to having "special strategies to promote transactions for these projects". project without a vibrant trading market".

Allegations of price manipulation have long been a "prominent" issue in the cryptocurrency field, Binance was also involved in a similar incident in 2021. In addition, there are a number of other prominent names in the past may be mentioned as:

· Tether and Bitfinex were sued for market manipulation and concealment of illegal funds.

· Jump Trading was sued for manipulating the price of TerraUSD (UST) to profit 1.3 billion USD.

· Wintermute with accusations of wash trading and "subsidizing" Celsius's CEL token

DWF Labs is an investment fund established by global cryptocurrency trading company Digital Wave Finance (DWF), with offices in many countries such as Singapore, Switzerland, British Virgin Islands, United Arab Emirates United Arab Emirates, Korea and Hong Kong.

DWF Labs focuses on investing in Web3-related companies and projects, providing financial funding, consulting, liquidity, network security, auditing processes for smart contracts and more. Although considered an investment fund in the field of cryptocurrency projects, DWF Labs operates as an OTC trading company. This investment fund often invests in cryptocurrency projects that already have tokens by offering to buy back millions of dollars of their tokens at a discount compared to market value.

On its official website, DWF Labs has stated that regardless of market conditions, DWF Labs will invest in an average of 5 projects per month. In most cases, DWF usually does not participate in specific venture rounds but only invests in projects by purchasing OTC tokens at a discount with a mutual agreement.

According to Grachev - media representative of DWF Labs, talked about 5 areas that the fund focuses on investing, which are: Traditional Finance (TradFi), DeFi, GameFi, CEX and artificial intelligence (AI). Grachev also said that before confirming an investment, DWF Labs will first conduct a physical examination of the project's basic information, and then the analyst will conduct more in-depth due diligence. After comprehensive evaluation, projects with positive results will be invested in by the fund.