The Bull Is Back? Top Cryptos to Buy on Coinbase in 2024

1. Bitcoin (BTC) — $40

2023: 🔼 155.8%

Wait, so after coming out swinging with the bear case for Bitcoin, this idiot is still putting it at #1?

Yup, and lemme tell you why.

As inaugural member of the Fantasy Sports Writer Hall of Fame (but why is that a thing?), all-time highest-grossing actor on a per-movie basis, and personal idol of mine Matthew Berry annually states, the secret to success is “minimizing risk and giving yourself the best odds to win.”

And there is no better option to do that than the king crypto.

The ETF might be a sell-the-news event, and the bull market from this year’s halving might not be in the realm of previous spikes, and the world economy might be so dire that people stack food and ammunition instead of sats.

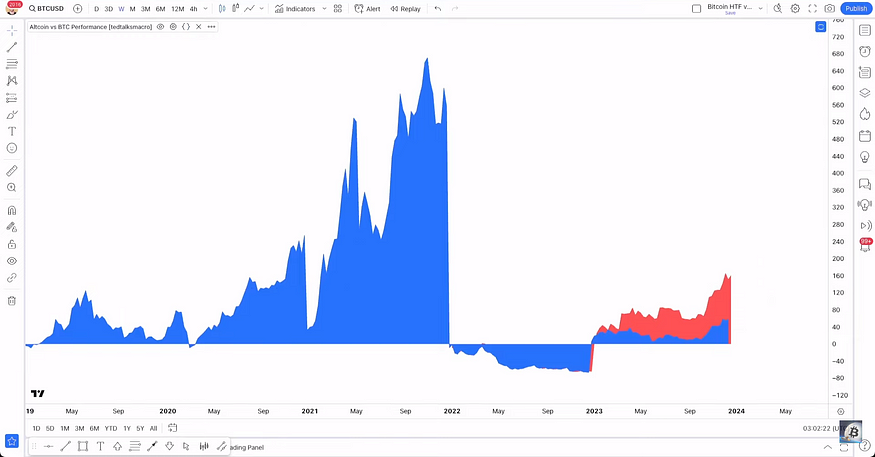

But all the trend lines are pointing in the right direction, and have been all year. As tedtalksmacro noted in a recent video, Bitcoin has outperformed altcoins for all of 2023: Measured by YoY growth, Bitcoin (red) has outperformed altcoins (blue) since basically the beginning of the year. (tedtalksmacro/YouTube)

Measured by YoY growth, Bitcoin (red) has outperformed altcoins (blue) since basically the beginning of the year. (tedtalksmacro/YouTube)

Now, tedtalksmacro posted this as a reason why altcoins were going to “explode in 2024.” I respect his analysis (seriously; “miketalkstedtalksmacro” was on my short list of 𝕏 screenname possibilities), yet why on earth would altcoins pump in ’24 when Bitcoin is kicking the door down to the new year with all the momentum?

And what if the SEC rugpulls everyone and stiffs the BTC ETF?

That would suck for Bitcoin, of course, but it would be terrible for alts, who rely on traders reaping profits from the orange coin to fuel their rockets:

Assuming everything stays as it has, which is dangerous but all we have to go on.

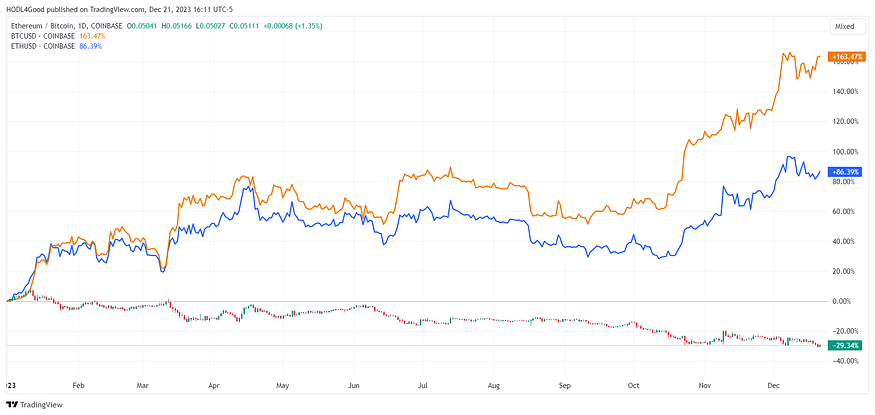

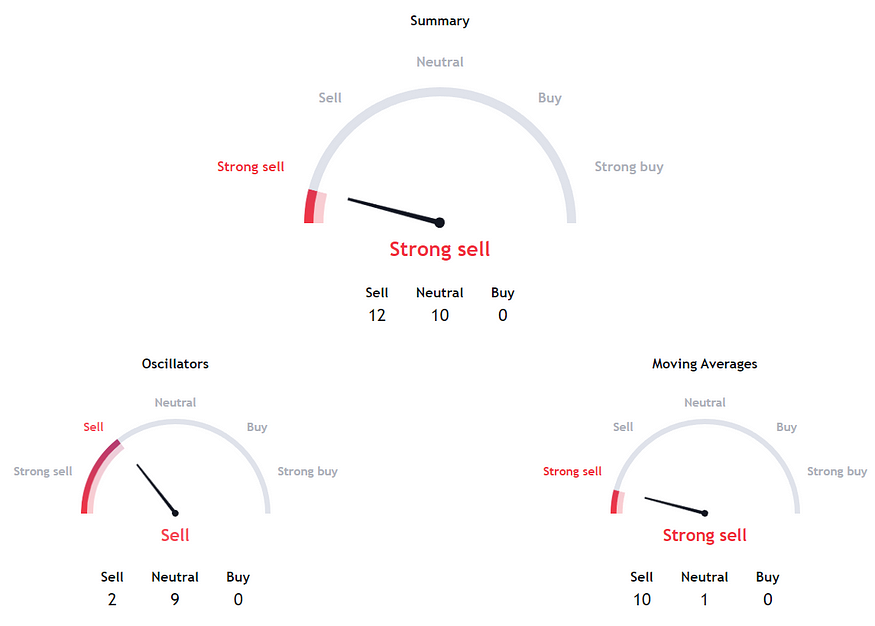

Ask yourself this: Where are we in this cycle? Not in Ethereum, which not only hasn’t flippened Bitcoin, it’s flapped and still flopping: The king vs. the prince. (TradingView)

The king vs. the prince. (TradingView) TradingView technical analysis for ETH/BTC over 1-month timeframe. Looks like my gas tank when I’m waiting for prices to drop.

TradingView technical analysis for ETH/BTC over 1-month timeframe. Looks like my gas tank when I’m waiting for prices to drop.

And if you look at what’s been beating Bitcoin recently, it hasn’t been the diamonds, it’s been the dogsh*t: Bitcoin compared to Dogecoin (yellow) and Shiba Inu (red). You can see the line for Bonk in the night sky somewhere above Uranus. (TradingView)

Bitcoin compared to Dogecoin (yellow) and Shiba Inu (red). You can see the line for Bonk in the night sky somewhere above Uranus. (TradingView)

This is the end of the old cycle and beginning of the new . . . in my opinion.

2024 Price Projection: If you’re pressing me into making a call, I think we clear all-time highs in BTC after the halving and flirt with 100K by the dawn of 2025, where macro events will kick it up to about $160,000 for a tidy little 10x from the bear-market low.

Every other coin on this list has an investable reason why they might outperform Bitcoin. If it doesn’t have one, I’d rather have BTC.

4. Injective Protocol (INJ) — $10

2023: 🔼 2717.3%!

In the immortal yet understated words of Clark W. Griswold, Jr., HALLELUJAH! AND HOLY SH*T! Where’s the Tylenol?

Where’s the Tylenol?

I wish I could claim a bunch of credit for spotting Injective in November 2022 when it was under $2.50, but if I saw this coming I wouldn’t’ve been so timid.I mean, something called “Injective” is inherently a little scary.

If you want to talk narratives, Injective is almost through upgrading its mainnet. They’re already billing themselves as “the fastest layer-1 built for finance,” but the Volan upgrade is practically promising Jesus Christ in a cup:

I’m nowhere near ready; I still have all my Christmas lights up.

But this incredulous run is less about self-aggrandizement and more about simple supply and demand, as seen in INJ’s tokenomics:

According to numbers from DefiLlama, INJ’s current market cap is $2.972 billion, while its fully diluted volume is $3.528B, meaning more than 80% of tokens are already in circulation. Of that, more than $1 billion is staked on-chain. And every week thousands of INJ tokens are burned, further reducing the available supply. Low supply + high demand = 🚀.

2024 Price Projection: Most altcoins typically only get one shot at mooning. LINK did more than a 111x over the two years from May 2019–2021. Polygon (MATIC, 2023: 🔼 28.0%) did twice the work in half the time, launching 206x from Decembers 2020–2021.

Might this be INJ’s turn? Maybe. It might seem dangerous to buy a token that’s up 28x, but if it’s destined for 100x or more, then there’s still 3.5x worth of juice left to squeeze out of that lemon.

Just be careful not to ride it all the way back down.

6. Fetch.ai (FET) — $5 2023: ⬆️ 664.0% “Mean Girls” “Stop trying to make ‘fetch’ happen, it’s not going to happen.” . . . except . . . Throw Throw Burrito “It’s Happening” . . . and I’m LOVIN’ EVERY MINUTE OF IT! AI is still one of the hot narrative plays working these days, both in equities (check NVIDIA, up more than 20% since Nov. 1) and in crypto. Could it just be that simple as picking the one that has “AI” in its name? Well . . . yeah. As ChatGPT explained it to me in February: Fetch.ai is a blockchain platform that aims to advance artificial intelligence (AI) by creating a decentralized digital economy where AI agents can interact with each other and with the world around them. The platform provides a decentralized infrastructure that allows AI agents to securely share data and collaborate to solve complex problems. . . . blah blah blah, can someone translate this to human, please? Okay, fine. Recently, Fetch.ai introduced DeltaV, a search-based AI platform that uses natural language to actually do stuff other than plagiarize term papers. What do I mean by that? Take a look at what it can do thus far: Screenshot of DeltaV chat session with options including “Book a flight,” “Rent a car,” “Check weather,” “Find an EV charging station,” and “Check stock prices” I used to work in the travel reservation industry and this basically eats that job. Seriously, I asked ChatGPT to book me a flight. This is what it said: screenshot of conversation I had with ChatGPT where I asked “Can you book me a flight?” and it replied “I’m sorry, but I cannot book flights or make reservations as I don’t have the capability to access external systems or process transactions. However, I can provide information and assistance on how to book a flight.” And then gave step-by-step instructions on how to book that flight. could have replaced this with “Ask DeltaV.” Let’s check in with what 𝕏 is doing with their AI assistant, Grok: Screenshot of promotional conversation featured on 𝕏 where a user asked Grok who Taylor Swift is dating like there’s any sentient creature in the known universe who doesn’t know they’re dating . . . actually, ChatGPT doesn’t, because its knowledge base only goes up to January 2022 Yep, DeltaV looks like the real deal. My only regret is that I can’t ask DeltaV about itself because I’m not whitelisted. Apparently this press badge is meaningless. I have also been a journalist, so AI is really wrecking me these days. (In case you were wondering: fedora no, trench coat yes.) 2024 Price Projection: I first recommended FET after it tripled in January. It then surged 60% in February, but gave all that back and then some into the summer. Now, if you were lucky enough to catch that bottom, you’ve bagged a triple since then. But if not, don’t sweat it: you’ll get another.