Even When The Market Hurts You… It Helps You

The Rules Haven’t Changed

I often have people contacting me, asking me whether it’s time to sell. This will usually coincide with a significant move in the market… and of course, this has been the case of late. As I have been explaining to investors over the past month or so, this is historically an extremely volatile period. Volatility has a way of introducing an unpredictable element when it comes to the price action of Bitcoin. Historically, we have always seen a correction around the time of the halving.

This cycle appears to be no different, and as a result, we could see Bitcoin move a lot lower before entering into parabolic mode. As I have previously mentioned, the corrections to date are somewhat unimpressive when compared to previous cycles. This is perhaps another gentle warning of further downside. I think there’s a strong chance Bitcoin hits $55K. I wouldn’t write off a quick dip to $50K either. These corrections are often very swift, a final flush before parabolic price action.

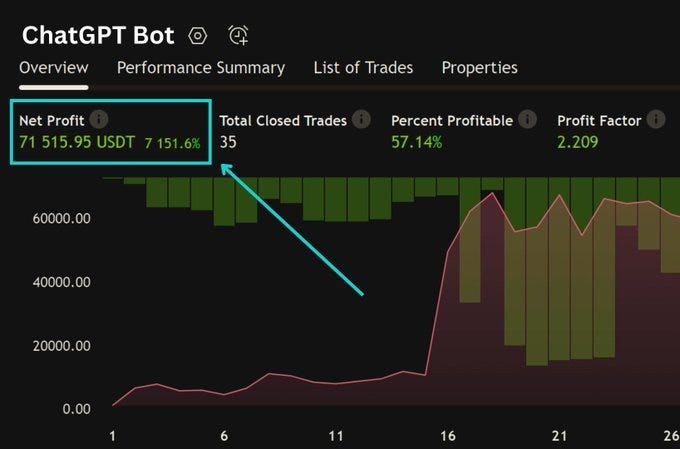

Essentially, within 6 to 8 months, prices will be significantly higher across the board. Trying to map the volatility of this period is an intricate and difficult task, which is why I practice multiple strategies. In this way, a negative move can have a positive outcome. Yes, your portfolio might be down. However, utilizing a strategy to increase coin holdings can be executed in any market.

Movement Is Money

As long as there is volatility, opportunity exists. In fact, a strategy similar to the above-mentioned strategy actually performs better in a collapsing market. Essentially, it’s a case of selling high, or higher, in order to repurchase lower. So, while part of your portfolio is bleeding, another portion can be increasing your coin holdings. This is why I have always advocated a multi-faceted approach to Crypto.

As an investor, or Crypto enthusiast, you need to have a strategy for every season, as well as any scenario the market decides to throw at you. The market enjoys being irrational, especially when you least expect it. You have to have a few aces up your sleeve, if you are to prevail. Even though this correction has hit altcoins hard, it is making accumulation a lot easier, especially for my latest goal.

As I mentioned recently, accumulation becomes increasingly difficult as valuations begin to rise. Many alts are currently offering a 40% discount, which is an amazing opportunity, especially if you have a long-term view. In hindsight, this correction will be seen as one of the few really lucrative buying opportunities prior to “Full Bull” mode. Unfortunately, many miss out on these opportunities due to fear.

It’s usually committed investors who take advantage of these opportunities. Time and dedication have taught them that it’s opportunities like these that can make a portfolio, regardless of the size. I for one, am truly grateful for this opportunity, and wouldn’t mind a dip to $55K. Speculators looking to make a quick buck might not share my enthusiasm. However, it’s the long-term committed play that usually yields the greatest fruit.

Final Thoughts

If, during this dip, the market is only hurting you, it’s time to improvise. It doesn’t have to be an exclusively negative experience. After all, the losses incurred during this downturn will be erased and replaced with gains within a matter of months, if we are to rely on historical data and the built-in monetary policy of Bitcoin, and the effect it has on the price action going forward.

Even though there are those who refute the halving effect, a 450 BTC daily reduction is still very much a big deal, especially if ETF purchases continue to grow, or even, remain steady. Furthermore, retail is only beginning to enter the market. These are, however, my thoughts and should not be construed as investment advice. Enjoy the ride and I will see you next time!

Disclaimer

First of all, I am not a financial advisor. All information provided on this website is strictly my own opinion and not financial advice. I do make use of affiliate links. Purchasing or interacting with any third-party company could result in me receiving a commission. In some instances, utilizing an affiliate link can also result in a bonus or discount.

This article was first published on Sapphire Crypto.

- Earn yield on your BTC, ETH & stablecoins - https://shorturl.at/uyLT0

- Tokenized real estate / $20 Voucher - https://shorturl.at/joEN5

- Purchase R500 Crypto = Free R200 BTC - https://shorturl.at/dmyC9

- Earn free ETH & OP reading & creating - https://shorturl.at/JPW58

- Earn HIVE & HE tokens reading/creating - https://shorturl.at/fBHPX

- Earn free SLCL (SPL) reading/creating - https://shorturl.at/quvP3

- Trade & buy altcoins & micro-caps - https://shorturl.at/atuMS

- Trade Crypto assets & futures - https://shorturl.at/uwSY3

- Earn passive income - https://shorturl.at/gxCIP

- Earn passive BTC - https://shorturl.at/fgEK2

- Free BTC every hour - https://shorturl.at/beinD

- Free BTC & DOGE - https://shorturl.at/dfiK1

- More passive BTC - https://shorturl.at/ahjI1

- Trade & buy altcoin gems - https://shorturl.at/yDENP