Can NFT AMM build a new Rainbow Bridge to Asgard?

Foresight Ventures: Can NFT AMM build a new Rainbow Bridge to Asgard?

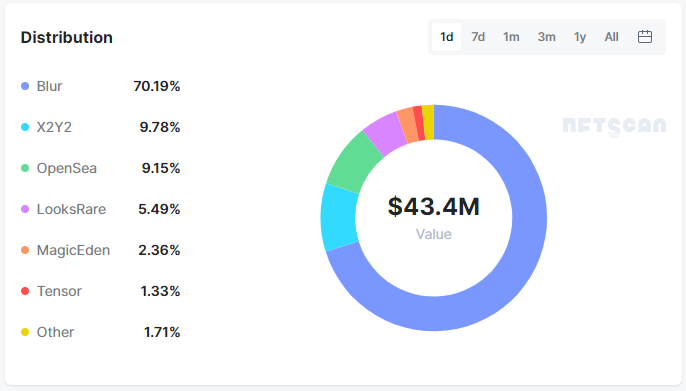

The walls around Asgard are as solid as a rock, and the emergence of Defi has opened up a rainbow bridge directly to Asgard, where liquidity has been fully unleashed. All of the NFT trading platforms are dedicated to creating innovative trading models for better trading experiences with sufficient liquidity. Although a unified pricing model has not yet emerged in the current NFT market, blue chip NFTs trading volume shows that the order book model marketplaces account for more than 95% of the trading volume, while the various marketplaces based on AMM models account for less than 5%.

The walls around Asgard are as solid as a rock, and the emergence of Defi has opened up a rainbow bridge directly to Asgard, where liquidity has been fully unleashed. All of the NFT trading platforms are dedicated to creating innovative trading models for better trading experiences with sufficient liquidity. Although a unified pricing model has not yet emerged in the current NFT market, blue chip NFTs trading volume shows that the order book model marketplaces account for more than 95% of the trading volume, while the various marketplaces based on AMM models account for less than 5%. Platform trading volume ratio, Resource: https://www.nftscan.com/marketplace, June 27, 2023

Platform trading volume ratio, Resource: https://www.nftscan.com/marketplace, June 27, 2023

Referring to the ratio of CEX and DEX trading volumes of Fungible Tokens (FT), we are very optimistic about the huge potential for growth in NFT trading volumes based on the AMM trading model. However, unlike FT, many factors such as the variety of NFTs, pricing model, and trading practice, determine that only a portion of NFTs are suitable for AMM to solve liquidity problems. Based on functionality, NFTs can be divided into the following four categories: Pictures and Arts (PFP) / Virtual Assets (Land/Game Equipment: Call options) / On-chain Assets (RWA) / On-chain Identity (Domain Names/Tickets, etc.). Based on their issuance and the needs of holders, PFP and virtual asset NFTs are more suitable for the AMM trading model at present.

Why are we long-term optimistic about the NFT-AMM?

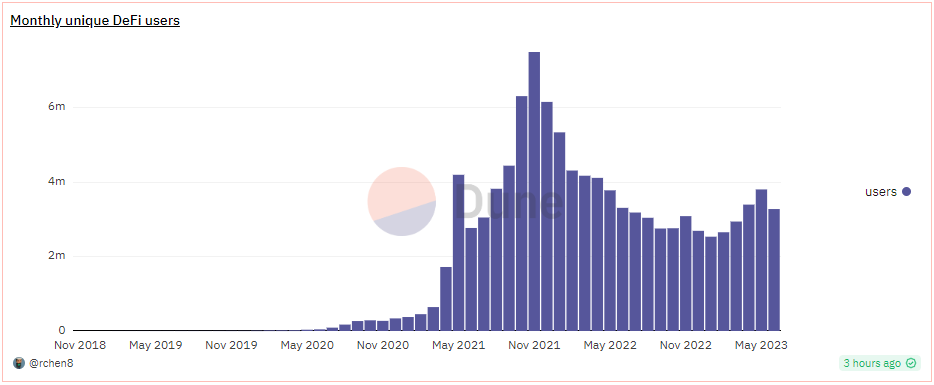

There is a large potential user base. Looking at the whole on-chain ecology, Defi users are potential users of the NFT-AMM track. Currently, the average monthly active users of the Defi ecosystem are about 1 million, while the number of independent traders in NFT is only about 200,000. Through the NFT-AMM trading model, the scope of users participating in providing liquidity can be expanded to not only native NFT holders but also all the participants in the Defi ecosystem. Monthly Defi Users, Resource: https://dune.com/rchen8/Defi-users-over-time, 27th, June 2023

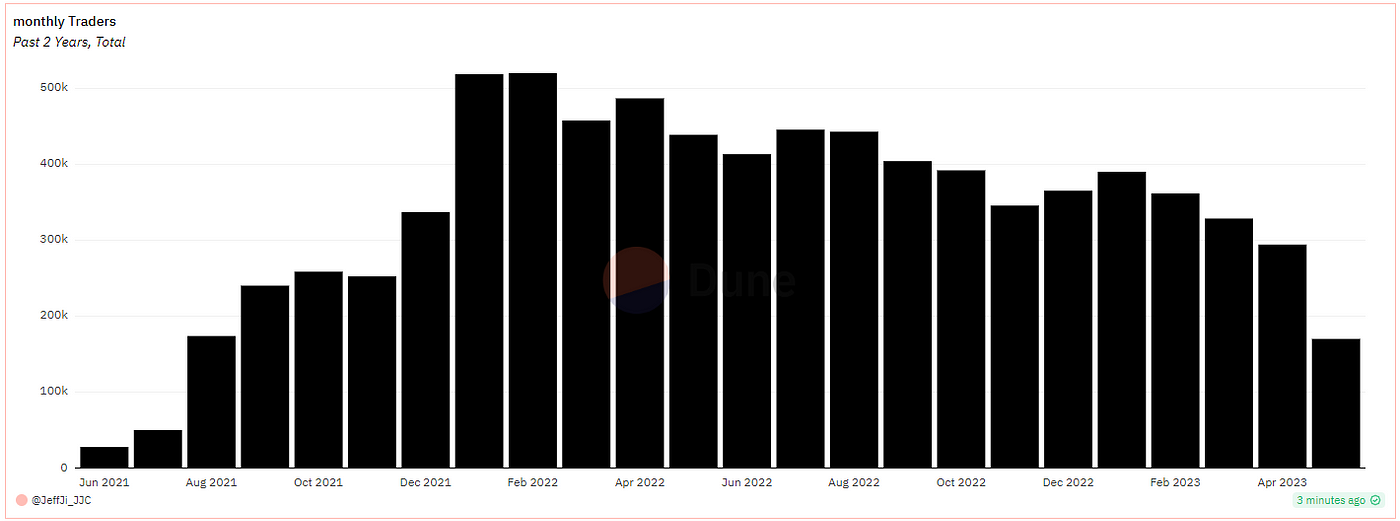

Monthly Defi Users, Resource: https://dune.com/rchen8/Defi-users-over-time, 27th, June 2023 Monthly NFT Traders, Resource: https://dune.com/queries/2670914/4440079, 27th, June 2023

Monthly NFT Traders, Resource: https://dune.com/queries/2670914/4440079, 27th, June 2023

There is enormous potential for growth in the types and quantities of NFT assets. NFTs are still continuously evolving in functionality and combinability, and there is significant potential for user growth. In May 2023, almost all of the transactions on Opensea came from the Top 100 NFTs, while it was only 65% in February 2022 (https://dune.com/mizmatcat/OpenSea). In addition, the asset-based NFTs of AAA games will also peak in 2023–2024, providing ample space for the active trading of NFTs.

The NFT-AMM can be the bridge between NFT assets and FT assets. Similar to Defi protocols, its innovative space for combinability represents its growth ceiling. Before the rise of Defi, the liquidity of FT assets could only be limited to centralized exchanges. AMM tools, represented by Curve/Uniswap, have liberated the activity of on-chain assets, while also gaining new value. Similarly, NFT assets need to achieve new value through AMM tools and create new pricing models. We envision that the NFT AMM model can innovate in the following directions:

- Combination with derivatives: NFT derivatives are also a sub-field where innovation is concentrated. In the article “IOSG Weekly Brief|From Commodity Speculation to Financial Speculation: The Symbolic Game of NFT Derivatives #174”, the author Sally divided trading demand into the following categories: speculation (earning returns from NFT price fluctuations with small funds), income leverage (increasing capital utilization with leverage), hedging risk, diversifying and standardizing investment portfolios. Driven by many market demands, by creating a leveraged speculative market, the NFT-AMM trading model can create dynamic games within the liquidity pool, on-chain data of capital flowing will thereby make the gambling space expand. We expect that the NFT-AMM trading model may create new NFT pricing models by combining them with derivatives.

- Combination with collateral lending platforms: Collateral lending platforms, led by BendDAO/Paraspace, are still using models that collateralize NFT assets and calculate borrowing amounts through floor prices. Even with the addition of Blur, the competitive landscape has not significantly changed. We look forward to seeing after the NFT-AMM model receives market and capital support, the use of LP tokens as a new type of interest-bearing, collateralizable, and liquid asset proof. By mobilizing the liquidity of LP tokens, it can change the existing structure of the collateral lending market and attract players who do not hold NFTs to enter the game by injecting liquidity.

- NFT-AMM trading mode can help project teams reduce liquidity management costs. Specifically, for game NFTs, if they simply adopt the Order Book trading model, project teams have to spend a lot of effort focusing on floor prices, and liquidity cannot be automatically managed. We expect that in the NFT-AMM model, project parties can inject corresponding assets into the pool, thereby being able to dynamically and massively adjust NFT liquidity strategies.

In the existing AMM market layout, many platforms are making attempts in different directions. Here we illustrate the highlights and corresponding problems of existing products on the market with a few examples.

- NFTX, which uses NFT fragmentation as the basis for trading, was one of the early platforms to introduce the AMM model to NFT trading.

- They hope to use fragmented NFT tokens as a type of asset in the liquidity pool. Users can inject assets such as ETH to pair with it, and then get trading pairs. This is a bold innovation that quickly gained market attention. However, as the variety of NFTs increased, users began to find that this trading model could only increase the price fluctuation of NFTs but lost the most important attribute of scarcity. Better liquidity was achieved at the expense of collection value. They gradually lose the market.

- On the basis of Uniswap V1, Sudoswap attempted to bring Uni-V3 to the NFT-AMM market.

- Sudoswap tries to bring the Uni-V3 mechanism into the NFT liquidity market and innovatively proposes diversified curves suitable for NFT trading to meet different user needs. Users can create liquidity pools in densely traded price ranges (usually near the floor price) to improve capital efficiency. The initial liquidity of the pool can only be determined by the creator, and only the creator can provide liquidity into the pool. Thus, we can see on the price curve that Sudoswap has created many sub-liquidity pools according to the optimal transaction price. The number and depth of sub-pools corresponding to each price range also vary, and the liquidity between pools is not interchangeable.

- Midaswap is using Trader Joe V2’s Liquidity Book model.

- Users can choose the price range to provide liquidity in Midaswap. Since the price is fixed in each Bin, under this model all LPs’ trading pair positions are aggregated into the same liquidity pool, thereby increasing the depth of the liquidity pool. And LPs only need to add liquidity on one side to obtain ERC721 LP tokens as liquidity vouchers. By cleverly using the token id of ERC721 LP token to lock the NFT liquidity added by LPs in the liquidity pool, two innovative functions can be implemented, which aggregates NFT liquidity in a pool without losing the original scarcity attribute of NFT, compatible with the advantages of NFTX and Sudoswap. At the same time, Midaswap is exploring the combination of LP tokens with NFT lending protocols across platforms to achieve cross-platform collateral lending or Liquidity Mining according to project needs.

Amid the innovations of the products mentioned above, users will provide market feedback with on-chain data. We think that some issues are not fully resolved, although there has been a significant improvement compared to the monotonous market a year ago. Below are some points that still need improvement.

- The problem of liquidity fragmentation due to the isolation of liquidity pools is particularly prominent in NFT trading. In the AMM design of the above platforms, the liquidity pools of the same series of NFTs are made up of multiple trading pools, most of which are centered around the floor price. This leads to a lack of connectivity between the liquidity of various trading pools. When prices fluctuate or oracles are attacked, each independent liquidity pool could be penetrated. Because liquidity and trading depth are only improved near floor price, users can only trade within small pools, so this model can’t handle mass-selling/buying.

- The floor price still directly affects the price range of the liquidity pool in the trading model, and no new pricing model can be formed. Discrete liquidity causes LPs to only reference the market’s floor price when creating a liquidity pool. The pool can only passively track the floor price of the Order Book platform, missing the opportunity to become a new pricing model.

- Similar to the above problem, when the price range of the trading pool is overly dependent on the floor price, the trading pool is susceptible to manipulation attacks. Because the trading pools are not connected, the price is vulnerable to attack when large buy/sell orders appear, leading to confusion in the trading bot strategies within the platform.

- The asset pool lacks diversity, leading to room for improvement in combinability. The purpose of introducing the AMM model is to bring more on-chain assets into the trading pool, thereby stimulating greater trading demand. However, the existing AMM models can only use ETH or other ecosystem assets as trading pairs, losing the possibility for other assets to enter the NFT trading market as LPs.

Having summarized the above problems and market pain points, we predict that future popular NFT-AMM projects should have the following characteristics or effectively solve the following problems:

- Accommodate more asset categories and users. Users who do not hold NFTs can also provide their assets into the liquidity pool.

- Combine with other DeFi tools. Bridge diverse DeFi platforms through LP tokens and bring in DeFi user assets through a variety of interest calculation methods.

- Combine with NFTFi assets such as collateral lending, options, and futures to increase the types of collateral and improve capital efficiency.

- Establish a new pricing model. When users sweep NFTs through AMM, the price will no longer solely rely on Oracle feedings.

Although the existing market products are not perfect, we still remain optimistic. The perfect solutions for NFT liquidity and composability will eventually emerge. Heimdall’s wheel has begun to tremble, hoping that NFT AMM can build a new rainbow bridge to Asgard.

About Foresight Ventures

Foresight Ventures is dedicated to backing the disruptive innovation of blockchain for the next few decades. We manage multiple funds: a VC fund, an actively-managed secondary fund, a multi-strategy FOF, and a private market secondary fund, with AUM exceeding $400 million. Foresight Ventures adheres to the belief of “Unique, Independent, Aggressive, Long-Term mindset” and provides extensive support for portfolio companies within a growing ecosystem. Our team is composed of veterans from top financial and technology companies like Sequoia Capital, CICC, Google, Bitmain, and many others.

Website: https://www.foresightventures.com/

Twitter: https://twitter.com/ForesightVen

Medium: https://foresightventures.medium.com

Substack: https://foresightventures.substack.com

Discord: https://discord.com/invite/maEG3hRdE3

Linktree: https://linktr.ee/foresightventures

Disclaimer: All articles by Foresight Ventures are not intended to be investment advice. Individuals should assess their own risk tolerance and make investment decisions prudently