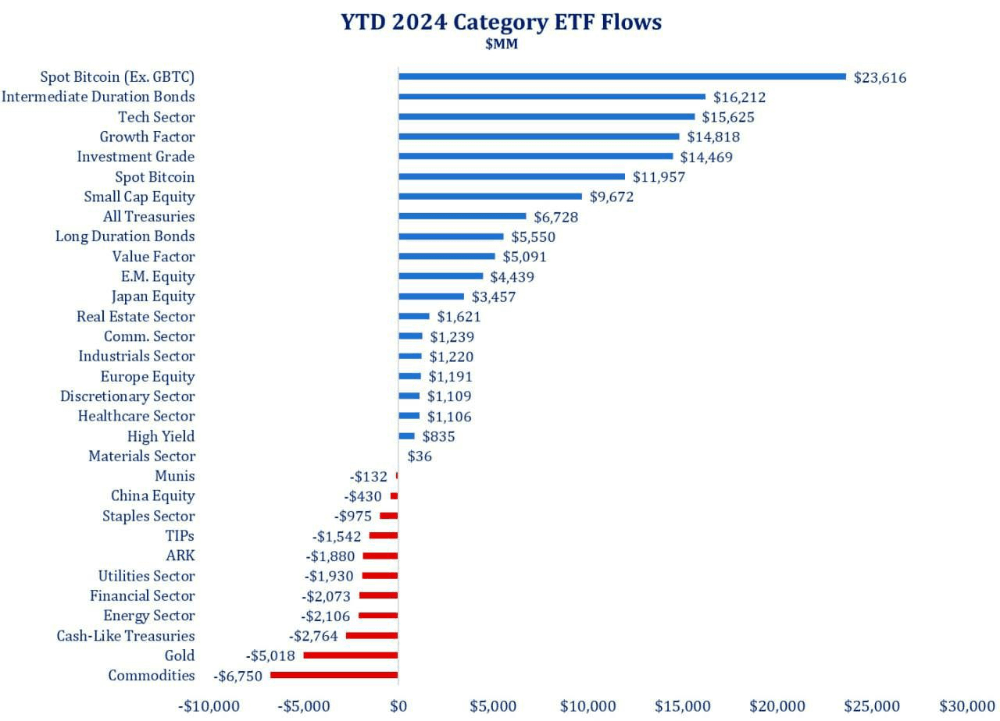

Bitcoin maintains its dominance in 2024 ETF flows so far

As 2024 unfolds, the much-anticipated wave of cryptocurrency exchange-traded funds (ETFs) is finally here. These investment vehicles, designed to track the price of underlying assets, offer investors a familiar and regulated way to gain exposure to the crypto market. However, in this burgeoning landscape, one clear leader has emerged: Bitcoin.

As 2024 unfolds, the much-anticipated wave of cryptocurrency exchange-traded funds (ETFs) is finally here. These investment vehicles, designed to track the price of underlying assets, offer investors a familiar and regulated way to gain exposure to the crypto market. However, in this burgeoning landscape, one clear leader has emerged: Bitcoin.

The Rise of Crypto ETFs

For years, investors craved a safe and accessible way to participate in the cryptocurrency market. Traditional financial institutions remained hesitant, citing concerns over volatility and regulatory uncertainty. However, 2024 has witnessed a significant shift. Regulatory frameworks are evolving, and institutions are dipping their toes into the crypto pool.

The introduction of ETFs has been a game-changer, attracting a new wave of investors who might have previously shied away from the complexities of directly buying and holding cryptocurrencies.

Bitcoin's Enduring Appeal

- First Mover Advantage: Bitcoin, the original and most established cryptocurrency, boasts a loyal following and a proven track record. Investors see it as a relatively stable bet within the volatile crypto space.

- Brand Recognition: Bitcoin enjoys unparalleled brand recognition compared to other cryptocurrencies. This familiarity attracts institutional investors seeking a secure entry point into the crypto market.

- Maturing Infrastructure: The Bitcoin ecosystem is far more developed than most other cryptocurrencies. Robust exchanges, secure wallets, and established mining infrastructure make Bitcoin a more practical choice for ETF backing.

- Diversification: While Bitcoin ETFs offer exposure to a single asset, they can be a valuable diversification tool for traditional portfolios. Investors can incorporate Bitcoin into their holdings without the complexities of direct ownership.

While Bitcoin currently reigns supreme, the ETF landscape is far from static. Here are some trends to watch:

- The Rise of Altcoin ETFs: As the regulatory environment permits, we can expect a rise in ETFs tracking other prominent cryptocurrencies like Ethereum, Litecoin, or even baskets of various coins.

- Thematic ETFs: ETFs focused on specific blockchain applications, such as DeFi (decentralized finance) or NFTs (non-fungible tokens), could emerge, catering to investors interested in specific segments of the crypto market.

Benefits and Potential Risks of Bitcoin ETFs

The emergence of Bitcoin ETFs presents both advantages and potential risks for investors:

Advantages:

- Increased Accessibility: ETFs make it easier for mainstream investors to enter the crypto market, potentially boosting adoption and liquidity.

- Regulation and Transparency: ETFs are subject to regulatory oversight, offering a layer of security and transparency compared to directly buying crypto on exchanges.

- Reduced Volatility: ETFs can potentially offer lower volatility compared to directly holding crypto due to diversification and professional management.

Potential Risks:

- Tracking Error: ETF performance might not perfectly mirror Bitcoin's price movement, leading to a tracking error.

- Fees: Management fees associated with ETFs can eat into investor returns.

- Limited Control: Investors holding ETFs don't have direct ownership of the underlying Bitcoin, limiting control over private keys and potential staking rewards.

The future of Bitcoin ETFs remains intertwined with the overall trajectory of the cryptocurrency market. Regulatory clarity, institutional adoption, and technological advancements will all play a role in shaping the landscape. As the market matures, Bitcoin ETFs are likely to become a cornerstone investment vehicle, offering a convenient and secure way for investors to participate in the crypto revolution.

Conclusion

Bitcoin's dominance in 2024's ETF flow signifies its enduring appeal as a gateway asset to the crypto market. While diversification and innovation are likely to reshape the future of crypto ETFs, Bitcoin's position as the first mover and a relatively stable bet within the crypto space is unlikely to diminish anytime soon. The emergence of Bitcoin ETFs marks a significant turning point, attracting new investors and paving the way for a more mainstream adoption of cryptocurrencies. However, investors should remain cautious, conducting thorough research and understanding the inherent risks involved before diving into this exciting yet volatile market.